You’ve heard of Big Tech, because how could you not? Here you are, reading this on the internet. You may have come to it through Facebook or Google, and you are likely scrolling through it on an Apple or Android device (Google’s mobile operating system).

After this, you may flip over to YouTube to watch videos, or to Instagram to peruse the latest mountains, sunsets, and #nofilter photos from friends and influencers. You might finally place that Amazon order that’s been sitting in your basket for a week—you aren’t sure of the quality of the item, but the price is great and it delivers in a day.

What’s that, you say? You have an impeccable attention span and eschew the instant-gratification economies of social media mega-platforms like Facebook (which owns Instagram) and YouTube (a Google property). Sure, but do you have a WhatsApp account (also Facebook)? Do you look up directions on Google Maps? Do you use Gmail, an Amazon Kindle, Amazon Alexa, Google Chrome, or Safari? Have you ever Googled, well, anything? Ever used Expedia, Intuit, Netflix, or any of the countless companies that build their businesses on top of Amazon Web Services?

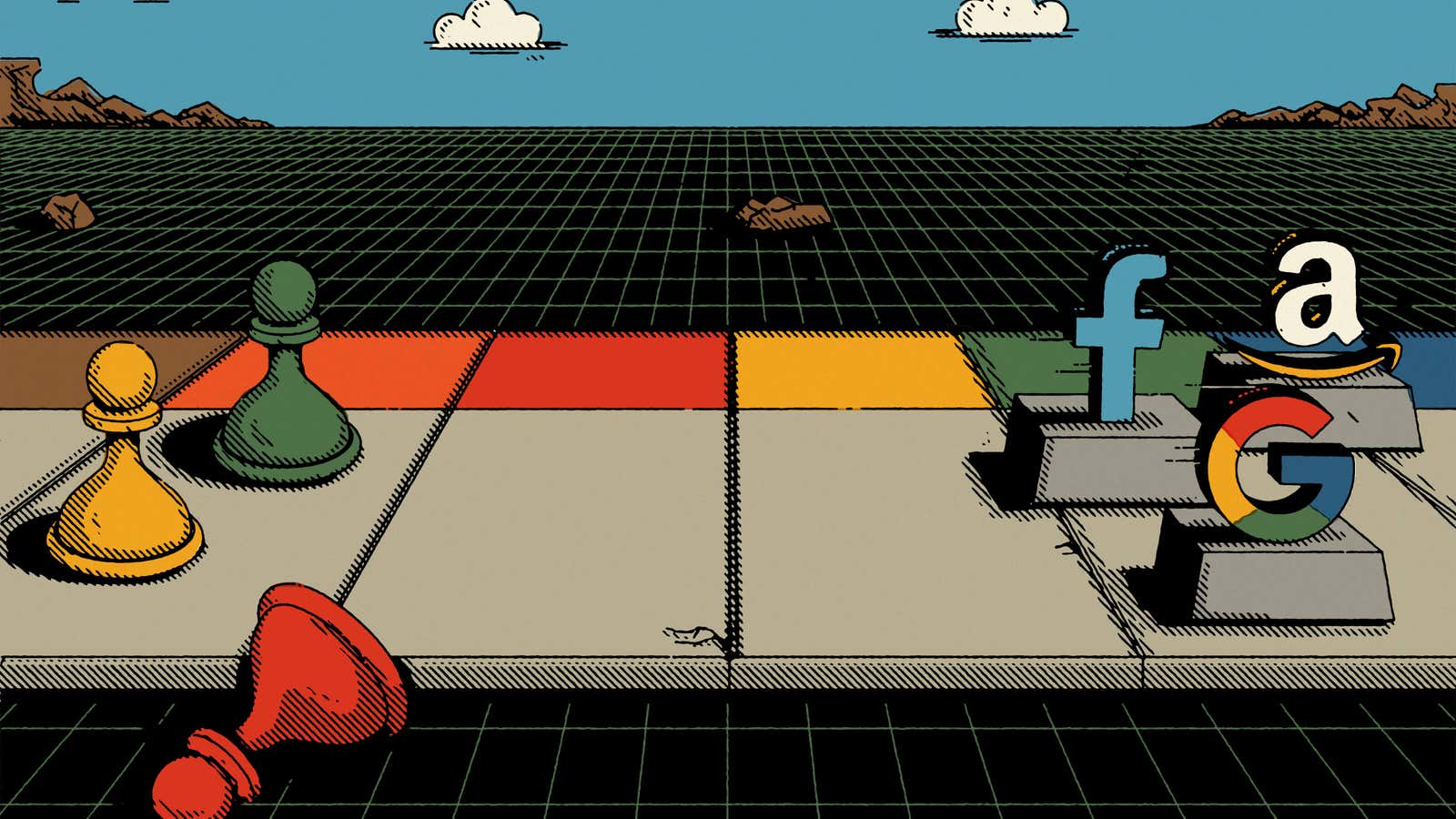

Big Tech is not just big, it is inescapable in modern life. The world’s five most valuable public companies are all American technology groups—Apple, Microsoft, Alphabet (neé Google), Amazon, and Facebook. They are collectively worth a whopping $4.6 trillion.

Technology moves fast, but even by its standards these tech giants emerged in a stunningly short period of time. Amazon was founded in 1994, Google in 1998, Facebook in 2004. It wasn’t that long ago that these behemoths were seen as the underdogs. Measured in human years, Google just this year became legally old enough to drink. Facebook doesn’t have a driver’s license yet.

There is now a growing global consensus that Big Tech is too big. Google today commands 73% of the US search ad market. Amazon controls roughly half of US e-commerce and 5% of all US retail sales. Amazon also holds nearly half of global public cloud services through AWS, and is carving out a sizable chunk of search. Facebook counts 2.2 billion daily active users across Facebook, Instagram, WhatsApp, and Messenger. That’s nearly 30% of the entire global population.

These are US companies, but their influence extends far beyond US borders. That has made monitoring and regulating them a global concern, especially considering America’s recent history of taking a laissez-faire approach to antitrust.

The European Commission is leading the charge. It is probing Apple’s App Store, Amazon’s use of data from marketplace sellers, and Google’s job search tool. It has also signaled interest in Apple Pay and Facebook Marketplace. Since 2017, the Commission has fined Google €8.3 billion ($9.1 billion) on competition grounds. European lawmakers in September appointed Danish politician Margrethe Vestager to an unprecedented second term as EU competition chief and named her executive vice president for digital, a vast expansion of her powers.

Across the Atlantic, the US has initiated a frenzy of antitrust activity in the past six months, from all corners of government. Fifty attorneys general from 48 states are investigating Google and 47 are investigating Facebook. The Federal Trade Commission (FTC) is probing Facebook. The Department of Justice announced a broad antitrust review of tech platforms. The US House Judiciary Committee has requested troves of documents from Facebook, Amazon, Google, and Apple as part of its own investigation into competition in digital markets. In surveys, roughly half of Americans think major tech companies should be regulated more.

By growing so large so quickly, Big Tech has left itself few places to hide. The enormity of these companies and their outsized influence—on our lives, our politics, and the power centers of the global economy—should be apparent to anyone who interacts with them. The question is no longer whether something needs to be done, but what, how soon, and whether it will be enough.

Table of contents

History: In trusts we do not trust | Philosophy: The Chicago School | Case study: Microsoft | The future: Breaking up is hard to do

HISTORY LESSON

In trusts we do not trust

The original monopoly, or trust, was Standard Oil. In the late 1800s, John D. Rockefeller took advantage of ruinous competition among local refineries to consolidate the industry into the era’s biggest and most powerful monopoly. Rockefeller and his fellow monopolists, of which JP Morgan and Andrew Carnegie were the most famous, felt they lent a stabilizing hand to the economy through consolidation.

Not everyone saw it the same way. In the summer of 1888, John Sherman, a US senator from Ohio, took up the antitrust cause. Sherman declared monopolies “inconsistent” with American ideals. “If we will not endure a king as a political power, we should not endure a king over the production, transportation, and sale of any of the necessaries of life,” he told Congress. “If we would not submit to an emperor, we should not submit to an autocrat of trade.”

A law passed by Congress in 1890 barred “monopolization” and “restraints of trade.” The Sherman Act remains the foundation of antitrust law in the US today.

For the first half of the 20th century, American antitrust enforcement waxed and waned. President Theodore Roosevelt is often remembered as a great antitrust crusader for breaking up Morgan’s railroad empire. Once that warning shot was fired, however, Roosevelt forged a secret alliance with Morgan and stopped bringing suits against his companies, including US Steel. Roosevelt “believed the problem with the trusts was that they just had to recognize who was boss,” Matt Stoller writes in Goliath: The 100-Year War Between Monopoly Power and Democracy, rather than with monopoly power itself.

The 1920s, a famous era of excess, brought to power Andrew Mellon, a preeminent private banker who controlled a network of industries spanning coal, steel mills, shipping, oil, and, of course, banks. Appointed treasury secretary in 1921, Mellon used his position to enrich his companies and block the FTC (established by president Woodrow Wilson in 1914) from taking antitrust action against his holdings.

After the stock market crashed in 1929 and the Great Depression set in, a congressman named Wright Patman (the hero in Stoller’s Goliath) moved to impeach Mellon for “high crimes and misdemeanors.” Mellon resigned in 1932, less than a year after Patman filed his charges.

It was Franklin Delano Roosevelt and the populist New Dealers who revived the antitrust cause. Under FDR, the Senate undertook a wide-ranging investigation of the banking sector that culminated in the creation of the Securities and Exchange Commission in 1934.

More than stifling competition, unrestrained private power was viewed by New Deal politicians and regulators as a threat to democracy. “Germany became organized to such an extent that a Führer was inevitable,” Thurman Arnold, the head of the antitrust division in FDR’s Justice Department, said in a 1939 speech (pdf). “Had it not been Hitler, it would have been someone else.”

SCHOOL OF THOUGHT

The Chicago School

This belief that keeping corporate power in check is vital to both consumers and democracy animates competition policy today in the European Union. “The best way to protect our interests—as consumers and as citizens—may be a combination of competition policy and regulation,” EU competition chief Vestager said in a speech in August.

Sometime in the mid-20th century America lost touch with these core principles. In their place emerged a new school of thought that held that monopolies were not bad in and of themselves; they were only bad if their control of an industry led to higher costs for consumers. By the same logic, antitrust enforcement could be a problem if in preserving competition it inhibited the growth of bigger, more efficient firms that could lower prices for consumers.

This laissez-faire framework became known as the Chicago School of antitrust. Its singular focus on how antitrust affected the lives of consumers is known as the “consumer welfare” standard. Its leader was Aaron Director, a professor at the University of Chicago law school who, oddly, was neither a lawyer nor a PhD economist. His protégé was Robert Bork, a law student from Pittsburgh, who swung from socialist to devout free-market libertarian after taking an antitrust class co-taught by Director.

Bork, who later became a judge and served in Nixon’s White House, was an eloquent and compelling thinker, and he ushered Director’s antitrust theories from fringe to mainstream with a 1966 paper, “Legislative Intent and the Policy of the Sherman Act.” The paper was “arguably the most influential single antitrust paper in history,” writes Columbia Law School professor Tim Wu in his book, The Curse of Bigness: Antitrust in the New Gilded Age:

Bork’s signal contribution was this. He took Director’s “consumer welfare” idea—that antitrust was intended only to lower prices for consumers—and argued that it was not merely what an economist like Director thought the law should do, but that it had been, all along, the actual intent of the laws. Working with his Chicago allies, he then created a fully formed alternative account of what the antitrust laws should do and not do, in a book entitled The Antitrust Paradox. In 1964, when he first presented the thesis, it was considered absurd and even insane. But within twenty years he’d manage to convince a majority of the Supreme Court to adopt his position.

Bork’s framework was clever because it offered a seemingly straightforward approach to the thorny matter of antitrust. This “calming remedy, with an appealing simplicity and apparent rigor,” as Wu explains it, appealed to the judges who presided over such cases: “Bork’s antitrust economics are easy—not easy enough for a schoolchild, but easy enough for a lawyer who does not specialize in antitrust and is looking for a dignified and respectable manner in which to decide, or get rid of, a hard case.”

The Chicago School of antitrust and its consumer welfare doctrine paved the way for Big Tech’s dominance. Google consolidated the ad market through acquisitions, most notably a $3.1 billion purchase of competitor DoubleClick in 2007 that the FTC deemed “unlikely to substantially lessen competition” after an eight-month investigation. “This acquisition poses no risk to competition and will benefit consumers,” Eric Schmidt, then Google’s CEO, said at the time. Amazon bought up e-commerce competitors, often after bleeding them dry with race-to-the-bottom pricing. It also resolutely lowered prices and preached the gospel of “customer obsession.”

Tech companies capitalized on the antitrust rules crafted by the Chicago School to build dominant positions that could be celebrated as better for consumers. “Under the consumer welfare standard, those companies can erect a monopoly—or a trust, if you will—that on its face is compliant with what our antitrust policy is by charging low or zero prices to consumers,” says Marshall Steinbaum, an economics professor at the University of Utah. “Nonetheless, they are just as predatory, exclusionary, and powerful as the late 19th-century unitary corporations against which antitrust policy was originally directed.”

CASE STUDY

Microsoft: all tied up

Corporate bigness flourished under the Chicago School. The AT&T Corporation, which was broken up in the 1980s, reconsolidated in the 2000s as Verizon and AT&T. Over the past five years, AT&T also absorbed DirecTV and TimeWarner. The US airline industry, deregulated in the 1970s to increase competition, slowly merged into a small number of major carriers.

The last major antitrust action in the US was a series of cases the federal government brought against Microsoft in the 1990s. The first complaint, filed in 1994, alleged Microsoft used “exclusionary and anticompetitive contracts” to maintain a monopoly on personal computer operating systems. The government argued Microsoft forced PC makers to enter into long-term licenses to pay royalties to Microsoft when they sold PCs with or without Microsoft software, in what was known as a per-processor licensing fee structure. A 1995 decision (pdf) by a federal judge barred Microsoft from this per-processor model and imposed other limits on its contracts. But by then the company’s software was so widely used it was almost irrelevant.

The US government sued Microsoft again in 1998. The Justice Department alleged (pdf) that Microsoft was protecting its Windows monopoly—it had roughly 80% market share on Intel-based PCs—by tying Windows to other Microsoft software and barring companies from using competing products. The government was particularly concerned with Internet Explorer, Microsoft’s web browser. Microsoft made PC makers pre-install Internet Explorer to license Windows, and made it difficult to remove the browser from the desktop. The government saw this as an attempt by Microsoft to corner the nascent search market via Windows.

In 2000, a court put forward a plan to split Microsoft into two companies: one for operating systems, and one for software that ran on top of the operating systems. Microsoft appealed and a higher court overturned the breakup ruling. A final ruling (pdf) in US District Court in 2002 once again barred Microsoft from certain types of conduct and set rules for how it could interact with computer manufacturers and internet service providers.

Around the same time, Europe started looking at Microsoft for anticompetitive behavior with its Windows Media Player, another program tied to the Windows operating system. The European investigation had more teeth. In March 2004, the European Commission fined Microsoft €497 million for abuse of market power. It ordered Microsoft to offer a version of Windows OS without Windows Media Player to PC makers within 90 days, and to enable rival vendors of digital office services to develop products that worked on Windows PCs.

Four years later, the EU fined Microsoft another €899 million for not complying with its 2004 decision. “Microsoft was the first company in 50 years of EU competition policy that the Commission has had to fine for failure to comply with an antitrust decision,” then-EU competition commissioner Neelie Kroes said at the time. “I hope that today’s decision closes a dark chapter in Microsoft’s record of non-compliance.”

In the introduction to Tools and Weapons: The Promise and the Peril of the Digital Age, a recently published book, co-author and Microsoft president Brad Smith wrote that the time has come for the rest of tech to learn the lessons Microsoft did two decades ago.

“Today’s technology issues are far broader and deeper than they were twenty years ago,” he wrote. “We’ve reached a critical inflection point for both technology and society—a time that beckons with opportunity but that also calls for urgent steps to address pressing problems. As a result, like Microsoft two decades ago, the tech sector will need to change… In short, companies that create technology must accept greater responsibility for the future.”

WHAT’S NEXT?

Breaking up is hard to do

It’s important to understand the past, but let’s move to the present.

After a long drought, antitrust enforcers are once again turning their attention to the biggest and most powerful companies in the economy. Arguably the single most influential person in this new charge is Vestager, the Dane now in her second term as EU competition commissioner and with added responsibility for EU digital policy.

Vestager made a name for herself during her first term as competition chief by bringing hefty fines against tech conglomerates, most notably Google. In July 2018, the European Commission fined Google a record €4.3 billion for restrictions it imposed on Android device manufacturers and mobile network operators to protect its dominance in search. The year before, the Commission fined Google €2.4 billion for abusing its dominance as a search engine by giving an advantage to its own comparison shopping service.

But billion-euro fines only go so far when the companies paying them make many times that in annual revenue. Google, for instance, posted $137 billion in revenue, or €116 billion, in 2018, allowing it to effectively earn back its €4.3 billion fine in a little less than two weeks.

“We have reached a phase where competition law enforcement can only do part of the job,” Vestager said on stage at Web Summit in Lisbon on Nov. 7. “We need to find the right level of democracy framing tech and say, ‘This is how you should serve us.’”

Current EU probes into Big Tech include a formal antitrust investigation of Amazon regarding its use of data from independent marketplace sellers; a complaint filed by Spotify against Apple in March for its control of the App Store; and an investigation into Facebook’s Libra digital currency.

America has also recently come around to a more expansive view of antitrust, an abrupt change from last year when US president Donald Trump said Vestager “really hates the US” following several EU enforcement actions against US companies. And at a time when US politics are intensely polarized, the interest in taming the tech giants is notably bipartisan.

Nearly every state attorney general has signed onto antitrust investigations of Google and Facebook. New York attorney general Letitia James, who is leading the Facebook probe, said investigators will “use every investigative tool at our disposal” to determine whether Facebook stifled competition and put consumers at risk. Texas attorney general Ken Paxton, who leads the Google inquiry, promised in an October campaign email to “fight Google’s dominance over so much of our lives.”

In July, the US Department of Justice announced a broad investigation of “market-leading online platforms”—it didn’t name specific firms—and whether they have reduced competition, stifled innovation, or harmed consumers. The DoJ said in its announcement that it would review “widespread concerns that consumers, businesses, and entrepreneurs have expressed about search, social media, and some retail services online.” That same month, Facebook revealed it was being investigated by the FTC on antitrust grounds.

Yet another investigation is underway by the US House Judiciary Committee, which in September made extensive document requests to Facebook, Amazon, Google, and Apple. The House has sought information from these companies on market share, competitors, pricing strategies and algorithms, correspondence related to acquisitions, and data collection, among other things. The committee staff includes Lina Khan, an antitrust scholar who authored an influential 2016 article in the Yale Law Journal that argued the consumer welfare standard was unequipped to evaluate monopoly power in the modern economy and had allowed Amazon to escape antitrust scrutiny.

As the world reevaluates the tech giants, the thorniest question will be whether they ought be broken up. Once an unthinkable suggestion, breaking up Big Tech has in the past year entered into the mainstream conversation. Democratic senator and presidential candidate Elizabeth Warren in March vowed to break up Facebook, Google, and Amazon if elected, and even advertised her plan on a billboard in San Francisco. Chris Hughes, a Facebook co-founder turned critic, in May called for Facebook to be split up.

Tech companies understandably tend to bristle at these suggestions and downplay their own scale. Apple CEO Tim Cook said in June he didn’t think anyone could reasonably consider Apple a monopoly. Google CEO Sundar Pichai has said that regulations “for the sake of regulating” have “a lot of unintended consequences.” In his latest letter to shareholders, Amazon CEO Jeff Bezos highlighted the volume of sales on Amazon by third-party sellers and described Amazon as a “small player in global retail.”

Vestager, the competition regulator the world is watching most closely, has so far stopped short of calling for breaking up the tech platforms. “From a competition point of view, you would have to do something where breaking up the company was the only solution to the illegal behavior,” she said at Web Summit. “We don’t have that kind of case right now. I will never exclude that that could happen, but so far we don’t have a problem that big, that breaking up a company would be the solution.”

Short of breaking up Big Tech, what else can be done? These companies benefit from the ambiguity of that very question, and antiquated regulation provides little direction. The easiest path has always been to do nothing and leave it to the market. So long as the status quo remains, the tech giants can weather the fines and settlements, and grow ever bigger.