Hewlett-Packard, the once-great technology giant that practically invented Silicon Valley startup culture, is just about done making disastrous decisions that threaten its entire business. (Decisions like its ill-starred acquisition of software company Autonomy, whose value HP then had to write down by $8.8 billion.) And Wall Street likes that: The stock is up about 80% since its nadir in November of 2012.

Credit for that is due to CEO Meg Whitman, whose turnaround plan, announced in October 2012, initially invited skepticism. Whitman has said it will take five years to get HP back on track. It’s working so far, if your measure of success is in how much she has cut costs—an accomplishment Whitman trumpeted on the investor call accompanying today’s earnings announcement.

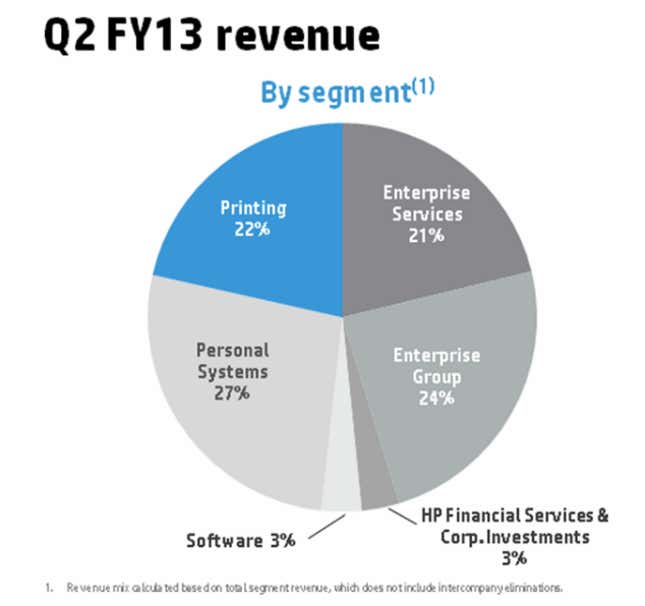

But here’s the problem: a more efficient, better-managed HP doesn’t mean much in the long run if the company cannot move beyond the stagnating businesses that make half of its current revenue—PCs and printers.

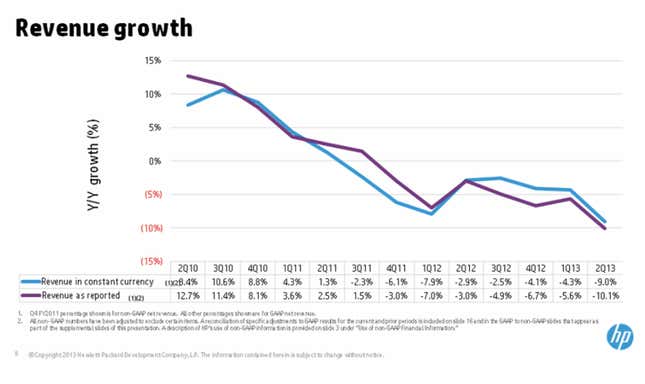

The bottom line is that HP has seen its revenue decline every quarter for more than a year.

HP has tried to come up with new consumer products to replace its PC business. That didn’t go so well. Its now-discontinued TouchPad tablet ran its own operating system, WebOS, requiring apps that didn’t run on the dominant mobile platforms, Google’s Android and Apple’s iOS.

That leaves just one business where HP seems to be successfully innovating and beating at least some of its competitors. That’s enterprise servers, the high-powered computers that websites are run from. Everyone from Apple to China’s largest IT services provider, Synapsis, is apparently interested in HP’s new Moonshot servers. And yet overall, HP is losing ground to Dell, which may soon eclipse HP as the world’s #1 seller of servers, much as Lenovo recently eclipsed HP as the #1 seller of PCs. What’s more, both Dell and HP are threatened by even cheaper systems from Asian manufacturers. Moonshot seems to be HP’s response to all of these threats, but it will take years to see if it helps.

Insufficiently enterprising?

“Enterprise solutions”—servers and other services for big companies—constitute the half of HP’s business that isn’t PCs and printers. To underline just how much enterprise solutions matter to HP, just before the earnings announcement today Whitman put the company’s former chief operating officer in charge of that division, replacing the previous head. As PC and printer revenue continues to shrink, HP looks more and more like IBM, which left all but the high-end hardware market some time ago.

But that model may be running out of gas for IBM, as well. And even if HP continues to land big contracts for enterprise solutions, an HP without PCs and printers is still only half the HP of today.

HP has 300,000 employees, so there’s still plenty to cut to keep the company solvent, even if the economy remains lackluster. But without any innovative consumer products to speak of, HP is essentially at the mercy of big businesses’ appetite for technology. And they seem to be wanting less and less of whatever HP is selling.

That’s probably because those big firms are moving their business from the sort of “private clouds”—i.e. corporate data centers—that HP equips, to “public clouds” of the sort that Amazon provides. These public cloud providers are massive, and are more likely to use their own server designs than anything that includes a markup from HP.

Whitman has said that to make more money, HP need to innovate. The ultimate question is, while she’s managing HP’s consolidation and retreat admirably, is she the CEO who can get the company to once again break the mold? Given her background as head of eBay, a company that changed little under her decade-long rule, we have to be dubious.