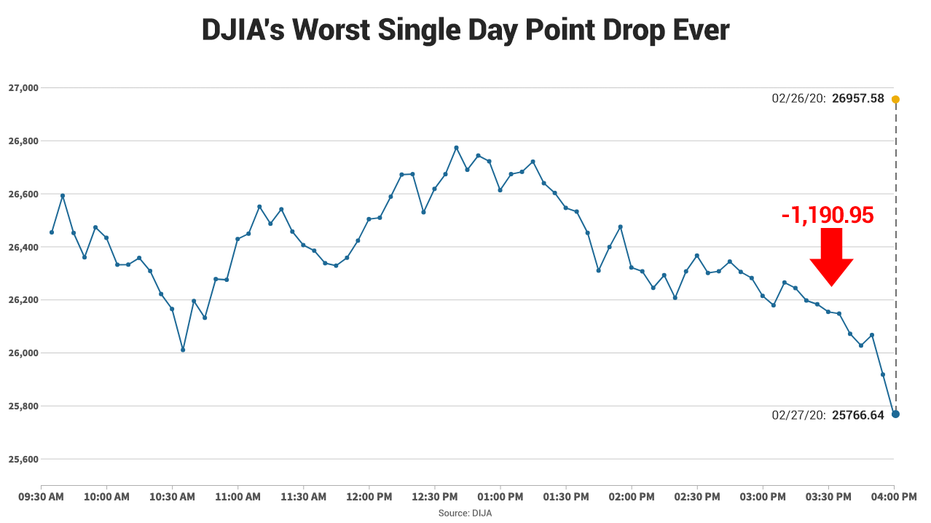

Dow's point drop worst on record as stocks fall into correction

Dow posts worst point drop ever

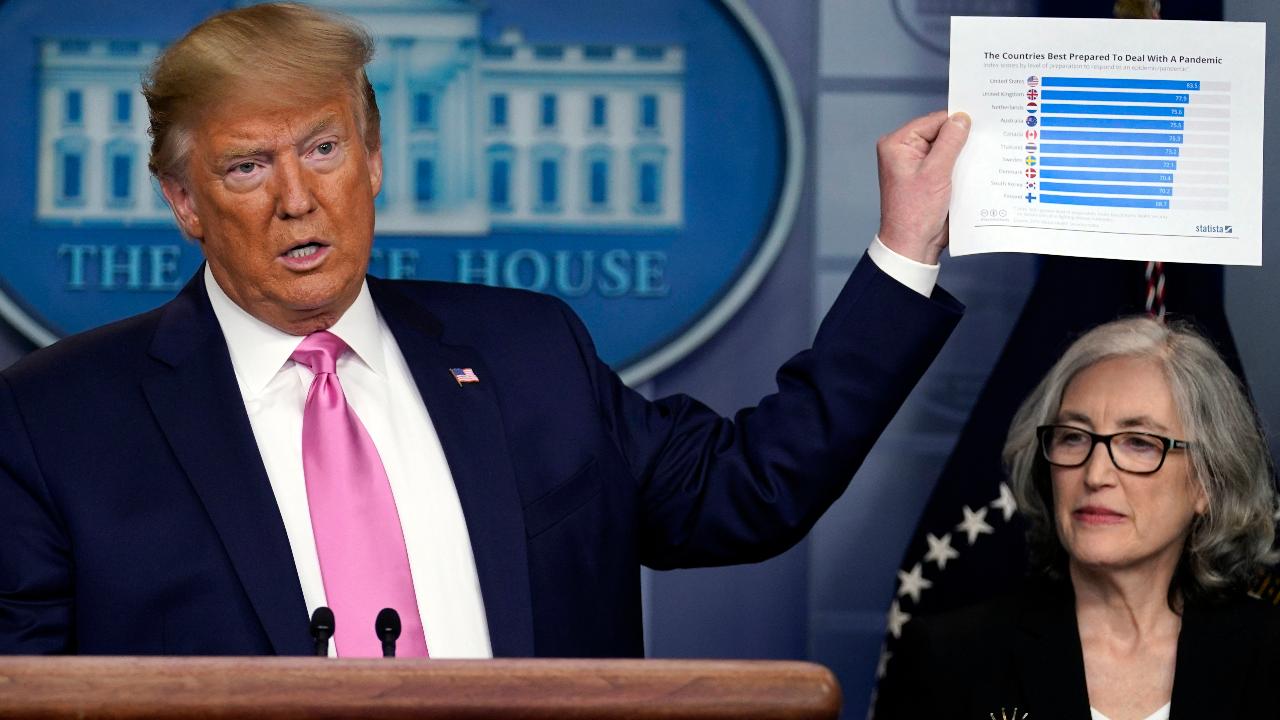

U.S. equity markets plunged into correction territory Thursday in what was another volatile session which followed President Trump’s announcement on Wednesday of a coronavirus task force.

The Dow Jones Industrial Average fell over 1,193 points, its worst single point drop ever, as selling accelerated into the close of trading.

The S&P 500 and Nasdaq Composite lost well over 4 percent apiece.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 5022.21 | -29.20 | -0.58% |

| I:DJI | DOW JONES AVERAGES | 37753.31 | -45.66 | -0.12% |

| I:COMP | NASDAQ COMPOSITE INDEX | 15683.372497 | -181.88 | -1.15% |

The early selling had all three major averages down at least 10 percent from their February peaks. Both the S&P 500 and the Dow Jones Industrial Average were on track for their sixth straight day of losses.

On Wednesday evening, Trump said Vice President Mike Pence would head a task force to combat the outbreak and that his administration was “ready to do whatever we have to” if the virus threat grows. Hours after Trump’s press briefing, U.S. health officials announced the first case in which they were unable to determine the source of infection.

Overnight, South Korea reported 505 new cases and Japan announced the closure of all schools in the country starting March 2. Elsewhere, Saudi Arabia suspended religious pilgrimages to Mecca and elsewhere.

The coronavirus has infected at least 81,109 people globally and killed 2,762, according to the latest figures from the World Health Organization.

Looking at U.S. stocks, Microsoft warned the coronavirus outbreak would impact the supply chain for its “Personal Computing” unit, which accounts for about one-third of its revenue. Other tech giants, including Apple and HP, have already warned about supply-chain disruptions.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 411.84 | -2.74 | -0.66% |

| AAPL | APPLE INC. | 168.00 | -1.38 | -0.81% |

| HP | HELMERICH & PAYNE INC. | 40.84 | -0.36 | -0.87% |

Chipmakers remained under pressure with AMD, Intel and Nvidia all adding to recent losses.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMD | ADVANCED MICRO DEVICES INC. | 154.02 | -9.44 | -5.78% |

| INTC | INTEL CORP. | 35.68 | -0.58 | -1.60% |

| NVDA | NVIDIA CORP. | 840.35 | -33.80 | -3.87% |

Airlines, online travel agencies and casino operators were mostly lower.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAL | AMERICAN AIRLINES GROUP INC. | 13.89 | +0.86 | +6.60% |

| DAL | DELTA AIR LINES INC. | 47.88 | +1.32 | +2.85% |

| EXPE | EXPEDIA GROUP INC. | 128.73 | -0.21 | -0.16% |

| WYNN | WYNN RESORTS LTD. | 97.48 | -1.87 | -1.88% |

| MGM | MGM RESORTS INTERNATIONAL | 42.04 | -0.65 | -1.52% |

Oil majors Exxon Mobil and Chevron were weaker as West Texas Intermediate crude oil futures for April delivery were down 2.5 percent at $47.50 a barrel.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 118.65 | -0.01 | -0.01% |

| CVX | CHEVRON CORP. | 156.36 | +0.12 | +0.08% |

Elsewhere, drugmakers searching for a coronavirus vaccine were mixed with Gilead Sciences and Moderna lower while Novavax and Nanoviricides gained.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GILD | GILEAD SCIENCES INC. | 66.93 | -0.38 | -0.56% |

| NVAX | NOVAVAX INC. | 3.89 | -0.10 | -2.51% |

| NNVC | NANOVIRICIDES | 1.16 | -0.02 | -1.69% |

| MRNA | MODERNA INC. | 103.44 | -0.35 | -0.34% |

Barrick Gold and Newmont mining gave up their early gains as gold futures for April fell back to the flat line at $1,643 an ounce.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GOLD | BARRICK GOLD CORP. | 16.70 | +0.22 | +1.33% |

| NEM | NEWMONT CORP. | 38.55 | +0.43 | +1.14% |

On the earnings front, Best Buy reported better-than-expected fourth-quarter results, which were boosted by strong sales of headphones, smartphones and tablets.

J.C. Penney reported a surprise profit and same-store sales that fell less than Wall Street was anticipating.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BBY | BEST BUY CO. INC. | 76.22 | +1.05 | +1.40% |

| JCP | n.a. | n.a. | n.a. | n.a. |

U.S. Treasurys continued their ascent, pushing the yield on the 10-year note to a low of 1.24 percent. The benchmark yield rallied, however, after the government confirmed an earlier estimate of 2.1 percent GDP growth in the fourth quarter.

In Europe, France’s CAC was down 3.2 percent while Germany’s DAX and Britain’s FTSE were lower by 3.6 percent and 3.2 percent, respectively.

CLICK HERE TO READ MORE ON FOX BUSINESS

Asian markets finished mixed with Japan’s Nikkei tumbling 2.1 percent while China’s Shanghai Composite and Hong Kong’s Hang Seng edged up 0.1 percent and 0.3 percent, respectively.