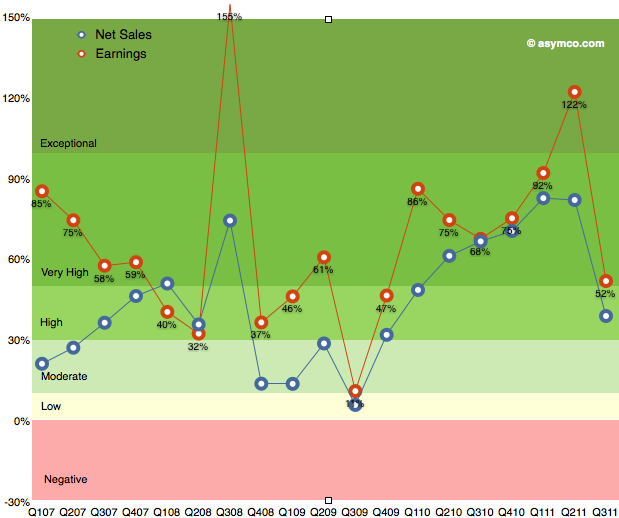

As the chart below shows, the last quarter (third calendar, fourth fiscal 2011) was slow with only 52% earnings growth. The discussion centered on the (surprisingly) disruptive effect of the iPhone transition. Surprising since most analysts, myself included, were lulled into thinking that the portfolio of iPhones and their wider distribution would create a smoother sales pattern vis-a-vis the more cyclical pattern seen in the first three years of production.

The second quarter was surprisingly strong and the third was surprisingly weak. So how do we estimate the fourth?

We have the pent-up demand for the new iPhone, we have the dynamics of holiday spending and we have a question mark on pattern of growth for the iPad. I’ll discuss each assumption in turn:

The first assumption remains that iPhone growth is approximately 100% for the full year. Last calendar year there were 47.5 million iPhones sold. A 100% growth would imply about 95 million for this year. So far 56 million were sold. To reach a doubling then 39 million would need to ship in Q4.

Another approach is to look at quarterly growth rates. Thus far, we’ve had 113%, 142% and 21% for the first three quarters. To reach an average of 100% for the year then the fourth quarter would need about 120% or 36 million units.

36 to 39 million would be a good bounding range if there were no other mitigating factors. The information published so far shows no particular problems with either production or access to markets so I’m going to go with 35.7 million.

The second major assumption relates to the iPad. The iPad has been a challenge to predict since launch. Not only is it a new category but it comes with a different launch cycle than the iPhone and has significant constraints on production. There have been only two quarters where we could measure y/y growth: 182.8% in Q2 and 165.6% in Q3. I was initially tempted to dial in 150% for Q4 but the question of transition comes up. The first iPad model grew well into the holiday quarter but dropped dramatically into the first as it went through the transition to the iPad 2.

Are we going to see the transition effect earlier this year? I’m being cautious and suggesting only 100% iPad growth or 14.6 million units this quarter. This is still a very challenging product to forecast.

So here are my fourth calendar quarter forecasts (with y/y growth in parentheses):

- iPhone units: 35.7 million (120%)

- Macs: 5.2 million (27%)

- iPads: 14.7 million (100%)

- iPods: 13.6 million (-30%)

- Music (incl. app) rev. growth: 22%

- Peripherals rev. growth: 25%

- Software rev. growth: 25%

- Total revenues: $44.6 billion (growth: 67%)

- GM: 42.0%

- EPS: $12.3 (91%)

This earnings value would imply a trailing twelve months’ EPS of about 33.5. At $390/share the P/E would be 11.6. Cash and equivalents may increase to $90 billion.