The iPhone Stimulus Is Here, Everybody!

From runways moving cargo plans to retail floors moving boxes, the iPhone 5 is leaving its mark on the U.S. economy. What's good for Apple ...

For decades, economists have come to expect odd things from data this time of year, owing to production schedules at the goliaths of American industry, auto manufacturers. But increasingly, autumn variations are being chalked up to a newer behemoth: Apple.

- Nobel Prize for Economics Goes to the World's Smartest Matchmakers

- What You Need to Know About the New $20 Billion Sprint Nextel/Softbank Deal

The Wall Street Journal noted that sales of the iPhone 5, which topped 5 million units in its first weekend alone, could clearly give a fillip to retail sales numbers in September. And behold, retail numbers did in fact arrive rosier, helped in part by an especially strong 4.5% month-to-month jump in electronics and appliance stores, after a six-month average pace of -0.4%, according to UBS economists. Nonstore retailers -- another area were iPhone sales were supposed to show up -- also helped drive numbers higher with 1.8% increase from August.

But as Quartz's Tim Fernholz pointed out, the iPhone was moving economic data before it ever hit store shelves. The Federal Reserve spotlighted the handset's impact on the cargo industry during its recent Beige Book report.

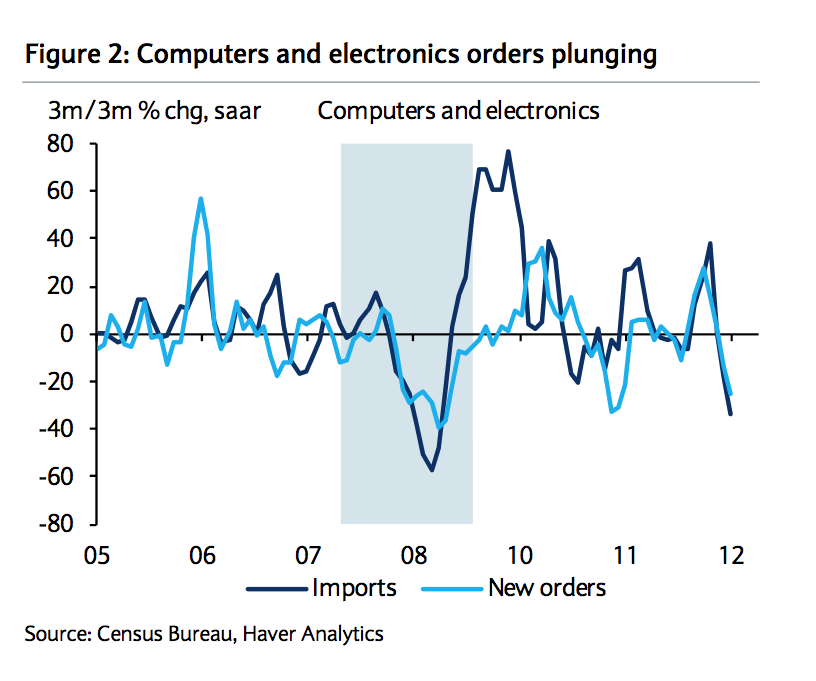

On the other hand, some are also citing the launch of the iPhone as a contributing factor to some of the recent data suggesting a slowdown in US business spending. For example, Barclays economists have noted that the recent fall in capital goods imports was driven in part by imports of computers and electronics, which tumbled 33.8% in August on an annualized basis. "Partly, this reflects payback after a surge in orders early in the year, but it also may reflect to some extent tech product cycles, where there is sometimes a lull in demand before a new product (such as a new smartphone) is introduced," they wrote.