Cisco beats Q2 expectations with growth in services

Cisco managed to beat second quarter market expectations on Wednesday, with Q2 results driven by software and subscription growth. However, its product revenue was down due to declines in infrastructure and application sales.

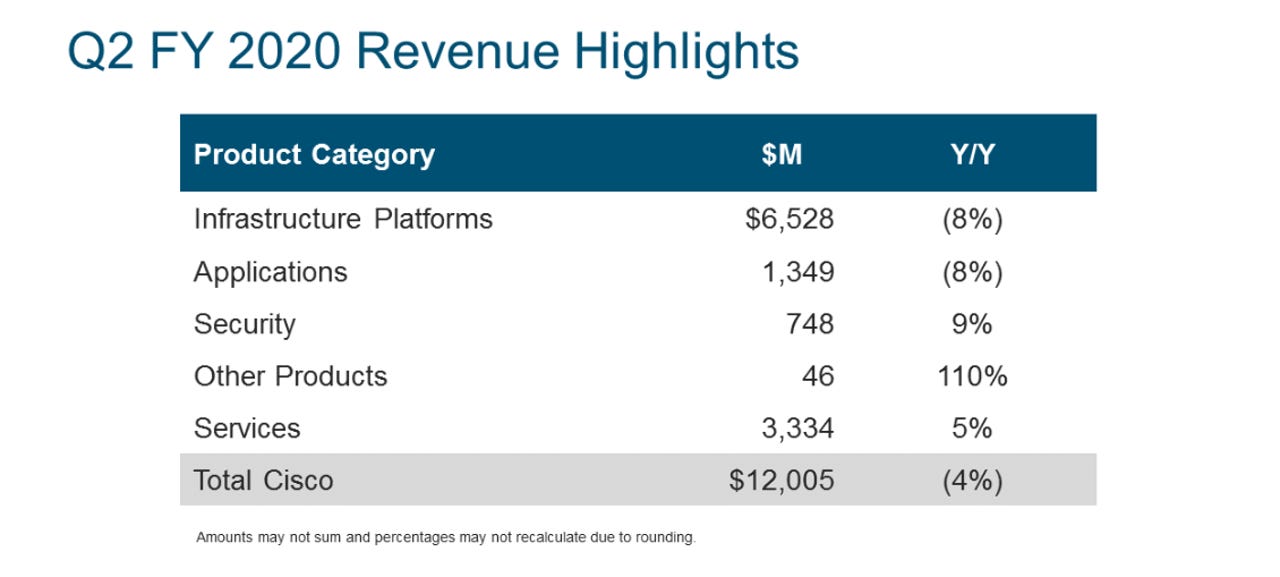

Second quarter non-GAAP net income came to $3.3 billion, or 77 cents per share. Total revenue was $12 billion, down 4 percent year-over-year.

Wall Street was expecting earnings of 76 cents on revenue of $11.98 billion.

"I am incredibly proud of the innovation our teams continue to drive," CEO Chuck Robbins said in a statement. "I am confident in our long-term growth opportunities as we help our customers build out the networks for the future."

Product revenue was down 6 percent to $8.67 billion. Within this category, sales from infrastructure platforms was down 8 percent to $6.53 billion. Switching revenue declined, and routing declined, driven by weakness in service provider business. Wireless declined overall, though Cisco saw strong growth in Meraki and is ramping its Wi-Fi 6 products. Data center revenue declined driven by servers, offset by strong growth in Hyperflex.

Application revenue was also down 8 percent to $1.35 billion, driven by a decline in unified communications sales. However, AppDynamics saw double-digit revenue growth.

Sales of security products grew 9 percent to $748 million, with strong performance in identity and access, advanced threat and unified threat management.

"In security, our differentiated end-to-end approach across the network, cloud, and endpoint is winning customers, with 100 percent of the Fortune 100 now using one or more of Cisco's security solutions," Robbins said on a conference call.

"Other Products," which brought in $46 million, grew 110 percent.

Service revenue was up 5 percent to $3.33 billion, driven by software and solution support. Software subscriptions were 72 percent of total software revenue, up 7 points year-over-year.

Revenue was down across geographic segments. In the Americas, sales declined by 5 percent, in EMEA by 3 percent, and in APJC revenue was down 1 percent.

Cisco also declared a quarterly dividend of 36 cents per common share, a 1 cent increase, or up 3 percent over the previous quarter's dividend.

For the third quarter, Cisco expects a non-GAAP EPS between 79 cents and 81 cents. It expects revenue to decline between 1.5 percent and 3.5 percent year-over-year.