Cloud arms race buys Intel time, massive profits, but indigestion likely

Intel has capacity for its server processors and is selling a lot of Xeons as cloud providers are building out data centers at a rapid clip. That data center demand is buying Intel time to address PC chip shortages, ramp its 10nm processors and develop its AI-based roadmap.

The processor giant crushed its fourth quarter earnings targets with revenue up 8% and non-GAAP earnings of $1.52 a share. Intel delivered $72 billion in revenue for 2019 in what was a challenging year.

Over the past year, Intel has had to deal with ongoing production issues, changes in leadership and renewed competition from AMD and Qualcomm. The chipmaker also saw new competitive pressure from companies like Amazon, which announced instances based on its own Graviton2 processor. Intel also sold its modem business to Apple.

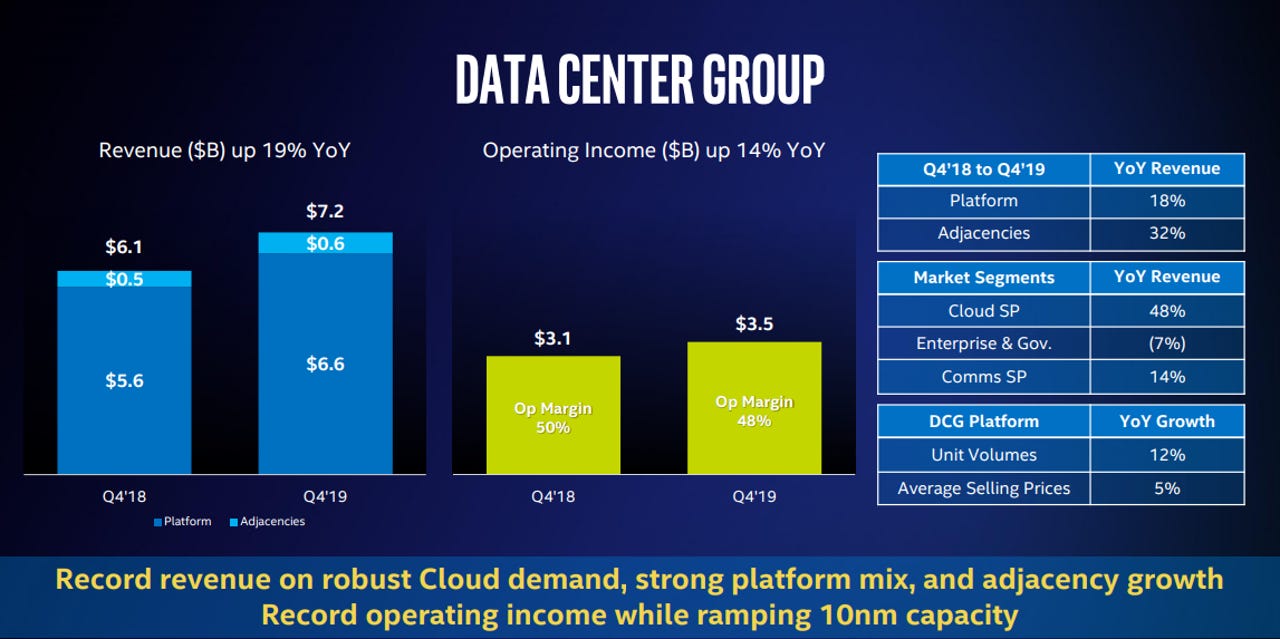

Nevertheless, so-called data centric businesses shined for Intel as its data center group delivered sales growth of 19% in the fourth quarter. The IoT group saw revenue growth of 13% in the fourth quarter. Meanwhile, Intel held its own in the PC business as it worked around inventory shortages and got a big bump from the end-of-life of Windows 7.

Intel CFO George Davis said:

We are expecting an exceptionally strong Q1 as cloud customers continue to build capacity and adopt our highest-performing products. This would mark 3 quarters of strong cloud buildout, and we expect more modest capacity expansion for the remainder of the year as cloud service providers move to a digestion phase. We are also planning for an increasingly competitive environment as we move through the year.

That competitive market highlights how Intel is going to use its leverage and scale to compete a bit with price. Davis indicated that gross margins would fall.

Here's Intel's landscape to ponder. Yes, AMD is a pain in Intel's rear. Yes, Nvidia is changing the discussion around computing architecture. And yes, Qualcomm is headed to the PC business. But Intel can still print money so hold off on that obituary.

CEO Bob Swan said:

Back at our May Analyst Day, we told you that the industry was at an inflection point where the exponential growth of data is fueling massive expansion in multi-cloud environments, transforming networks and catalyzing the intelligent edge. We believe we're well positioned to lead this data revolution, and we expect to generate $85 billion in revenue and $6 in earnings per share in the next 3 to 4 years. 1 year into that plan, we are tracking well ahead of our commitment. We have $3 billion more revenue, and we've earned an additional $0.52 in earnings versus our May expectations. Our expectation is to continue to make deposits towards our multiyear goal every 90 days.

In the end, Intel has a data center buildout it can leverage and more importantly has inventory. Swan said:

We're in pretty good shape on server. And I think that going with 19% growth in fourth quarter depleted our inventory level. You have that kind of spike in demand. We're not perfect across all products or all SKUs. But server CPUs, we really prioritize that and try to put ourselves in a position where we're not constrained, and we're in pretty good shape. Pretty great shape, macro, micro, a few challenges here and there, but server CPU supply is pretty good.

Intel's competitive position looks swell right now. We'll see how this data center war plays out once cloud providers pause to digest. Stifel analyst Patrick Ho noted that Intel still faces fierce competition in processor manufacturing.

If Intel wants to regain process technology leadership (and at least stem the share loss tide on the PC client front), it will need to spend aggressively over the next few years. We believe this "arms race" among the leading players (Intel, TSMC, Samsung) is one that has extremely well capitalized, well-funded, and focused companies that can go "blow-to-blow" with one another (and for an extended period).

Related: