Smartphone market share numbers for the second quarter of 2012 reveal that occasional bitter rivals Apple and Samsung continue to dominate the market, while competitors fight over the leftovers. Market research firm IDC shows Samsung holding a 30 percent share worldwide, while Apple trails with 17 percent. But NPD's recent data paints a different picture domestically, with Apple garnering 31 percent of the US smartphone market share, and Samsung holding 24 percent.

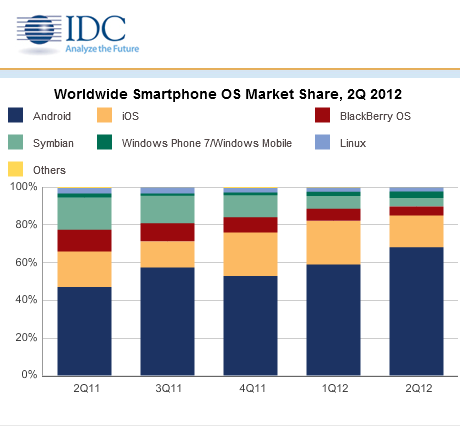

Worldwide, Android is clearly the dominating platform, with a 68 percent total share according to IDC. iOS has 17 percent as previously mentioned, while BlackBerry, Symbian, and Windows Phone platforms take a few percentage points each. Though overall smartphone sales continue to grow as feature phones decline in popularity, RIM's BlackBerry platform and Nokia's Symbian platform are plummeting in share.

It's worth noting that while Windows Phone trails in fifth place with just 3.5 percent share, its year-over-year growth in unit sales was 115 percent, far more than the overall 42 percent growth of the market. Android had similar triple-digit growth, but started from a much larger base, resulting in its market-leading position.

Samsung alone is responsible for 44 percent of Android sales, more than the next seven vendors—including Google-owned Motorola—combined. The company recently released its third-generation Galaxy SIII handsets and the oversized Galaxy Note, accounting for a large portion of sales.

The market is a bit different in the US, though. Apple still dominates with the iPhone, despite declining sales that follow a typical pattern as Apple gears up to release a new model in the fall. Along with Samsung, those two companies are responsible for 55 percent of the domestic smartphone market according to NPD. HTC, Motorola, and LG round out the top five spots.

The burgeoning US pre-paid market is where the current action is, it seems. Year-over-year smartphone sales to post-paid contract subscribers was flat, while pre-paid smartphones grew 91 percent.

"Prepaid smartphones are no longer just cheap, also-ran options, focused on older and less capable phones," Stephen Baker, NPD's vice president of industry analysis, said in a statement. "Carriers have been smart to aggressively market some of their best current smartphones on a pre-paid basis to a new set of customers, in order to keep sales humming along."

Notably, Virgin Mobile and Cricket have recently begun offering Apple's iPhone 4S on a pre-paid basis in addition to recent Android offerings. While the device costs significantly more upfront than a typical "on-contract" price of $199, inexpensive voice and data plans cost far below typical post-paid prices of around $80 per month.

reader comments

85