Microsoft's commercial cloud fuels better-than-expected Q1 results

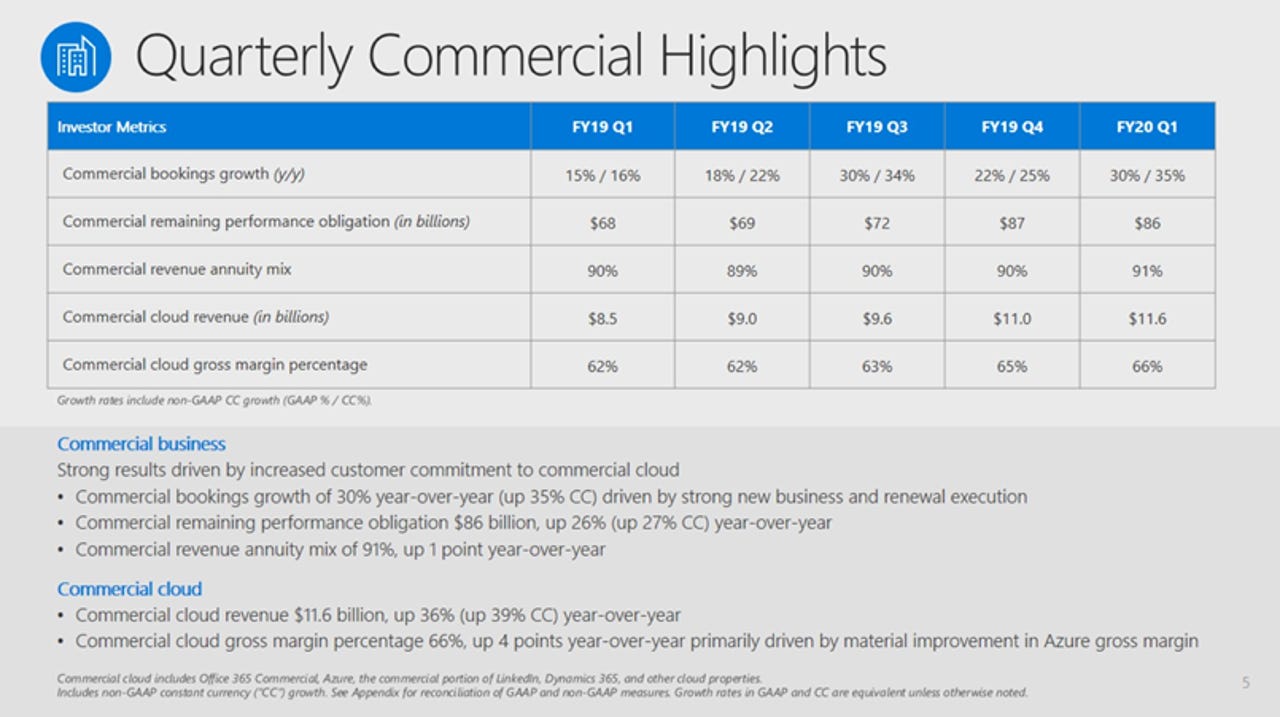

Microsoft's first quarter was well ahead of expectations as its commercial cloud revenue was $11.6 billion, up 36% from a year ago.

The company reported first quarter net income of $10.7 billion, or $1.38 a share, on revenue of $33.1 billion, up 14%.

Wall Street was expecting Microsoft to report fiscal first quarter earnings of $1.25 a share on revenue of $32.23 billion.

Going into the quarter, analysts were expecting strong execution with tougher comparisons ahead. There was also a consensus that Microsoft would step up its investments in artificial intelligence, machine learning and the Internet of things. One concern may be that trended Azure growth has been slowing. Microsoft is the No. 2 cloud provider behind Amazon Web Services.

- Surface Neo and Surface Duo tell you everything about Microsoft's future

- Microsoft introduces new open-source specs for developing cloud and edge applications

- Microsoft to start nagging Windows 7 Pro users about January 2020 end of support deadline

- What to expect from Windows 10 November 2019 Update: A pleasant surprise

The company reported strong results across its office commercial, Dynamics product line, LinkedIn and server products and cloud services.

To get a feel for Microsoft's first quarter it's worth checking out its growth by product lines. There are just a few areas where growth was down from a year ago.

Among the key items:

- Azure revenue growth in the first quarter was up 59% from a year ago.

- Surface revenue fell 4% in the first quarter ahead of Microsoft's product refresh to $1.14 billion.

- Windows commercial products and cloud services revenue was up 26% in the first quarter.

- Dynamics 365 revenue growth was 41%.

- Office 365 Consumer subscribers were 35.6 million.

- Office 365 Commercial seat growth was 21%.

Related:

- Microsoft to enable end users to buy Power Platform licenses without administrative approval

- Microsoft warned: Your cloud contracts are 'serious concern' says EU privacy watchdog

- Putting Azure to work: Tips for IT pros

- Multifactor authentication issue hitting North American Azure, Office 365 users

- Microsoft's unified Office Mobile app: What it is and why it matters

- At Surface event, Microsoft's vision for dual screens, productivity was compelling, but can it execute?

- What's Microsoft's developer story for its new dual-screen Surface devices?