IBM reports mixed Q2 as strong dollar hurts revenue

IBM on Monday reported a mixed second quarter as revenue fell short of expectations, but earnings were better than expected. Big Blue's growth businesses such as cloud and analytics showed strong revenue gains compared to a year ago.

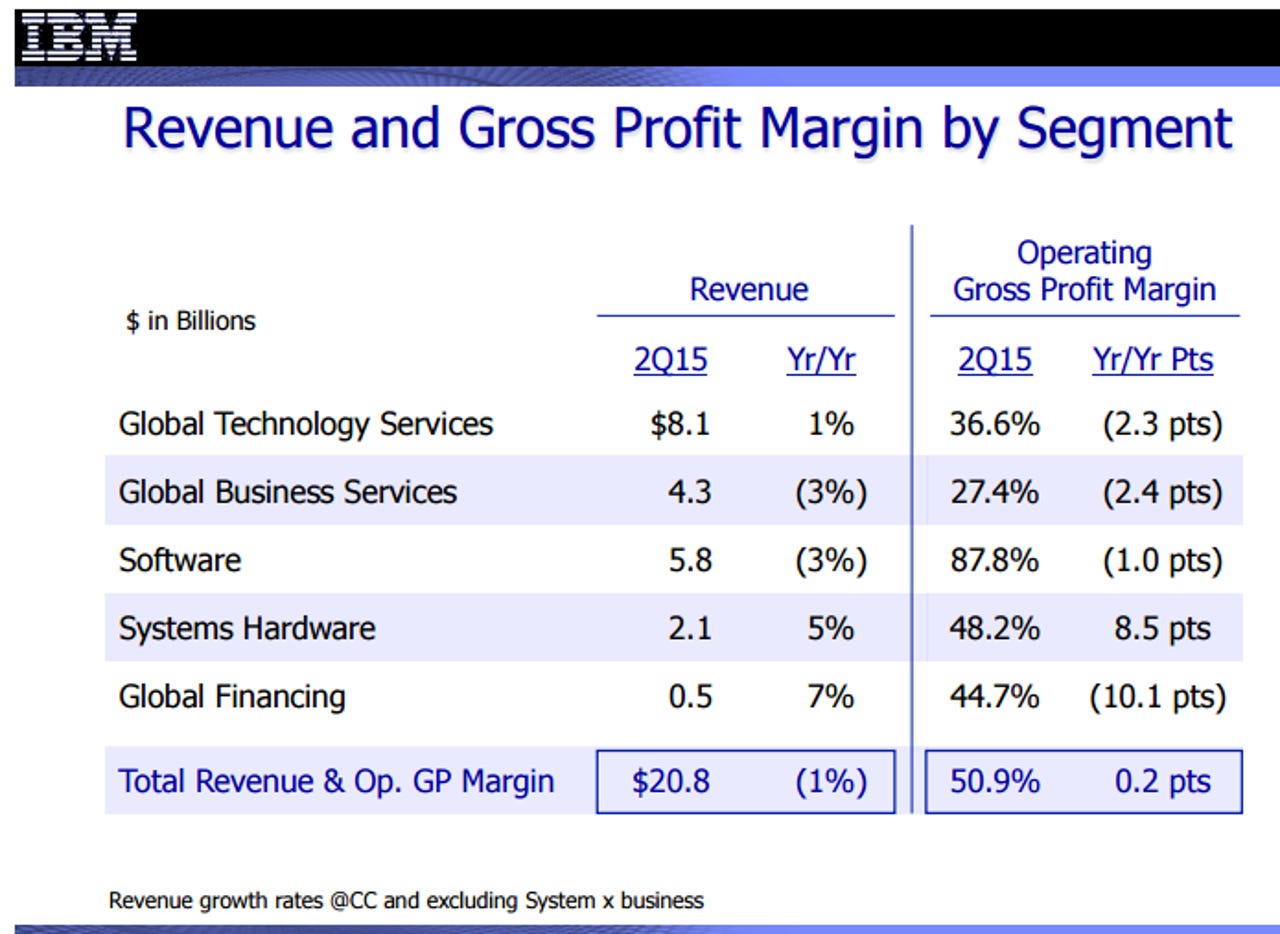

Big Blue reported second quarter earnings of $3.5 billion, or $3.58 a share, on revenue of $20.8 billion, down 13 percent from a year ago. Adjusting for currency and the server business sold to Lenovo, IBM's sales were down 1 percent.

IBM's non-GAAP earnings were $3.84 a share in the second quarter. Wall Street was looking for non-GAAP earnings of $3.78 a share on revenue of $20.95 billion.

As for the outlook, IBM maintained that it will deliver annual non-GAAP earnings between $15.75 to $16.50 a share.

The trick with IBM is determining the inflection point when its growth businesses will outgrow the decline in established units with slow growth. IBM has ditched its System x business and recorded a loss for its discontinued microelectronics business.

IBM's quarter had the typical moving parts. Here's a look:

- The company's cloud, analytics and engagement units delivered growth of 20 percent.

- Cloud revenue was up more than 50 percent. IBM counts a mix of hardware and services as cloud revenue. IBM's as-a-service revenue is on a $4.5 billion annual run rate.

- Revenue from analytics was up more than 10 percent in the second quarter.

- By region, IBM saw Americas revenue fall 8 percent from a year ago with sales from Europe/Middle East/Africa falling 17 percent. Asia Pacific sales were down 19 percent. Revenue from Brazil, Russia, India and China (BRIC) fell 35 percent. In all regions, the stronger dollar hurt sales.

- Technology services revenue fell 10 percent and business services slid 12 percent in the second quarter. These businesses were down 1 percent and 3 percent, respectively, in constant currency.

- Software revenue fell 10 percent.

- Hardware sales fell 32 percent in the quarter, largely due to the divested commodity server business. On the bright side, revenue from IBM's new mainframe was up 9 percent from a year ago.