About

Brian Nelson's Tumblr

Brian Nelson is the president of Valuentum, an independent financial publishing firm that serves individuals and financial advisers.

+ FOLLOW THIS TUMBLRWhy Intel Wants Altera

In its biggest potential acquisition in history, newsletter portfolio holding Intel is reportedly in talks to acquire Altera, though deal terms have yet to be disclosed. We think Intel could pay up to ~$40 per share for the company on the basis of the high end of our fair value estimate range for Altera and still generate value for shareholders, though we wouldn’t expect Altera’s $2 billion revenue stream to be much of a needle-mover against Intel’s $50+ billion revenue base, at least initially. However, there are a few reasons why this would be a strategic win for Intel.

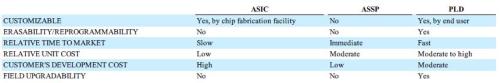

Altera is one of the top standard cell ASIC (application-specific integrated circuit) suppliers in terms of revenue. Due to the rising cost of transistors, however, the ASIC and ASPP (application-specific standard product) models have come under pressure as of late. Altera’s response has been to position itself as one of the two largest manufacturers of field-programmable gate arrays, FPGAs, a sub-segment of programmable logic devices (PLDs) that have much better economics than either ASICs or ASPPs and are poised to displace legacy technologies, almost across the board (ASSP, ASIC, DSP, MCU, CPU, and GPU).

Image Source: Altera

By most estimates, the ASIC and ASSP replacement opportunity alone offers growth that’s twice as fast as the overall semiconductor industry, something Intel wants, and Altera brings to the table a complete FPGA portfolio (Generation 10), from the Max 10 (refresh CPLD/low-end) to the Arria 10 (mid-range markets), and the Stratix 10 on the high end. Altera estimates that the PLD (FPGA) market was nearly $5 billion in 2014, but the combined portion of the ASIC and ASSP markets that was accessible for PLD displacement was over $50 billion, revealing the tremendous growth potential of PLDs (FPGAs). Altera’s Stratix Series already cooperates with Intel 14nm Tri-Gate technology, offering customers double the performance gains in most cases. In a recent Intel presentation, the tech behemoth showcased the significant cost per transistor savings in its 14bnm TriGate technology. The new HyperFlex core fabric architecture results in a level of performance and power efficiency that is unmatched by any existing FPGA architecture, according to the firm.

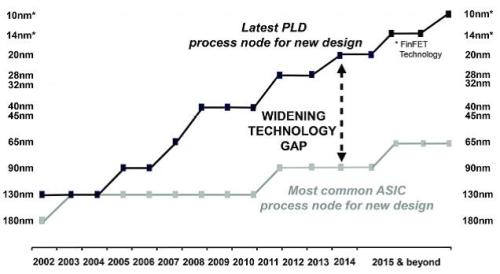

We like Altera’s competitive position to win new business and its existing partnership with Intel, which should smooth deal integration. In fact, Altera’s management will tell you that its partnership with Intel has given it an upper hand in addressing performance, power consumption, and cost at the same time, while rivals have struggled with each sequentially. From what we can tell, this has given Altera has an early-mover advantage, even relative to its chief FPGA rival Xilinx, and the growing “process technology gap” for new designs between PLDs (FPGAs) and the ASIC alternative is revealing. Even if Altera doesn’t sustain such an advantage relative to technology-savvy peers, the benefits of FPGAs over ASICs should generate a market large enough for a number of players.

Image Source: Altera

If there’s one firm that knows the future of the semiconductor industry, it’s Intel. The move to acquire Altera is not based on a hunch. The executive suite at Intel knows the potential of FPGAs because it has been working closely with Altera for a few years now. Altera will create an “incumbency” advantage in this market relative to rivals (as it displaces older technology), and we think Intel has grand plans to capitalize on the growth potential. The cost of switching PLD vendors, for example, is incredibly high given the significant investment in design and prototyping, suggesting a long life-cycle, and Intel knows the value of a profitable recurring revenue stream. Cost savings by bringing Altera in-house will be material for Intel.

As for Altera on a standalone basis, the company’s economic returns have been great as of late, with the company’s operations registering a very attractive Economic Castle rating. From a financial standpoint, free cash flow is robust, and the company is targeting healthy gross (67%-70%) and operating (33%-34%) margins over the next several years. Altera’s cash flow from operations has expanded to ~$670 million at the end of 2014 from ~$590 million at the end of 2014 while capex has hovered around $40-$60 million. The firm’s total cash stood at ~$2.6 billion at the end of 2014, relative to total long-term debt of ~$1.5 billion. Altera’s strong financial health is exemplified by the fact that it has raised its dividend threefold since the end of 2008. The strong cash-flow generation and excess cash would help pad Intel’s dividend growth prospects.

The semiconductor industry continues to consolidate—NXP Semi bought Freescale recently—and we don’t think this will be the last deal that Intel inks should it be completed. Our $35 per share fair value estimate for Intel remains unchanged until further financial deal details come to light. We continue to hold Intel in the Best Ideas portfolio (here) and Dividend Growth portfolio (here). We expect to raise our fair value estimate for Altera in light of the tremendous interest in its product portfolio, which we had underestimated prior to the announcement of deal talks with Intel. Our fair value estimate of Xilinx remains unchanged.

Image Source: yellowcloud

abouchadia liked this

abouchadia liked this  abouchadia reblogged this from abouchadia and added:

abouchadia reblogged this from abouchadia and added: J.ai vu du progres oui c.est ça du bon travail et n.oubliezz pas un certain jour tout va se liquider puisque vous n.avez...

financecontributors-blog reblogged this from valuentumbrian

financecontributors-blog liked this

valuentumbrian posted this