iPad Sales Faltering Under Phablet Competition And Longer Replacement Intervals

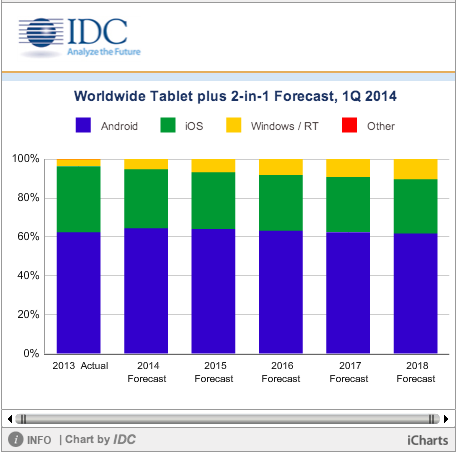

Market research firm International Data Corporation (IDC) has lowered its 2014 worldwide tablet plus 2-in-1 forecast to 245.4 million units, down from its previous forecast of 260.9 million units. The new forecast represents a 12.1% year-over-year growth rate — notably slower than the 51.8% year-over-year growth of 2013. IDC now projects that based on a sharp decline in demand than predicted in the first quarter and concerns that tablets and 2-in-1s will face additional market challenges the rest of the year,

“Two major issues are causing the tablet market to slow down. First, consumers are keeping their tablets, especially higher-cost models from major vendors, far longer than originally anticipated. And when they do buy a new one they are often passing their existing tablet off to another member of the family,” says Tom Mainelli, Program Vice President, Devices & Displays at IDC. “Second, the rise of phablets — smartphones with 5.5-inch and larger screens — are causing many people to second-guess tablet purchases as the larger screens on these phones are often adequate for tasks once reserved for tablets.”

However, that’s a pattern that some of us followed for years with Macs before iPhones and iPads ever came on the scene. It’s been argued (unconvincingly IMHO) that Apple builds their hardware too well for their own good marketing-wise, although an expectation of superior materials and build quality is implicit for many Apple fans. For example, my current three-year-old iPad 2 wil get handed off to my wife when I upgrade, and possibly to another family member later if it stays reasonably usable, even though no longer cutting edge.

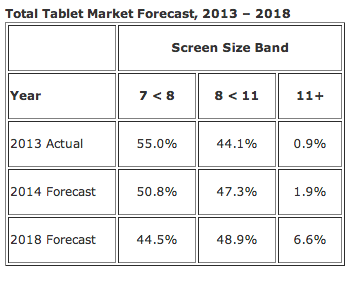

IDC notes that In the past year alone, the phablet share of smartphone shipments has more than doubled, from 4.3% in the first quarter of 2013 to 10.5% in the first quarter of this year, representing 30.1 million units shipped. As large phones clearly impact near-term tablet growth, IDC expects the market to rebound by shifting its focus back toward larger-screened devices. Products with larger screens–like Microsoft’s new 2-in-1, the 12-inch Surface Pro 3— are expected to play a greater role in the market going forward.

“The shift back toward larger screens will mark a welcome sea change for most vendors as the average selling price for these devices will remain roughly 50 percent higher than the average sub-8-inch device,” explains Jitesh Ubrani, Research Analyst, Worldwide Quarterly Tablet Tracker. “Microsoft is also expected to benefit from this shift as the share for Windows-based devices is expected to double between now and 2018.”

Source: IDC Worldwide Quarterly Tablet Tracker, May 29, 2014

Note: Total tablet market includes tablets plus 2-in-1s. “Phablet” is defined as a smartphone with screen size of 5.5 to 7 inches.

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

For more information, visit:

http://www.idc.com