AMD Q4 Earnings Top Estimates, Shares Down on Bleak Guidance

Advanced Micro Devices AMD reported fourth-quarter 2019 non-GAAP earnings of 32 cents per share, which beat the Zacks Consensus Estimate by 6.7%. Notably, the figure soared 300% year over year and improved 77.8% sequentially.

Revenues of $2.127 billion surpassed the Zacks Consensus Estimate of $2.101 billion. Moreover, the top line improved 50% year over year and 18% sequentially.

Seasonal uptick on holiday season, and strength in both Computing and Graphics, and Enterprise, Embedded and Semi-Custom segments drove the year-over-year improvement.

Shares Down on Bleak Q1 Revenue Outlook

Following bleak first-quarter 2020 guidance, shares of AMD are down 4.5% in the pre-market.

AMD expects first-quarter 2020 revenues to be roughly $1.8 billion (+/-$50 million), indicating year-over-year growth of 42%. However, it reflects a decline of 15% on a sequential basis.

The Zacks Consensus Estimate for revenues for the first quarter is pegged at $1.84 billion.

Notably, AMD’s stock has returned 162.5% in the past year, outperforming the industry’s rally of 47.8%.

Segmental Details

Computing and Graphics segment (78.1% of total revenues) revenues grew 69% year over year and came in at $1.662 billion.

In desktop vertical, seasonal uptick in demand for second and third generation Ryzen processors on account of holiday season drove segment results.

During the reported quarter, AMD introduced Ryzen 3950X mainstream desktop processor and latest Ryzen Threadripper processors aimed at high-end desktop market.

Client processor average selling price (ASP) improved year over year and sequentially, on higher Ryzen processor sales.

Revenues from Mobile processors grew double-digit on a year-over-year basis, primarily on account of higher unit shipments during the reported quarter.

Moreover, the company is banking on utilization of new Radeon Pro 5300M and 5500M mobile GPUs in Apple’s AAPL latest MacBook Pro. The processors are based on 7 nanometer (nm) RDNA architecture to enable advanced graphics performance.

Management also remains optimistic regarding growing clout of Ryzen 4000 mobile processors families across leading OEMs.

In graphics domain, higher sales of Radeon 5000 series GPUs based on RDNA architecture drove year-over-year unit shipments by double-digit percentage growth. GPU ASP increased year over year and sequentially, primarily driven by higher channel GPU sales.

Additionally, AMD rolled out Radeon RX 5500 XT and 5600XT graphics card, powered by the AMD RDNA gaming architecture.

Management noted that Data Center GPU sales improved sequentially. The company inked new deal wins in cloud, game streaming and VDI verticals in the reported quarter.

Notably, the company is investing in software enhancements to aid developers leverage Radeon Instinct accelerators for complex AI and HPC applications.

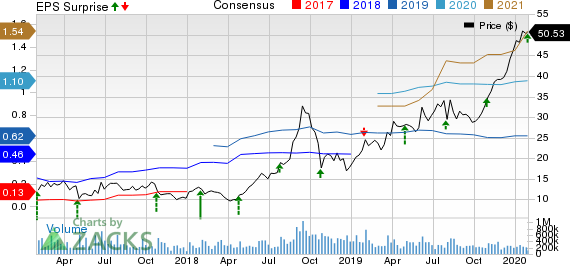

Advanced Micro Devices, Inc. Price, Consensus and EPS Surprise

Advanced Micro Devices, Inc. price-consensus-eps-surprise-chart | Advanced Micro Devices, Inc. Quote

Enterprise, Embedded and Semi-Custom segment (21.9% of total revenues) revenues of $465 million were up 7% year over year.

The year-over-year improvement can primarily be attributed to higher EPYC server processor sales, partially mitigated by lower semi-custom product revenues.

In server domain, management noted that improving ASPs and higher unit shipments of latest second-gen EPYC processors drove double-digit growth in revenues.

Strength in AMD’ latest EPYC processors are enabling the company garner new deal wins from major enterprise, cloud, and HPC companies.

For instance, Google is leveraging EYPC processors to enhance data center environment and strengthen Google Cloud Platform. Moreover, Amazon AMZN, Microsoft MSFT, Oracle, Tencent, among others, are utilizing EPYC processors to enhance their respective data center architecture.

Particularly, AMD is optimistic about extended utilization of its 2nd Gen EPYC processors by Amazon Web Services, in Amazon EC2 (or Elastic Compute Cloud) compute-optimized instances, namely C5a and C5ad.

Further, Microsoft Azure HBv2 virtual machines are leveraging AMD’s EPYC 7742 processor for HPC applications.

In enterprise domain, Dell has rolled out new platforms based on latest EPYC processors. Considering HPC vertical, San Diego Supercomputer Center intends to utilize Dell EMC PowerEdge servers powered by AMD’s second Gen EPYC processors.

Advanced Micro Devices, Inc. Revenue (Quarterly)

Advanced Micro Devices, Inc. revenue-quarterly | Advanced Micro Devices, Inc. Quote

Operating Details

Non-GAAP gross margin expanded 400 basis points (bps) on a year-over-year basis to 45%, driven by strong adoption of latest 7 nm based EPYC and Ryzen processors.

Operating expenses on a non-GAAP basis increased almost 15% year over year to $545 million, due to higher investments in Research & development (R&D) and go-to-market initiatives. R&D expenses rose 6.5% year over year to $395 million. Marketing, general and administrative expenses surged 49.3% year over year to $206 million.

Adjusted EBITDA soared 208.6% year over year to $469 million on earnings growth.

Non-GAAP operating income came in at $405 million, up 271.6% year over year. The year-over-year improvement was driven by higher revenue base and improvement in gross margin.

Segment wise, Computing and Graphics operating income soared 213% year over year to $360 million, courtesy of solid improvement in Ryzen processors sales. Enterprise, Embedded and Semi-Custom operating income was $45 million, against an operating loss of 6 million reported in the year-ago quarter. This can be attributed to strong adoption of EPYC processors.

Balance Sheet & Cash Flow

AMD ended the fourth quarter with cash and cash equivalents (including marketable securities) of $1.50 billion compared with $1.21 billion in the previous quarter.

Total debt (long-term plus short-term) was $486 million, down from $872 billion reported at the end of the previous quarter.

Operating cash flow came in at $442 million, compared with $234 million in the previous quarter.

Free cash flow was $400 million compared with $179 million in the previous quarter.

2019 at a Glance

AMD reported revenues of $6.731 billion in 2019, up 4% over 2018 tally. The Zacks Consensus Estimate for revenues for 2019 was pegged at $6.71 billion.

The Computing and Graphics segment generated revenues of $4.709 billion, an improvement of 14.2% year over year driven by robust adoption of 7 nm based EPYC and Ryzen processors developed on Zen 2 architecture.

The Enterprise, Embedded and Semi-Custom segment generated $2.35 billion, up 3% year over year.

Guidance

For first-quarter 2020, AMD expects robust sales from Ryzen, Radeon and EPYC products to drive year-over-year revenue growth.

However, sequential decline in revenues is anticipated on account of softness in semi-custom sales and seasonality.

Non-GAAP gross margin is anticipated to be 46%. Operating expenses are anticipated to be $580 million.

Conclusion

Although AMD reported stellar fourth-quarter results with robust year-over-year growth in earnings and revenues, cautious revenue guidance for the first quarter is a concern.

Nevertheless, momentum in Ryzen, Radeon and EPYC processors remains a key catalyst.

In the high-end desktop market, the company is banking on growing clout of its third-generation Ryzen Threadripper processor.

Moreover, Ryzen 4000 mobile processors powered laptops from ASUS, Acer, HP, Dell, Lenovo and other major OEMs, slated for release in 2020, are expected to help AMD in expanding presence in the commercial market.

Zacks Rank

AMD currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research