Dell has combined its server and storage teams in response to a slowdown in enterprise sales in North America and China.

Speaking in the Dell Q4 earnings call yesterday, COO Jeff Clarke said: “Earlier this month, we combined into one sales organization, and we will realize the next level of synergies and cross-sell opportunities, like selling more storage and data protection to our server customers… go mine that customer base and expand the customer base for storage.”

The company thinks there is plenty of opportunity to tap. “We have roughly 30,000 server customers a quarter and less than half buy our storage,” Clarke said. “The server component of that buyer base is modestly growing and the storage one isn’t. That has been our challenge.”

Dell Q4 by the numbers

Dell Technologies revenue growth slowed in the fourth fiscal 2020 quarter, as surging PC sales offset declining server and storage sales. The company attributed the latter to US and Chinese enterprises buying less. But it had its first profitable year since fy2013, partly because it stopped chasing unprofitable server deals in a declining market.

Q4 revenues were $24bn, up 0.7 per cent, and net income come was $416m compared to a loss of $287m a year ago. Full fy2020 revenues were $92.2bn, up 1 per cent over fy2019, with $5.5bn net income contrasting with fy2019’s loss of $2.18bn. Dell shares declined 5.2 per cent in trading hours and 3.6 per cent in after-hours trading.

CFO Tom Sweet said: “We delivered full year net income of $5.5bn and adjusted EBITDA of $11.8bn in fiscal 2020. I’m pleased with our profitability and remain committed to maximizing Dell Technologies’ equity value for all aligned shareholders.”

Full year profits were given a big boost by an income tax provision in Q2 fy2020, resulting in a $4.5bn net income for that quarter. But every fy2020 quarter has been profitable, unlike fy ’19 and fy ’18 when every quarter was unprofitable.

Summary numbers;

- Cash and investments – $10.2bn,

- Gross margin – 34.7 per cent, up 1.2 per cent

- Operating expense – $5.6bn, up 4 per cent due to increased sales coverage,

- Free cash flow (not including VMware and Dell Financial Services) – $2.76bn vs $1.6bn a year ago,

- Cash from operations – $3.51bn vs $2.37bn,

- Debt repayments – $1.5bn.

Sweet said Dell had paid down $19.5bn gross debt since the EMC transaction.

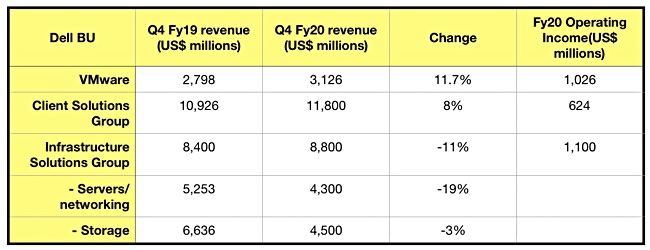

VMware and the Client Solutions Group (PC and notebooks) performed better than Dell’s Infrastructure Solutions Group (ISG) which looks after server, networking and storage and saw Q4 revenues decline 11 per cent;

ISG storage revenue was $4.5bn, down 3 per cent, while servers and networking revenue was $4.3bn, down a whopping 19 percent, although Dell claimed it gained market share. Chasing unprofitable server deals certainly brought in a lot of revenue until Dell changed that strategy after fy2019.

China syndrome

There is a China syndrome killing Dell server sales. Sweet said: “Server revenue’s down roughly 14 per cent year-over-year. … China demand’s down roughly 35 per cent, and the rest of the world’s down roughly 5 per cent.” North America Enterprise business was roughly down double digits. In other regions and server market segments the company clawed out double-digit growth.

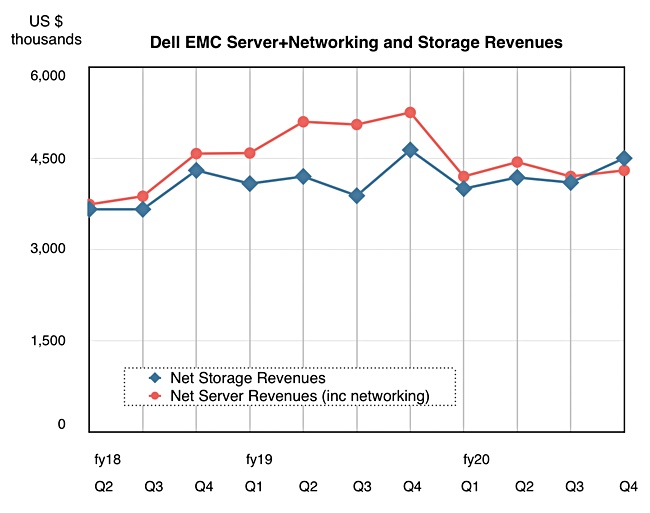

A side-effect of the server slump is that storage revenues have overtaken server+networking revenues;

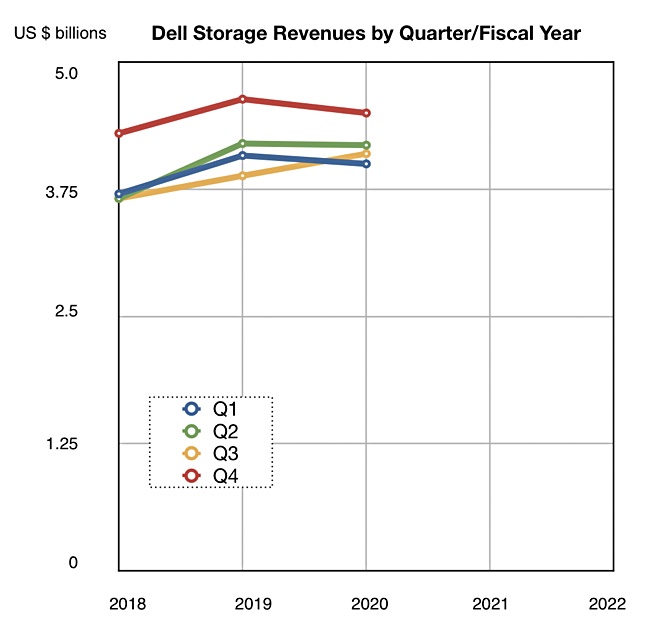

We can also see that, apart from the third fy20 quarter, Dell’s quarterly storage revenues fell this fiscal year.

ISG woes

In the earnings call Clarke said: “Server and networking revenue declined in FY ’20, but profitability was up as we didn’t chase unprofitable server deals in a down market.”

Storage array sales were soft although there was double-digit revenue growth for Dell EMC’s hyperconverged (HCI) kit.VxRail sales rose more than 60 per cent, but not enough to offset low array sale.

Sweet said lower ISG sales were “due in large part to a soft market, particularly in China and in certain large enterprise customers in the U.S. and Europe.” He said fy2020 exhibited “a tough sort of infrastructure spend environment.”

According to Clarke, storage sales will start growing, citing “our new mid-range storage solution being evaluated now by dozens of customers.”

MidRange.NEXT and delay

He is also confident because Dell has simplified its portfolio and is starting a new midrange product cycle: “By Dell Technology World in May we will have refreshed our entire storage product lineup under the Power brand, completing a 2.5-year journey of modernising our entire ISG portfolio. We have never been more competitive from top to bottom. We are planning to grow FY ’21 storage revenue at a premium to the market with growth strongest in HCI, followed by core storage and data protection. … FY ’21 is the year of ISG.”

Clarke acknowledged MidRange.NEXT had been delayed: “It is late. I committed to be done by the end of the year. It didn’t get done by the end of the year.” The extra time has been needed to improve quality and reliability. … We will be taking orders and delivering before the end of the quarter.”

He expressed optimism in servers returning to revenue growth: “In FY ’21, we’re planning for both the overall server market and our server revenue to return to growth, driven by higher value workload servers, increasingly more robust AI and machine-learning solutions and distributed IT requirements at the edge. “

Outlook

Dell expects FY2021 revenue to be between $91.8bn and $94.8bn. This does not factor in possible coronavirus outbreak effects.

Wells Fargo analyst Aaron Rakers expects Dell’s storage revenue to “decline slightly in F2021 … Dell remains confident in its ability to drive improved storage results in F2021 as its sales hires reach full productivity and the company has recently introduced cross-selling incentive plans.”

Clarke is set on turning ISG around: “We have to see the ISG perform on a year-over-year basis, it has to be a dramatic improvement.”