Apple Card (Finally) Gains CSV Statement Export

Do you have an Apple Card? Did it throw a wrench into your personal accounting practices? When the Apple Card debuted, one of the top complaints we heard from readers was that Apple offered no way to export your statements such that you could import the data into a personal finance app. That has finally changed, with Apple now offering CSV exports of monthly Apple Card transaction data from the Wallet app. You can import that CSV data into any spreadsheet and many financial apps.

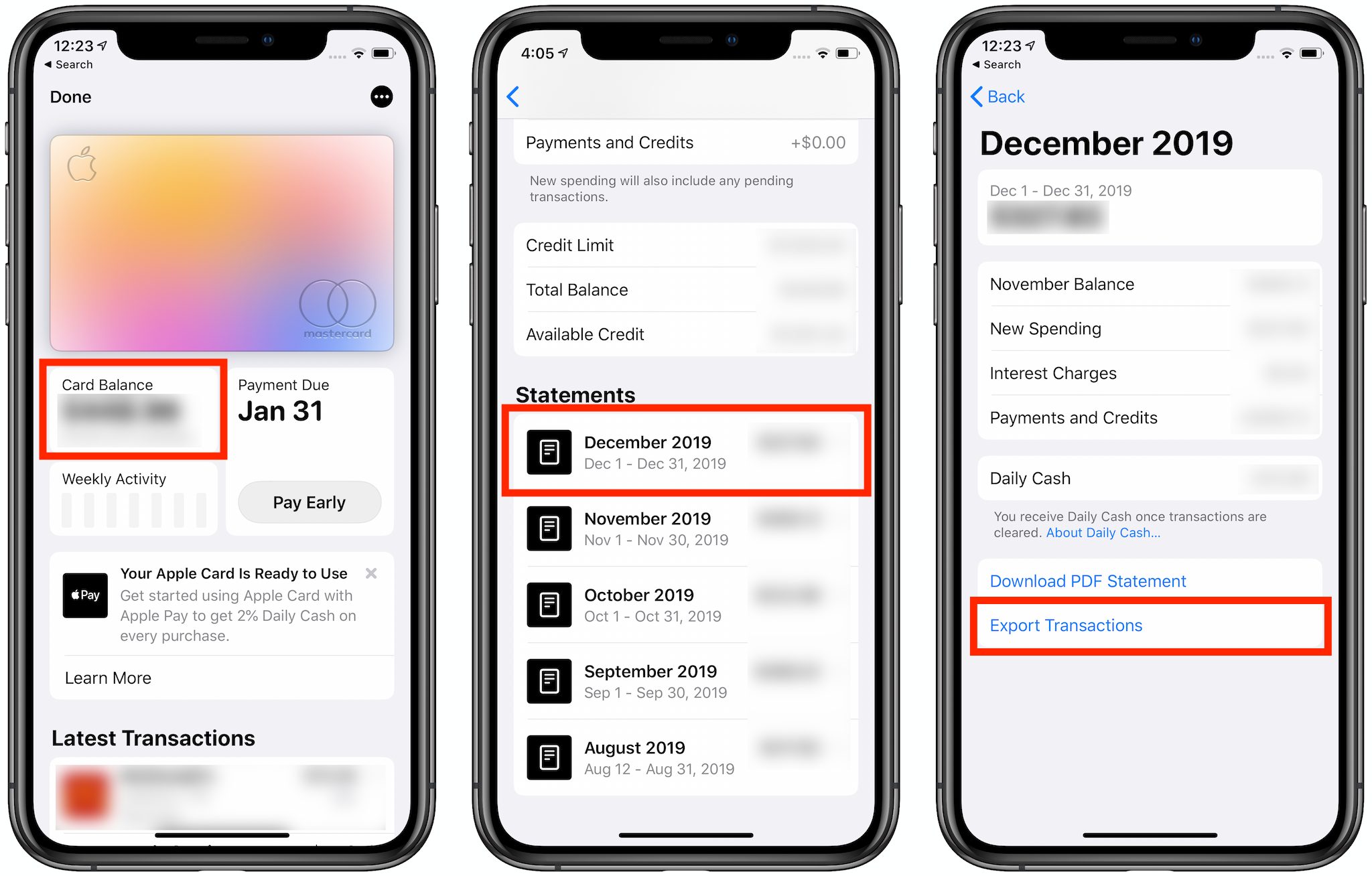

Here’s how to get your data out of the Wallet app:

- Open Wallet.

- Tap your Apple Card.

- Tap Card Balance.

- Tap a month under Statements.

- Tap Export Transactions.

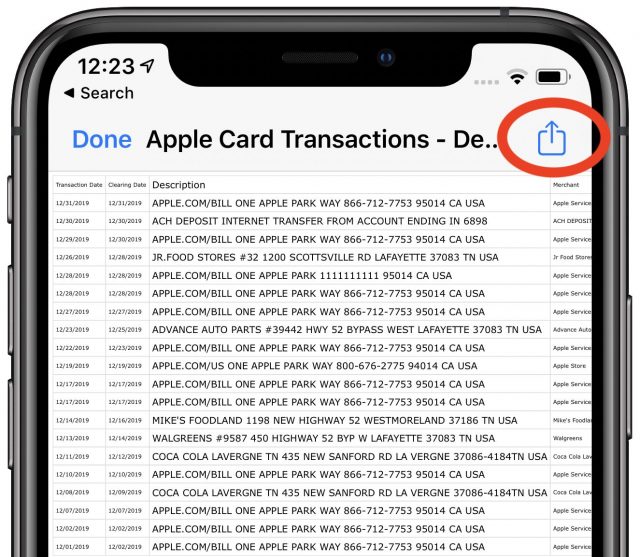

That basic export will display the CSV data on your iPhone, which isn’t very useful. Tap the Share icon to send the CSV data somewhere else, like iCloud Drive through the Files app or to your Mac with AirDrop.

Does this fit the bill for Apple Card data export and management, or do you need something more robust? Are you importing into a personal finance package, and if so, which one? Let us know in the comments.

Does this fit the bill for Apple Card data export and management, or do you need something more robust? Are you importing into a personal finance package, and if so, which one? Let us know in the comments.

I tried it out last night for import to Moneydance using my December statement as a test. Every other credit card I use has an option to export in ‘Quicken’ format, commonly denoted with a .qfx file extension.

Because I hadn’t worked with importing a csv file into Moneydance before, I wanted to examine this file a bit more closely. So, I opened copies in Numbers (to see it as a spreadsheet) and BBEdit (to see the raw text).

My initial attempt to import the file into Moneydance failed, giving a Java.error on some of the numeric data. By looking at the file, I could see that what had been identified as a long numeric string was actually an alphanumeric string that was part of a merchant sub-identifier. So I deleted the troublesome numbers and the file was able to load.

Now, I needed to associate each field with a defined field in Moneydance. Once I did that, the data loaded correctly. While this process was less work than entering the whole statement manually, it was more work than doing a load of a .qfx file.

So, hopefully, we will soon see other forms of data export.

Note that Apple’s original objection to providing anything other than PDF files was that they did not want to allow direct connections from other financial vendors (e.g. Mint) to the data. However, sending data only to the user does not violate this. If the user wants to manually upload the data to the Cloud, that’s on him.

Due to the lack of a standard CSV format, I only use QIF files with PocketMoney Desktop, Quicken for Mac 2007LC, iCompta 6, and iFinance 4.

iMore reports that Apple said that OFX format export is coming soon.

This is nice and all, but what I really would like is for this information to automatically be integrated like every other credit card into to things like Mint where many people do their accounting.

I’m not a Mint user, but Josh just pointed me to this article. All I can say is that it sounds like Intuit is acting like… well, Intuit. Charlie Brown and the football—Intuit is constantly pulling apps or services away. How many times did it cancel and bring back Quicken for the Mac?

FYI, this would be seem to be available in ios 13 only. I just tried it on my iphone 8 with ios 12 and I still just have pdf statement option. (I’m not going to 13 yet because of all the issues I’ve seen)

https://www.propersoft.net offers a series of programs to convert pdf to qfx and csv to qfx as well as qfi and other formats

Using PDFPen Pro I exported the pdf file to Excel, reduced the number of columns to date, detail and amount and then printed to pdf which in turn I converted to qfx and imported to my accounting software. Now you can remove unwanted columns, save to csv and using Propersoft convert to the format required by your software.

Make sure, before you print to pdf that you set the page so everything prints to one page width. Otherwise you get it on two pages and Propersoft doesn’t recognize it.

Propersoft offers a limited free use so you can test it. I had trouble and went back several times to get additional temporary reiustrations before I bought the software.

I thought Mint was included when Intuit sold the Quicken product line to a venture capital firm a few years ago? Intuit was supposedly going to concentrate on TurboTax and QuickBooks.

I tried to import the downloaded .cvs file directly into Quicken Deluxe 2020 version 5.14.2 using File>Import>Mint.com File (CVS)… . It did not work for several reasons. Firstly, it ignored the account that I had setup for the import and created a new one! Secondly, the column headings were different; even when I corrected the column headings with TextEdit, it still did not import correctly and created some extraneous columns that were not in the CVS file. I gave up after several tries. Apple will have to do better than this weak offering.

I use Banktivity7. After two tries I figured out how to import the CVS file into my Apple Card account and into my cash back account. I wish I could import throughout the month instead of waiting for the statement.

I stopped using the Apple Card when I realized I couldn’t import the info into Quicken. I like to see all my financial information in one place. I do use the card for the discounts on Apple products. Once I can use it like other cards and aggregate the info in my personal financials, it will become the dominant card I use. Until then it won’t be used.

Export of statements is great but I’d like to see export of “Latest Transactions”.

Sigh… Apple…

With a few exceptions (such as the Wells Fargo Propel American Express card) virtually every credit card issuer either provides Quicken Direct Connect, or works with Quicken screen scraping, or will export a QFX file, or at least a QIF file.

I don’t plan to use Apple Card, but for all of you who do, I hope Apple can see outside its universe on this one.

Obviously, people who use software to manage their money want seamless interoperation. Want to get their transactions into their preferred software on their own schedule. Want one click action. It’s up to Apple management to decide whether Apple will meet this customer requirement.

The good news is that QFX files may be on the way. The next step, to provide best customer experience, is direct connection from within the customer’s chosen software.

The Apple Card transactions can be imported into Moneydance with these steps:

You may prefer some other combination for the fields, but the above works for me. Moneydance does not remember your choices for the fields; you have to select your choices from dropdown menus for every file you import.

I find it easier to have a table for AppleCard in a Ninox database (https://ninoxdb.de/en) where I keep other credit card data. The table has column headings named the same as the Apple Card Transactions .csv file’s first record. That makes importing the transactions more automatic.

The CSV export makes it easier to follow transactions than the PDF export, but the PDF export does have information about daily cash. The CSV export is likely to remain my favorite, even if Apple adds more export formats.

One has to question who makes such idiotic decisions at Apple so as to not allow one’s own customers proper direct data connection exporting.

It’s almost as if (getting a bit conspiratorial here, lol!) some highly paid programmers don’t understand most people actually need to track their expenses thoroughly, so thought “no one needs to track credit cards surely, so we won’t bother with that feature”.

Apple’s stance about some kind of security threat is utterly pointless – it’s the END USER who wants to use their own transaction data, not some random entity.

And furthermore the data goes one way (export) so doesn’t feed back into their systems either where transactions can be somehow made.

I consider giving me all the data in a CSV to be the best and most proper direct data access.

Certainly I have no interest in a proprietary Intuit format, but I shed myself of Intuit more than 20 years ago and nothing I have seen since has made me doubt it was a great decision for even a second. Horrible company. Don’t trust them at all

Banktivity 7 user here, too. Could you let us know what you did to get the CSV import to work? Thanks.

After using Quicken, Mint, and TurboTax for years, I’ve completed an Intuit “cleanse.” I’m troubled by Intuit’s lobbying and poor behavior — as detailed by ProPublica’s excellent reporting.

I’ve been using YNAB for over a year, and it’s the best financial management system I’ve ever used. While not inexpensive ($84/year), YNAB is truly a education-oriented, consumer-focused company that never sells your data or uses it for re-marketing.

To Josh’s original question, while Apple Card’s CSV import is welcome, it’s not something I would use regularly. Although some YNAB users import their transactions from their banks, many choose to enter every transaction manually — often immediately at the point of sale. That’s what I do. This keeps my accounts 100% current, which drives responsible spending behavior, as is the YNAB way. It can take days for transactions to completely clear the bank.

I would like it if Apple Card would automatically download and match transaction with the YNAB web app, as this can help catch minor entry errors. This works seamlessly with Chase and other credit cards. This missing sync is one of the reasons I only use my Apple Card when it has a clear cash-back advantage that’s better than the other point-accruing cards in my wallet. At the moment, my Apple Card transaction volume is low.

So you want direct data access then, as well as many other users. Why not. For those that don’t wish to avail themselves of said feature for whatever reasons, they don’t have to.

The problem with “self-entering” is: )

)

A. remembering to always do so (yet ANOTHER task in ones everyday that has a strong possibility of being forgotten at least sometimes

B. If you share a card account with a partner, then they also have to be in on the deal, or it’s pointless (many other halves may not do this as well as you do, or may simply not want to).

C. What about auto-charges from companies? They happen without you actually being present (physically or online) when they occur.

IMO, it should basically offer what most others do:

*The latter two of which should be downloadable at any time rather than just at the end of the month.

First, I created two accounts in Banktivity7: (1) a credit card account for the purchases and (2) a cash back account.

The import involves two separate imports:

1 - Selecting the credit card account, File>Import Transactions

Select the fields Date, Description and Amount > Continue

2. Selecting the cash back account, File>Import Transactions

Select the fields Date, Description and the column without a heading > Continue

That’s one thing that’s not an issue with the Apple Card.

Personally I have so few transactions that so far I just enter them manually. I keep the notifications on the phone until I’ve entered them. But having even CSV export, I won’t have to do that anymore - I’ll just import them at the end of the month. Fine with me.

On the other hand, there’s one benefit of “self-entering” - you can catch mistakes.

I track my charges with a spreadsheet. I hand-enter every charge from my printed receipts. I hold on to those slips of paper until my statement arrives, at which point I reconcile the two.

Most of the time there are no errors, but there have been a few occasions where the charge reported by the bank was different from the charge on my receipt. Usually because someone in a restaurant made a mistake (I assume it was a mistake) entering the tip.

If I relied entirely on data from the card company, I would never catch these mistakes. Since I don’t, I can spot them and get the matter fixed - usually by calling the merchant and talking with them, less frequently by contesting the charge.

I’m a long time user of Quicken and find it invaluable to combine account information from multiple banks and financial institutions. I’ve contacted both Apple Card Support and Quicken Support to request that the inability to import from Apple Card to Quicken be fixed. I found it interesting that Quicken can import CSV files from Mint.com but not Apple. Personally, I want the QFX format that automatically downloads to Quicken. Until this is done, I find no other recourse except stopping use of Apple Card. BTW, I appreciate finding all the information posted here. Thanks

Most do it the other way around to this, as it’s less data-entry effort and associated room for data-entry mistakes…

If using spreadsheets or an app-based system, step 2 may involve importing using a number format (CSV/OFX/QFX/etc.), instead of just manually reading a vanilla PDF digital-paper type statement.

But whatever works for oneself is fine.

One thing that annoys me about Apple Pay, is that there is almost nothing like a receipts functionality. Apart from that last 10 transactions totals in the app settings per card, which is useless as it only has a TOTAL and no breakdown of what was bought, and given it’s only the last 10 transactions, anything after that and the info is gone forever.

EDIT: Of course Apple promote said non-breakdown or proper receipts system info as a privacy feature (“we don’t know what you bought” = your privacy). But reading between the lines, in reality this is obviously more about them not implementing a proper receipts feature, or not being able to, so instead spinning that into it being a privacy feature.

You go into many “digital payments only” places, and they don’t actually offer you ANY receipts anymore – they literally have no way of printing one off or emailing you one or anything (asking for one and they look at you funny sometimes too, lol: “What you want a…receipt…erm, why?” type attitude). So you’re left with either forgetting about it, or manually making your own note of the transaction.

This is becoming more and more common in restaurants and similar type of establishments, yet there seems to be nothing Apple or retailers are doing about this. After all, you have no recourse for mistakes if they never issue you with a receipt as proof of transaction and amounts, do you. And people who really need to track their outgoings intensively, business expenses at one end (where receipts are typically mandatory), and especially poorer folks at the other, aren’t helped by this either. Bad.

For me, until Apple allows online access to Apple Card transactions (like every other card issuer out there), my use of their card will be extremely limited. For 6% back at Christmas, I was happy to enter the transactions by hand; other than that, it’s a non-starter. The CSV statement export is useless.

Agree. Many of these “new banks” are offering only app-based solutions with no browser website to access at all.

Apart from having better views in browser, it ends-up as being just plain annoying if you are at a computer trying to do some accounting, having to login and stare at a tiny phone screen showing you say 100 transactions you’re trying to deal with.

Another of these overly simplistic “cool” things, in a vein attempt to appeal to da youngsters. As if they suddenly don’t need to track financials like anyone else.

I use Personal Capital. It ONLY accepts direct transfers from other financial service providers. It does not allow manual entries. One can set up a manual account, but all you can do is adjust balances. You cannot enter individual transactions.

When I spoke to Goldman Sachs about this problem with the Apple Card, I was told that Apple does not provide a web portal “at this time.”

I understand that there are rumors that Apple will begin to allow direct access (iMore: “According to Apple, though, OFX or Open Financial Exchange will be supported in the near future as well.”

I hope so as this predicament is keeping me from using the card although I really want to.

I too only use Quicken file types to import into Moneydance. Sounds like the csv file isn’t a good solution. I’m unfamiliar with OFX, will that import better, more like a quicken file type?

My understanding is that OFX (Open File Exchange) files should import msmoothly, just as QFX files (also referred to as Quicken Web Connect files) do. I believe that QFX is a superset of the OFX format. My guess is that the major differences are structures for direct import over the Internet from the financial institution which you don’t use if you if you manually export from Apple and them import into Moneydance.

Near as I can tell, you now have to manually download the CC statement files from all the sites and import them manually. They all seem to have turned off the direct web importing.

I use Banktivity, but my answer would be the same if I was still using Quicken. I won’t bother getting an Apple Card until they support the export of transactions into these applications. CSV statement exports are a step in the right direction, but they’re not enough. I won’t get an Apple Card if it makes my financial/budgeting tasks more painstaking and time-consuming.

Apologies, I mis-remembered the steps for importing the cash account. Namely, the CSV file only includes Applecard activity - not cash back. So, in order to import the cash back transactions into my Apple cash account I save the PDF statement, open it with PDFPen and export as XLSX. Sheet 2 includes the cash transactions that can be imported

I never use O/QFX to download transactions as the financial institutions don’t have all the data I use. I tried it and spent MORE time editing the transactions than I did entering them correct manually. Once I enter them into my primary application, I then use QIF to get them into my secondary and tertiary applications.

I used the CSV file for importing the January statement into Moneydance and discovered a bug. The issue is that it is quite possible for a textual comma to appear inside a field. Apple does not use any substitution for it, and so, it causes the rest of that field to be interpreted as the next field and all subsequent fields to be moved right one field. This occurred in my file when there was address in the memo field.

Apple needs to encode or substitute for those commas so that they are not interpreted as field separators.

Hi,

I can import the CVS file, but charges are listed in the Payment column and payments show up in the Charge column in Moneydance? I see others here have successfully imported this Apple Card CVS file, how did you guys solve this issue?

Yes, this happened to me as well. I was surprised to see someone say that it worked in MoneyDance, as it definitely did not work for me.

What I did for last month was open the csv file in Excel, create a new amount column what was the existing amount times -1, and saved and imported that file. The only issue with csv import in MoneyDance is that it’s not like ofx or qfx import - you can’t match transactions to what is already in your register, so I had to delete a few that I had already entered.

I’m looking forward to ofx file export when it happens.

Thanks for your feedback, and I will be waiting for this feature too and will continue to manually enter my transactions.

FYI, I purchased the Mac App CVS2OFX, but cannot get it to create a file that imports correctly, so if anyone wanted to know if this app is worth its rather high cost, it is not.

Thanks

I did try this app as well, just yesterday, when I was struggling with this. It does work for me.

Before you open the csv file in the app, make sure the first time that the mappings field is set to [auto]. That should try to map the fields, and it does a pretty good job. For me it set Date to Transaction Date, amount to Amount / USD, Name to Merchant, Memo to Description, and the rest to Do not use. There is a button on the bottom “Change amount sign” that will flip the signs of all the amounts so that deposits and payments show up in the right fields. You can save the mapping to a name of your choice to use for next month.

I plan to purchase this app as I can use it for PayPal transaction import as well. It is costly but in the long run will be worth it for me.

I’m the guy who uses Moneydance. When importing the CSV file, I was presented with a dialog box to define the correspondence between the CSV field and Moneydance fields (with an Ignore option for fields not to be used). I chose the following correspondence:

Transaction Date -> Date

Clearing Date -> Ignore

Description -> Memo (this is where transaction details normally appear)

Merchant -> Description

Category -> Category

Type -> Ignore

Amount -> Debit Amount (this gets the signs right)

I then imported the file. I needed to correct the one entry that had a comma in the CSV file description and also change the category for every entry to ones I use in Moneydance. Hopefully, for future statements, Moneydance will recognize previously used merchants and change the category appropriately (it does that for QFX import) and manual entry).

In response to another comment, there is a Download PayPal Transactions extension available that works with the PayPal API (or you can load PayPal statements from CSV or QIF formats).

Wow, I never noticed this button, that solved my problem and I was able to import and match my transactions. Sweet, I thought I spent money on something that I had no use for.

I use the Moneydance Extensions “Download PayPal Transactions…”, works like a charm. Set it up once and then just download directly to Moneydance.

I saved a mapping for the Apple Card in CVS2OFX, but the Change amount sign is not saved and I have to select it every single time. Minor annoyance, but at least I am now able to import those transactions and match them.

Thank you so much for showing me the way.

On my version of MoneyDance (2019.3, which I believe is current), there is no “Debit Amount”.

Strange. I’m also using 2019.3. I am doing the Import via the Import… item in the File Menu. The window title on the field selection window is Import not Text File Import. The possible field names are Date, Check#, Description, Memo,Category, Cleared Status, Amount, Debit Amount, Credit Amount, Balance, Ignore.

Well, that was the answer. I was using text file import from the extensions menu. Why is that even there if File / Import can do the same thing but better? (Just a note that I wasn’t using File / Import because I though it was only for QIF, QFX, or OFX files. At some point I recall trying to do a text file import that way and having it not work, but that was a while ago, and obviously it’s been fixed, or I just had a bad CSV file.)

Today, Apple added OFX export capability. Unfortunately, I have yet to see a report of it successfully loading in a financial program. There is a report on MacRumours that it failed in Quicken, and when I tried in Moneydance, the application just stalled, rather than presenting a dialog box asking which account to associate it with? The console window showed problems with understanding the file.

I reported the problem to Apple. Others who are interested should try it.If they succeed in loading, please report the application where it worked. If not, please file a report with Apple, so that there will be pressure to fix it.

It also failed when I tried importing in Moneydance. Looking at the OFX file, there are no CRLF or LF to separate the XML elements, as I believe the spec calls for. However, I tried it after putting newlines in before every XML element and that still didn’t work.

Been lots of import failure reports in Macrumors too. Both CSV and OFX.

Anyway, I wonder if non-US markets will see Apple Card anytime soon? Does Goldman Sachs even operate consumer (non-B2B) stuff in other territories? (If Apple were to stick with the same banking partner across markets.) Isn’t this consumer banking a new avenue for them away from the more risky investment banking of their past, in even the US anyway, so likely international would be a big leap to expect.

The trouble is that Europe has tighter regulations on reward scheme enticements and suchlike. So this likely makes it difficult for Apple to offer a unified matching offering in other markets.

i.e. they likely wouldn’t want to offer better or worse cashback between markets globally.

Just tried to OFX import to Quicken - unsuccessful:

response: “Unable to read the selected Web Connect File”

The post that this message replies to showed the mapping I used to load the monthly Apple Credit Card Statement in CSV format to Moneydance. For the February statement, I made a change to ignore the Category field. As merchant categories differ from expense categories, this makes sense. Furthermore, it allowed Moneydance to autofill the category field based on previous transactions with the same merchant. For reference, here is the mapping that I am now using:

Transaction Date -> Date

Clearing Date -> Ignore

Description -> Memo (this is where transaction details normally appear)

Merchant -> Description

Category -> Ignore (this is the change)

Type -> Ignore

Amount -> Debit Amount (this gets the signs right)

Note: trying to load the OFX formatted file still fails with errors in the console.

I found iCompta would not accept the OFX file for Apple Card, so I exported a few transactions from the app in OFX format and compared the files. The Apple Card OFX file was missing a few closing tags. I found by adding the lines

right before the closing

</OFX>tag, I could get iCompta to parse the file correctly and import the transactions.Thanks,

After making the suggested edit, I was able to import my OFX file into Moneydance. It looks like everything was assigned to an appropriate field. There were two small differences from the way I matched the CSV file:

–The Clearing Date was used rather than the Transaction date for the Date field (accurate from a posting point of view, but harder for the user to match)

–The Description field was used for the Description and the Memo field was left blank. The Merchant field from the provider was not used. As I posted, I prefer the Merchant field become the Description while the Description from the provider provides memo detail.

Let’s see if we can summarize what’s been learned here so I can do an article. The OFX file works in:

Anything else?

I had no luck importing the QFX file into Banktivity, though CSV import works perfectly (I do have to manually change the sign of the transactions in Numbers first, however). Banktivity does not seem to like something about the Apple Card QFX format.

After adding the two tags, I was able to import the OFX file using Banktivity 7. Quicken 2017, however, wouldn’t import the file.

“After adding the two tags, I was able to import the OFX file using Banktivity 7. Quicken 2017, however, wouldn’t import the file.”

What do mean by “adding the two tags?” I’m interested in how you got Banktivity to import the QFX file.

Thanks.

Tried loading the OFX export file into Quicken Deluxe 2020 v5.15.1. No joy. Error alert: “Unable to read the selected Web Connect file. Please contact your financial institution.” Oh, and FWIW, I checked and the two “missing” tags aren’t. Missing anymore, I mean. Apparently Apple has been reading TidBITS.

Look back at Conrad’s earlier posting Apple Card (Finally) Gains CSV Statement Export - #54 by chirano!

I ran into the same problem with Quicken 2017. I downloaded a file from Discover Card to compare against and found it contained a few lines with information about the financial institution. When I copied those lines into the Apple Card OFX file, Quicken successfully imported the file.

Interesting. Could you post those lines (assuming they have no confidential information)? I’d like to give it a shot with Q20.

I copied these lines below over. I don’t know if all of these lines are necessary to get Quicken to import the file.

The only personal information is the user ID, which is the user name to log into the Discover website.

I think Quicken uses this information to keep track of which transactions have already been imported.

Thanks. I got it to work, but for me, it’s way too fiddly to be of any practical benefit. FWIW, I whittled it down to the following. Note that these tags and data need to go within the

SONRSelement (I put mine just before the):Apple Computer96259625The “fiddly” comment is based on the fact that I completely made up the

ORGelement data, and I stole theFIDandINTU.BIDelement data (9625) from your post (this is apparently the legitimate value for Discover). Quicken would not load the file with a made-up number (I tried 1234), but it seemed happy enough to use Discover’s.I have no idea what (if any) long term affects twiddling with the data like this might have. So it was interesting as an experiment, but a dead-end in terms of being a practical working solution, IMO.

Probably doesn’t matter for credit card, but the FID is required for bank accounts. There wasn’t one for Apple Card. The one listed here http://www.ofxhome.com/index.php/institution/view/694 “1234” is for Goldman Sachs. Not sure why it doen’t work, unless the site made the number up, as well.

-Al-

IIRC, QFX is Quicken’s proprietary version of OFX so I’m not surprised that Banktivity choked on QFX and Quicken 2017 choked on chirano’s OFX file. I still find the old QIF better than both CSV and OFX for transferring between different software applications.

FWIW, I was able to directly import the .OFX file for April into MoneyDance without editing, adding any missing tags, etc.

The latest news on this front:

FWIW, MoneyDance imported the QFX formatted transaction file from May perfectly for me. As I said last month, Apple also fixed the issue with OFX export, as I used that for April’s transactions last month.

I had stuck with CSV import that allowed me to define the input fields as the OFX version placed the detailed transaction info, rather than just the merchant name in the Description field. I don’t know if the current OFX format fixed that, but the QFX format just put the merchant name in the description field and left the memo field blank. So, that is what I used for the May statement, and I am happy about it.

I believe that some folks using online financial applications are still unhappy. Mint (and maybe some others) will not work with imported files and want direct access to the credit provider. One of the core principles of the Apple Card was that they would not provide direct access to other institutions–if the institution wants the data, the user will need to actively provide it. Since Moneydance works locally, there is no issue for me.

A question for Quicken users: how does the import of QFX files work? I’m guessing it’s something like File > Import, but I figure there’s more to it than that.

In Quicken 2020 Version 5.16.1 (Build 516.33903.100) it’s exactly as easy as File > Import then choose “Bank or Brokerage File (OFX, QFX) …” and the import is seamless. I imported 9 months of Apple Card transactions without a flaw.

Thanks!

We’ve now published another article with details on the new QFX and QBO exports—let’s move comments over there since this thread is now crazy long.