David Rolfe's Firm Cuts Apple, Visa

David Rolfe (Trades, Portfolio)'s Wedgewood Partners sold shares of the following stocks during the fourth quarter.

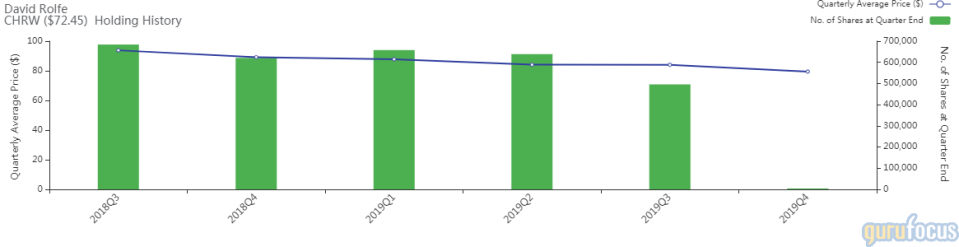

C.H. Robinson Worldwide

The guru trimmed the C.H. Robinson Worldwide Inc. (CHRW) position by 99.15%. The portfolio was impacted by -3.69%.

The domestic freight brokerage firm has a market cap of $9.80 billion and an enterprise value of $10.91 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 34.96% and return on assets of 12.5% are outperforming 95% of companies in the transportation industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.29 is above the industry median of 0.27.

First Eagle Investment (Trades, Portfolio) is the largest guru shareholder with 6.32% of outstanding shares, followed by Mairs and Power (Trades, Portfolio) with 1.62% and Pioneer Investments (Trades, Portfolio) with 0.30%.

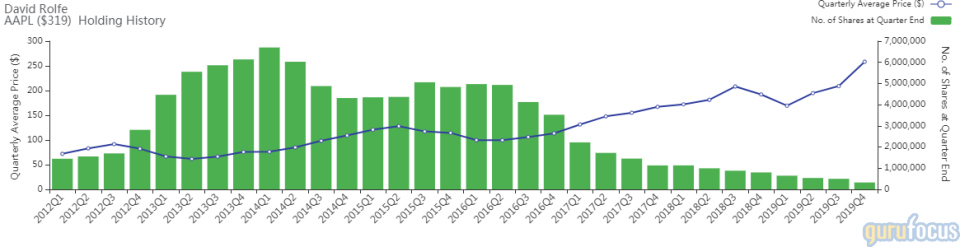

Apple

Rolfe cut the Apple Inc. (AAPL) holding by 34.76%. The portfolio was impacted by -3.44%.

The designer, manufacturer and seller of consumer electronics has a market cap and enterprise value of $1.40 trillion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 57.5% and the return on assets of 16.75% are outperforming 98% of companies in the hardware industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.99 is below the industry median of 1.17.

The largest guru shareholder of the company is the Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 5.60% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.32% and Pioneer Investments (Trades, Portfolio) with 0.20%.

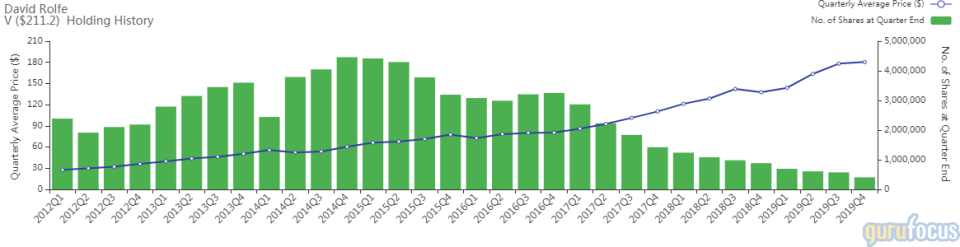

Visa

The guru curbed his Visa Inc. (V) position by 29.14%. The trade had an impact of -2.54% on the portfolio.

The payment-network giant has a market cap of $468 billion and an enterprise value of $477 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 35.7% and return on assets of 17.23% are outperforming 97% of companies in the credit services industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.76.

The company's largest guru shareholders include Fisher with 0.91% of outstanding shares, Frank Sands (Trades, Portfolio) with 0.68% and Buffett's firm with 0.48%.

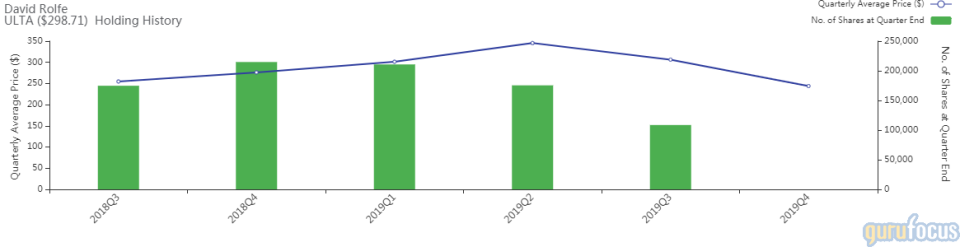

Ulta Beauty

The investor closed his Ulta Beauty Inc. (ULTA) position. The portfolio was impacted by -2.41%.

The beauty products retailer has a market cap of $17.07 billion and an enterprise value of $18.8 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 37.59% and return on assets of 16.67% are outperforming 95% of companies in the retail industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.11.

The largest guru shareholders of the company are PRIMECAP Management (Trades, Portfolio) with 0.52% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.46% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.08%.

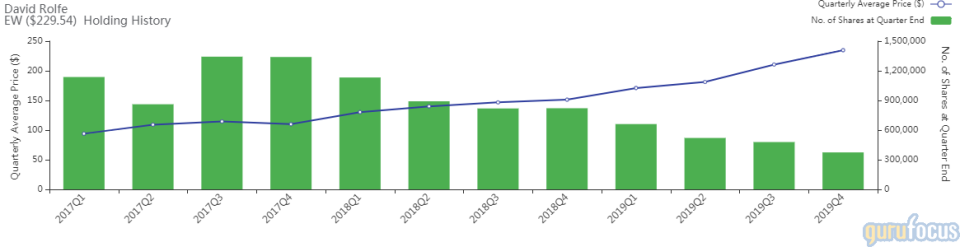

Edwards Lifesciences

Rolfe trimmed the Edwards Lifesciences Corp. (EW) position by 21.87%. The portfolio was impacted by -2.04%.

The designer and marketer of medical devices has a market cap of $48 billion and an enterprise value of $47.16 billion.

GuruFocus gives the company a profitability and growth rating of 10 out of 10. The return on equity of 29% and return on assets of 18.16% are outperforming 95% of companies in the medical devices and instruments industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 2.24 is above the industry median of 1.47.

Other guru shareholders of the company are Sands with 2.91% of outstanding shares, Spiros Segalas (Trades, Portfolio) with 0.77% and Pioneer Investments (Trades, Portfolio) with 0.62%.

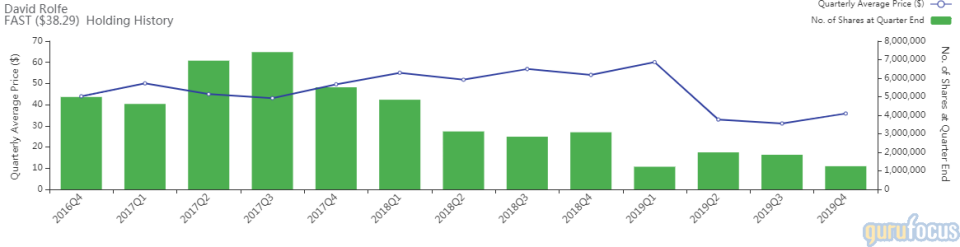

Fastenal

The investor reduced the Fastenal Co. (FAST) position by -33.09%. The portfolio was impacted by -1.79%.

The company has a market cap of $21.99 billion and an enterprise value of $22.40 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 31.75% and return on assets of 21.56% are outperforming 92% of companies in the industrial distribution industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 0.3.

Mairs and Power (Trades, Portfolio) is the largest guru shareholder of the company with 0.91% of outstanding shares, followed by Rolfe with 0.22% and Pioneer Investments (Trades, Portfolio) with 0.22%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Richard Pzena's Firm Buys Westinghouse Air Brake Technologies

Pioneer Investments Buys Microsoft, Amazon, Apple

Lee Ainslie Buys Crown Holdings, Monster Beverage

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.