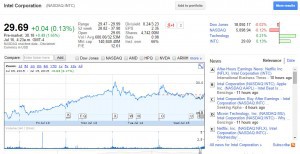

Reports over the weekend from the US seem to indicate that the processor firm will make a $17bn bid to buy the FPGA maker, perhaps today.

A previous takeover move earlier this year failed on price. It seems that Intel is now prepared to increase its offer to well over $50 a share

The deal now looks surprisingly modest following Avago’s $37bn Broadcom, but it would be highly significant in its own right.

Intel has been increasingly interested in integrating programmable logic elements into its processor-based system-on-chip devices (SoCs) and the acquisition of Altera would give it access to some market-leading technology in this area.

Altera is one of two firms which dominate the $5bn FPGA market. The other is Xilinx.

This market has moved away from FPGAs used for prototyping and glue logic, towards SoCs devices in recent years. As a result it is moving into an area which is very important to Intel.

In the mobile market processors are increasingly moving toward SoC designs. This is an area where Intel has found it difficult to compete with SoC suppliers such as Qualcomm and Samsung.

Perhaps Intel believes Altera’s programmable logic platforms will give it the key to unlock the SoC market.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News