It should be clear by now that the “C” in the iPhone 5C was never going to stand for “cheap”. But what about the S in the iPhone 5S? The latest pricing from China Telecom, the third-largest mobile network operator in the largest mobile market in the world, shows that in China at least it stands for “super-premium.”

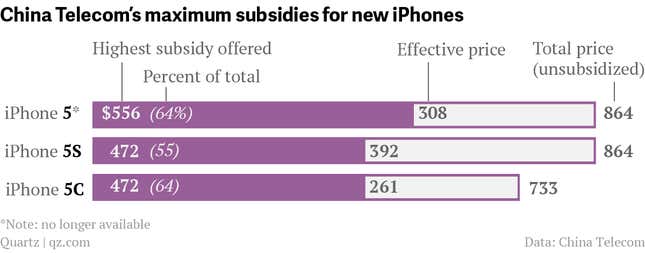

According to a table posted on its website, China Telecom has reduced subsidies (the discount on a new phone for buyers who sign up for a minimum contract period) by 15%. What this boils down to is that subscribers will pay at least 1,598 yuan ($261) for the iPhone 5C on a two-year contract, or just $50 less than they did for the iPhone 5. The iPhone 5S, meanwhile, will cost at least $392 with a subsidy, $84 more than the iPhone 5. That’s even though both the 5 and the 5S cost the same at their full, contract-free price: $864.

The changes become clearer when you look at percentages. Under the old subsidy regime, China Telecom offered up to 64% off the iPhone 5’s market price. That proportion remains the same for the 5C. But for the 5S, the maximum subsidy is now 55%.

In the US, by contrast, wireless carriers offer the most basic 5C for $99 with a contract, an 82% subsidy on the phone’s $549 purchase price. The iPhone 5S costs the same as the iPhone 5 did: $199 upfront as against $649 unlocked, a 69% subsidy.

In short, in the US, the iPhone 5C is a discount phone. In China, the 5S is a premium phone.

There are two ways to interpret this. One is that Apple wants to market the 5S as a super-luxury phone in China. The other is that it’s just local economics. China Telecom and China Unicom, the second-largest provider, have long struggled with the cost of subsidies eating into their profits. China Mobile, the largest operator with 740 million subscribers, does not yet carry iPhones, despite many rumours that it will, for perhaps the same reasons.

They would do well to observe their counterparts over the water in Japan. DoCoMo, the biggest Japanese network, just started offering the iPhone—and sparked a price war, with some cutting the upfront price of an iPhone with a contract to zero.