A6X: How Apple's iPad silicon Disrupted mobile video gaming

To maintain its momentum in tablets with iPad, in 2012 Apple completed two additional new custom silicon projects specifically for its tablets. These reached— and then exceeded— the graphics of Sony's PlayStation Vita, then the state-of-the-art in handheld video gaming. Here's a look at how Apple 'embraced and extended' mobile gaming.

By the end of 2012, Apple's strategy of developing its custom mobile silicon was clearly a success. Proprietary silicon had enabled the company to deliver new products with features that the industry hadn't even anticipated.

That rush of innovation, in turn, helped it to drive high volume sales that rapidly brought down its costs and paid for new silicon advancements while creating a vast installed base of users that drove an expanding ecosystem of custom, tablet-optimized software.

This allowed Apple to position iPad as an alternative for many low-end PCs and netbooks, as well as being an entirely new kind of "Post-PC" product that could appeal to new users who preferred simplicity and serve entirely new roles for mobile workers. It also allowed Apple to Disrupt the existing market for dedicated mobile video gaming devices.

iPad and iPhone specifically replaced the combination of less-expensive hardware subsidized by more expensive games with a solution that better served most users: more expensive hardware with less expensive games. This was achieved in part due to Apple's proprietary control over its own silicon.

Apple silicon wasn't a secret; its intent was

Apple's silicon strategy wasn't exactly a secret. It was publicly known that it had acquired P.A. Semi in 2008. Steve Jobs had even stated on record that the deal was aimed at building mobile chips for iPod and iPhone. It wasn't known, however, what exactly Apple's silicon team was working toward until it released a new chip: A4 in 2010, then A5 in 2011, then A5X in 2012 and the entirely custom core design of A6 later that year. Each new chip was announced only when the product it powered was being introduced.

Up to that point, most of the silicon microprocessors that had played a significant role in driving mass-market consumer technology were a general-purpose design, speculatively developed to be sold as discreet components for a variety of uses.

Chip vendors laid out their plans as a public roadmap showing when new technological advances would arrive. Upcoming chips from Motorola; Intel; the PowerPC partners; and mobile ARM chips from Qualcomm, Texas Instruments, Nvidia, Samsung, and others were charted out well in advance and made available to any buyers seeking to use them.

That had typically been the case because the expense and effort of developing a significantly custom new chip was so vast that it didn't seem workable for one company to create their own advanced processors. Additionally, to help create markets for their upcoming chips in the pipeline, chip vendors wanted device makers to be aware of what they could expect, in order to plan the future together.

This public, distributed planning of the future of chips and the devices using them meant that few products could really be very surprising.

The curse of commodity crushing Apple

Across the 1990s, the expected, incremental enhancements of commodity had ground down the PC industry into a boring conveyor belt of PCs, each slightly improved over the last. It was a difficult market for Apple to stand out in, as the primary remaining way it could differentiate its Macs was through industrial design rather than introducing advanced new hardware technology.

Apple's original Macintosh models, and later initiatives such as AV DSPs and PowerPC, had once attempted to drive the technical underpinnings of the Mac in silicon. But in a commodity world, Apple's ability to integrate technologies together was challenged by the flexibility and ease of hardware cloners to ride the wave of cheap commodity and catch up to Apple with the help of a software company delivering a copy of Apple's user interface and app development work.

This worked so well for so long in PCs that virtually everyone assumed that it would carry forward into mobile devices, with Google's Android playing the part of Microsoft's Windows. The superiority of commodity also seemed to be an unchallenged fact in silicon, where Intel had solidly proven the economies of scale behind x86 chips in PCs.

Neither Acorn nor even an industry consortium of the heavyweights once lined up behind PowerPC could ultimately challenge x86 in PCs. On its own, Apple's annual sales of around 4 million PowerPC Macs certainly couldn't sustain a challenge to Intel's technical development supported by the combined sales of around 300 million x86 PC.

Video gaming defied commodity

There was a notable market exception to this commodity PC model, however: video game consoles. While PCs languished toward x86 monotony in the 1990s, Sony, Nintendo, and even Microsoft followed the original model of Apple's Macintosh by building unique, proprietary hardware, commonly powered by custom-developed MIPS or PowerPC silicon.

Video game consoles were able to buck the trend of PC commodity by offering unique capabilities powered by advanced silicon CPUs and GPUs, along with unique ecosystems of exclusive games software. Games consoles sold in the tens of millions of units, often achieved by discounting their hardware and then making back profits by charging video game developers steep licensing fees to write games for their platform.

Microsoft took notice of video games in the mid-90s and first sought to tie gaming to Windows, then introduced Xbox to pull the non-PC gaming market under its control. Apple took note of gaming as well, and while it struggled to attract material attention to the Mac, it found some success in licensing games for iPods in the model of conventional licensed gaming platforms.

In fact, iTunes's iPod Games was clearly the origin of the iOS App Store, which brought gaming— along with general-purpose apps— to iPhone and then iPad using a Walled Garden model that resembled the licensing programs of video game consoles.

However, Apple changed the script by continuing to sell premium hardware at a profit, while encouraging third-party developers to create original apps under an App Store where there were only minimal fees to participate. iTunes charged only a 30% cut on sales, a share dramatically lower than any previous market for software had charged.

The return of integration

At the same time, the economics favoring WinTel commodity in PCs changed as personal computing shifted from conventional Windows PCs into mobile devices, where tight integration was far more important than the flexibility of taking a commodity video card, logic board, a processor, and loading an OS flexible enough to make it all work well enough.

Apple had already proven that its tight integration of iPod had created something far better Microsoft's partners could loosely assemble in the model of a PC. Within just a couple years, iPhone's similarly tight integration had upended the markets of licensed phone platforms including Symbian, JavaME, Windows Mobile, and Palm OS.

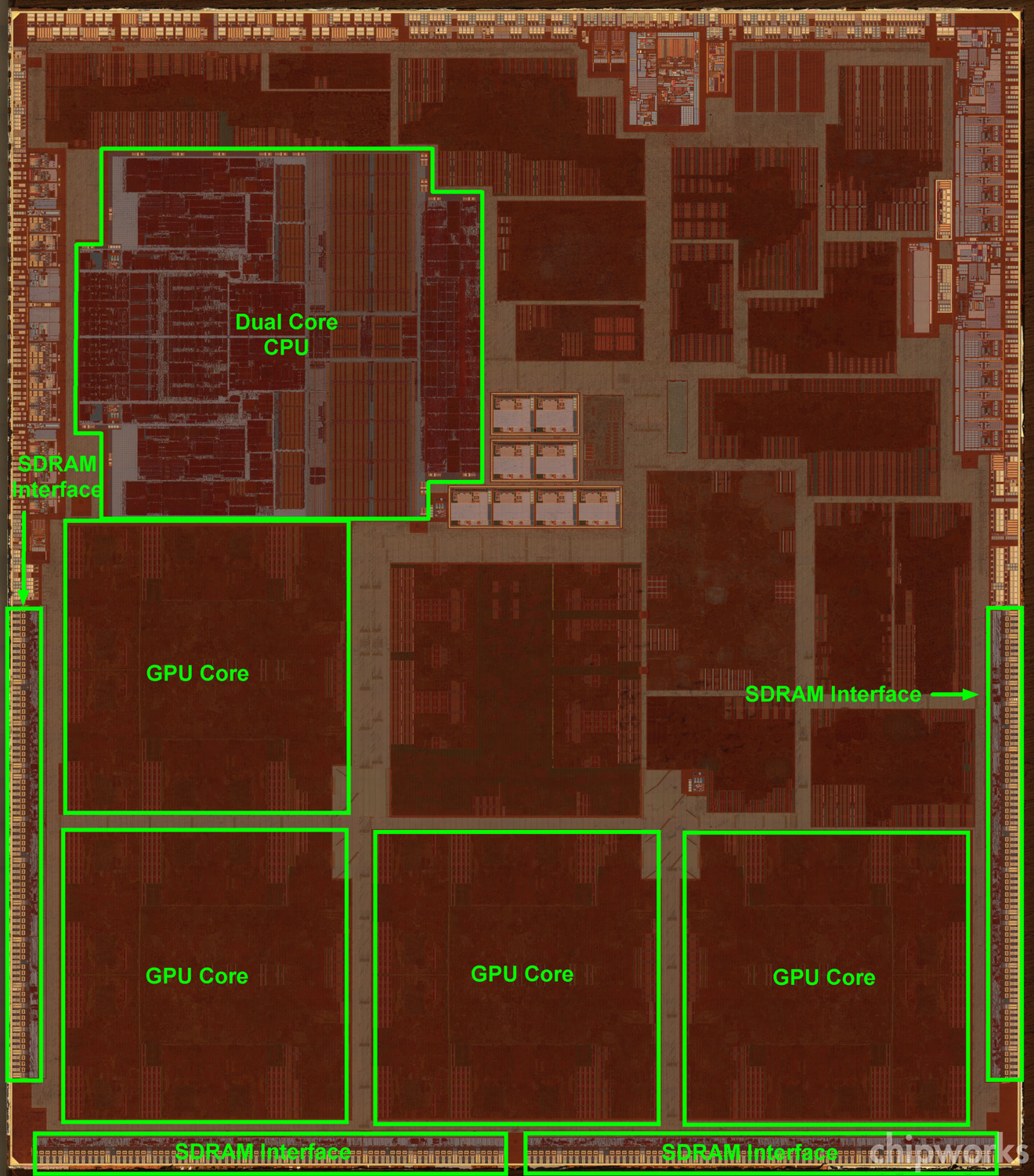

Additionally, in the emerging market for increasingly sophisticated mobile devices powered by ARM chips, the complexity of silicon shifted from a central microprocessor to an entire "System on a Chip," including CPUs, GPUs, memory and storage controllers, and various other components all in the same package. ARM SoC makers were now doing vast integration work, deciding which components to include and tuning them to achieve specific goals in efficiency, economy, performance and other factors.

That makes it obvious why Apple wanted to own its own mobile SoC silicon and drive this highly customizable integration by itself, even while it was also delegating away its Mac CPU design to Intel. iPod, and now iPhone, were showing that Apple could achieve a scale in mobile devices in the double-digit millions that it could never have hoped to achieve in desktop and notebook Macs.

Across its first two years of iPad, Apple shared its A4 and A5 silicon across every mobile device it was making. In 2012, it not only finished its first iPad-specific chip but also created a radically enhanced second generation of that chip just six months later.

Apple's sales volumes drive a Swift A6X

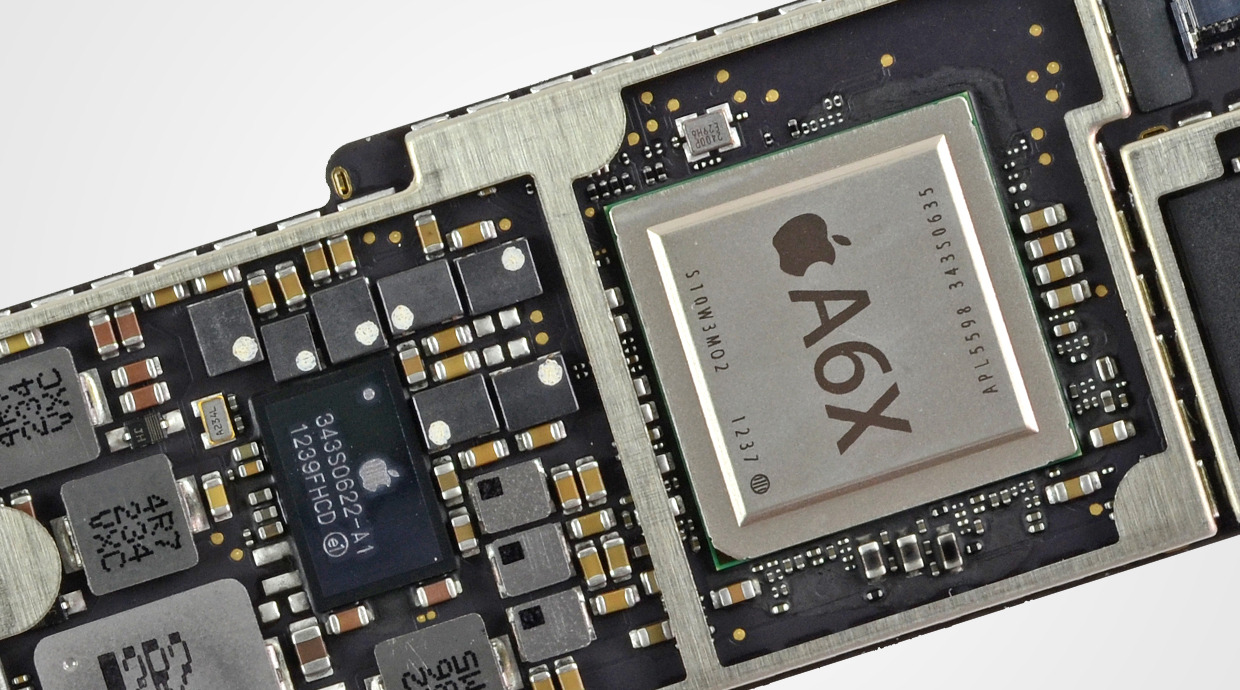

A primary example of how Apple's consistently reliable, high volume sales of finished products were driving the progress of its silicon— and vice versa— was the October 2012 delivery of its new iPad 4 using Apple's custom A6X, which arrived just six months after the introduction of iPad 3 and its A5X.

"We're not taking our foot off the gas," Apple's chief executive Tim Cook said at the introduction of the A6X-powered iPad 4. Rather than changing the design of the new model, it added FaceTime HD and the new Lightning connector of iPhone 5 while remaining compatible with existing apps and accessories.

Apple's new A6X chip once again delivered twice the performance in CPU and GPU of the A5X from just six months earlier. It achieved this in CPU by moving to Apple's new A6 Swift core design shared with iPhone 5.

In graphics, A6X upgraded its GPU from PowerVR SGX543 to PowerVR SGX554. The new chip also benefitted from Samsung's process node reduction that scaled down the size of the chip, making it faster and also less expensive to produce.

That GPU jump was particularly noteworthy because iPad 3 had debuted with the same GPU as Sony's PlayStation Vita, within thee months of that portable gaming tablet's debut. Just six months later, Apple radically upgraded its iPad 4 graphics with an entirely new custom chip with twice the graphics performance.

Sony continued to sell its PS Vita— with the same GPU it debuted with— across the rest of the decade: 2011-2019. Across its first two years of sales, PS Vita sold an estimated 4 million units. In contrast, Apple sold about 32 million iPads in Fiscal 2011, followed by 58 million in FY 2012, the first year of PS Vita sales.

That pretty clearly demonstrates why Apple could afford to speculatively invest in such a dramatic silicon upgrade for iPad just within 2012. Sony had no plans to constantly upgrade Vita's GPU. Within a few years, Sony determined that the market for handheld gaming couldn't support further custom hardware at all.

Cheap App Store mobile games were destroying the business model of taxing software developers selling expensive AAA titles.

iPad bifurcation to reach new price points

In 2012, a significant number of Apple's iPad sales were its cheaper, older iPad 2 model, which it continued to sell. However, all of its iPad sales were generating profits to develop new higher-end iPads and the silicon to power them. Other tablet makers, notably Samsung, were frequently just giving away their tablets just to induce demand.

If Apple's iPad sales had only reached sales of a few million units each year— like Sony's PS Vita or more conventional tablets like Samsung's Galaxy Tab or Microsoft Surface— it could not have justified the proprietary development of increasingly advanced custom silicon each year to power successive generations.

If Apple had remained content just selling iPad 2 across 2012, it would not have developed faster more powerful A5X and A6X silicon, and would not have been capable of delivering higher-end products like iPad 3 and iPad 4 to sell to a higher-end niche of buyers. Those premium products created a halo over its entry-level iPad 2, as well as the iPad mini— a new smaller version of the A5-powered, non-Retina display iPad 2— at the end of 2012.

Apple's premium iPad 4 could attract premium sales to users who wanted its Retina display. iPad 2 and iPad mini could serve broad audiences where they could attract away buyers who might otherwise have bought a netbook, an entry-level notebook, or a game console tablet-like PS Vita.

Disruption of expensive video games

Apple's massive iPad sales were not only accelerating the pace of its silicon advancement but were also creating an installed base for developers to write tablet-optimized software for it. Games represented the majority of the app titles being created for iPad and the App Store in general.

Sony's PS Vita was hailed at launch for delivering graphics on par with the original Xbox, but it failed to support the same business model of expensive AAA gaming titles that had previously driven gaming device and console sales. It was becoming clear that iPad and smartphones, in general, were not only eating up the market for PCs but would also disrupt gaming by better serving users who previously had to pay for much more for expensive games that were effectively over-serving the market.

As time when on, it was clear that mobile gaming largely destroyed any real future for dedicated portable gaming, in part because while purpose-built gaming devices could be better at gaming, they were not generally very good for things other than gaming. iPad delivered a wider range of less expensive games, but could also browse the web, play media, and perform a variety of general computing tasks.

iPad, destroyer of worlds

Beyond video gaming-oriented tablets, iPad was also general-purpose enough to eat up the market for specialized devices like e-ink readers, where the value of a dedicated book reader was similarly overcome by the iPad's advantage of being one device with many uses.

Along with iPhone, iPad also ate into the markets for standalone DVD-players, GPS devices, point and shoot cameras, and eventually even seatback media players. Much of its success came from Jobs' initial definition of a device being ultra-simple but also differentiated from phones with its own tablet-optimized software.

Back in 2012, Piper Jaffray analyst Gene Munster was adamantly predicting that Apple would soon begin selling TV sets running iOS. What he and so many others missed was that Apple was already building tens of millions of mobile television replacements with iPad, a device that could stream video, capture video, play video games, read books, browse the web and do many other things that a conventional TV couldn't, at a price that was competitive, and at a significant profit.

Nobody was making money selling TV sets because they were a commodity.

Most notably, iPad helped kill the notion that "commodity always wins." The idea that computing would always be driven by Intel chips and Windows software had been accepted by most analysts and journalists as gospel.

Apple's iPad proved that compelling hardware, driven by advanced new silicon, could undermine the commodity PC market and even overshadow it, building out a vast installed base of users that shifted the priorities of consumers and even the corporate enterprise that was supposedly beholden to WinTel and uninterested in any alternatives.

Commodity continues to lose in tablets

The first major challenge to iPad had been Google's industry consortium behind 2011's Android 3.0 Honeycomb, which arrogantly marched out in public as if it would be effortless to kick Apple to the curb in tablets. Instead, Google, Motorola, Samsung, and other major Honeycomb partners were burned with a deathly sting of disinterest in their large, complicated busy-box tablets with poor integration between their hardware and software.

That came despite strident efforts by Google to support Adobe Flash in Android. Google subsequently acquired Motorola Mobility, thinking that it could better compete with Apple by leveraging some of its own vertical integration.

However, while Motorola ostensibly gave Google product design and manufacturing capabilities, it wasn't following Apple's gameplan very closely. Just like Samsung, Motorola could develop and produce its own chips but was instead using silicon from a variety of competitors.

Motorola's Xoom tablet and Atrix phone used Nvidia's Tegra 2. The successor Xyboard and Atrix 2 used a TI OMAP4. It also sold phones with Qualcomm chips. Once again, Android was leading companies to failure.

In 2012, Microsoft unveiled its own Surface RT, with similar expectations of crushing Apple's iPad with an integrated device with more similarities to a conventional PC. Microsoft also hoped to line up all the support of its Windows software developers. However, Surface RT's failure to sell more than a million units helped killed any hopes of creating ARM-based software that could run on Windows RT.

By the end of 2012, and despite now owning Motorola, Google launched a second strategy in Android tablets: plans with PC maker Asus to deliver Nexus 7, a mini-tablet that was so terrible that even Android's most devoted fans described it as an "embarrassment to Google."

Google continued to pursue putting its name on cheap Acer tablets for two years while it struggled to figure out how to leverage Motorola to do anything apart from losing hundreds of millions of dollars. It eventually laid-off its employees and sold the remains to Lenovo.

End for OMAP

Google and Microsoft weren't the only companies struggling to adapt to a world where Apple was driving innovation using its own custom silicon. By the end of 2012, Texas Instruments abandoned the launch of its Cortex-A15 based OMAP 5 platform and backed out of the consumer SoC market entirely.

That was likely largely caused by the collapsing demand for its premium silicon after the failure of a long list of devices using its OMAP chips: Palm Pre, RIM's BlackBerry Playbook, Motorola's Xyboard tablet, MOTOACTIVE music player, Nokia's N9, Google's Nexus Q, and Galaxy Nexus.

Rather than empowering various chip vendors to run a common platform, Android appeared to be running them out of business.

The collapse of OMAP 5 also allowed Apple to continue hiring processor design talent. Apple subsequently was reported to have hired away much of TI's OMAP team located in Haifa and Herzliya, Israel, sites in close proximity to Anobit, the flash memory chip designer Apple acquired in late 2011— and reportedly used to develop its own performance-optimized storage controller.

That wasn't the only failure occurring in mobile silicon, as the next segment will examine.

Daniel Eran Dilger

Daniel Eran Dilger

William Gallagher

William Gallagher

Chip Loder

Chip Loder

Andrew Orr

Andrew Orr

Marko Zivkovic

Marko Zivkovic

David Schloss

David Schloss

Malcolm Owen

Malcolm Owen