Hewlett-Packard Company (NYSE:HPQ) is set to report FQ2 2014 earnings after the market closes on Thursday, May 22nd. Hewlett-Packard is a multinational information technology company which has seen its revenue slip on a year over year basis for 8 consecutive quarters over the past 2 years. Rackspace (NYSE:RAX), a cloud hosting company, has been struggling lately to compete with larger players in the industry like Amazon (NASDAQ:AMZN) Web Services as a price war has been raging. It’s rumored that Hewlett-Packard or one of its rivals such as IBM (NYSE:IBM) might be getting ready to acquire Rackspace. On Thursday Wall Street expects Hewlett-Packard’s earnings to come in 1c ahead of FQ2 of last year while revenue slips by 1%. Here’s what investors are expecting from Hewlett-Packard on Thursday.

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

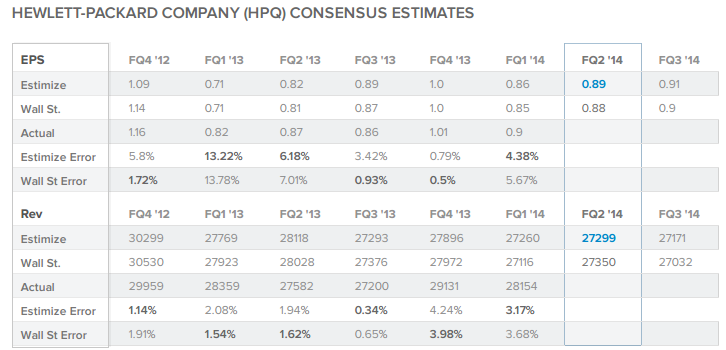

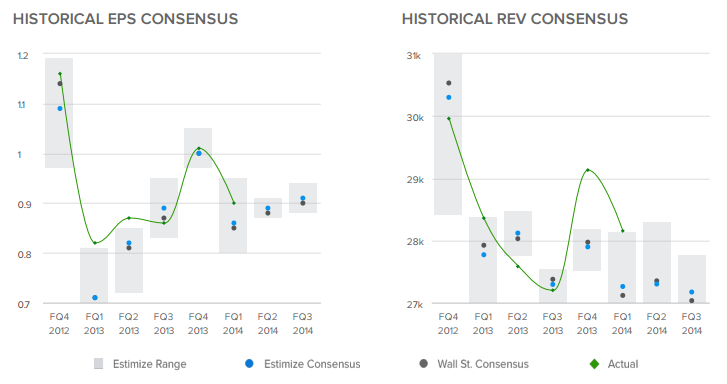

The current Wall Street consensus expectation is for Hewlett-Packard to report 88c EPS and $27.350B revenue while the current Estimize.com consensus from 25 Buy Side and Independent contributing analysts is 89c EPS and $27.299B in revenue. This quarter the buy-side as represented by the Estimize.com community is expecting Hewlett-Packard to report 1c ahead of Wall Street’s EPS consensus while coming up $51 million short on revenue.

Over the previous 6 quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting Hewlett-Packard’s EPS and revenue 3 times each. By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is more accurate than Wall Street up to 69.5% of the time.

More importantly it does a better job of representing the market’s actual expectations. It has been confirmed by Deutsche Bank Quant. Research and an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

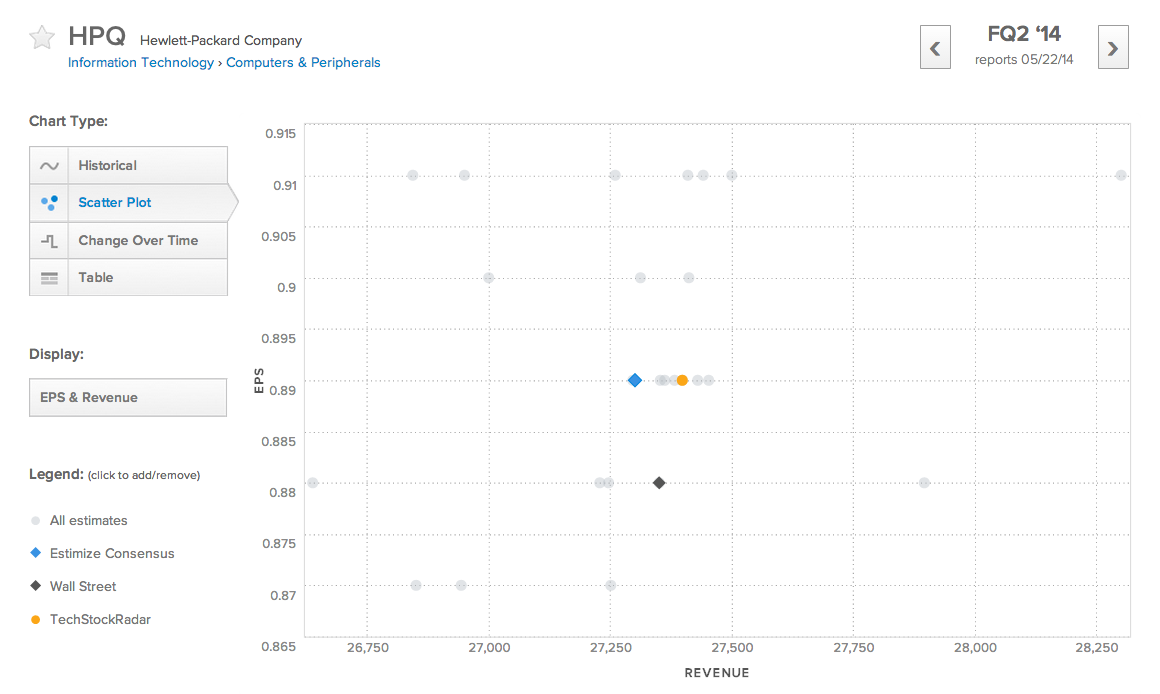

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. Here we are seeing similar earnings projections on Hewlett-Packard from Wall Street and Estimize.

The distribution of earnings estimates published by analysts on the Estimize.com platform range from 87c to 91c per share and from $26.637B to $28.301B in revenues. This quarter we’re seeing a narrow range of EPS estimates on Hewlett-Packard and a wider range of revenue estimates.

The size of the distribution of EPS estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A narrower distribution of estimates signals more agreement in the market, which could mean less volatility post earnings.

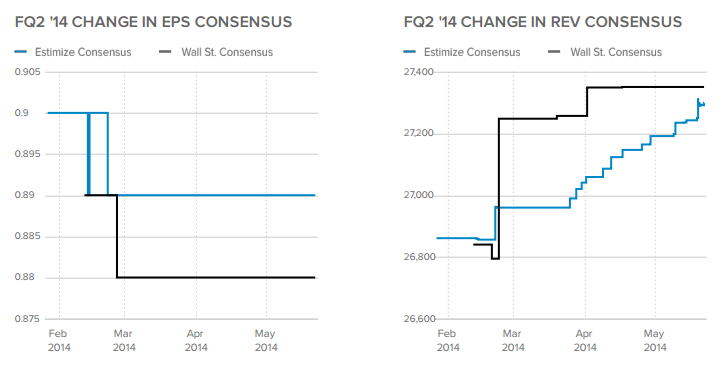

Throughout the quarter, the Wall Street EPS consensus fell from 89c to 88c while the Estimize consensus dropped from 90c to 89c. Meanwhile the Wall Street revenue consensus rose from $26.840B to $27.350B while the Estimize consensus climbed from $26.861B to $27.299B. Timeliness is correlated with accuracy and upward analyst revisions at the end of the quarter are often a bullish indicator.

The analyst with the highest estimate confidence rating this quarter is TechStockRadar who projects 89c EPS and $27.397B in revenue. TechStockRadar is ranked 13th overall among over 4,450 contributing analysts. Over the past 2 years TechStockRadar has been more accurate than Wall Street in forecasting EPS and revenue an impressive 66% and 63% of the time respectively throughout 538 estimates.

Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case TechStockRadar expects Hewlett-Packard to report in-line with the Estimize community on EPS while coming out ahead on sales.

On Thursday contributing analysts on the Estimize.com platform are expecting HP to sneak past Wall Street’s EPS consensus while reporting slightly lower sales. The Estimize community is also expecting HP to report a 9th consecutive quarter of falling year over year revenue, which has fueled speculation that HP might consider making an acquisition to boost sales.

Get access to estimates for Hewlett-Packard published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.