About

Bidness Etc

Bidness Etc is a New Age Platform For The Latest In Finance & Everything Else

+ FOLLOW THIS TUMBLRApple 4Q Results, How Long Can iPhone Ride To The Rescue

Apple is about to publish its 4Q results. With China woes and possibly slowing iPhone sales, Bidness Etc wonders if the party is over or if we can still fill our boots

Apple Inc. (AAPL) is on the cusp of publishing its latest financial results, after markets close on Tuesday. Normally, there would be a fanfare in expectations of ever greater numbers. This quarter is slightly different.

Earlier this year, Berenberg analyst Adnaan Ahmad predicted Apple would face negative iPhone growth in this quarter. Since 2008, its reliance on this single source has been growing; 50% of its sales for fiscal 2014 derived from the iPhone 6 and 6 Plus alone. BGC Partners analyst, Colin Gillis, who sets a Hold rating on Apple shares, believes the corporation has little room to increase the iPhone’s average selling price.

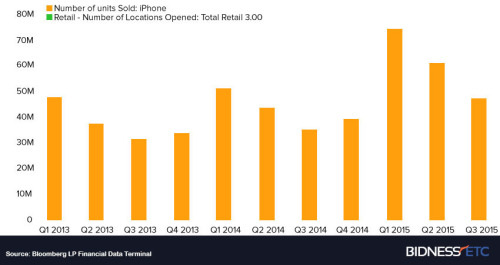

Looking Back On iPhone Sales

A

trend analysis for iPhone sales shows the September quarter was a weak

one for unit sales. Sales peaked during the December quarter, due to the

holiday season. After last year’s release of iPhone 6 and 6 Plus, Apple

posted a December quarter rise of 46% in iPhone sales.

Though

the consensus currently remains bullish on Apple, it faces a bigger

challenge. It has to beat its own sales record of 74.50 million units

sold during 1QFY14, producing a remarkable $18 billion quarterly

revenue.

The Street predicts Apple could beat that record,

though not by much. The consensus expects a sales report of 78 million

iPhone units, a 4% YoY decelerated growth in shipments.

iPhone 6s and 6s Plus

The

two iPhone models – the iPhone 6s and iPhone 6s Plus – were launched on

September 25. The phone featured an A-9 processor, manufactured in

partnership with Samsung and Taiwan Semiconductor Manufacturing Company

(TSMC); a 12-megapixel back camera, and 3D Touch. Alongside this is a

new sales strategy: the iPhone Upgrade Program lets buyers get an

unlocked iPhone 6s in exchange for their current iPhone. They pay for

the new model in installments spread over two years.

The

quarter closed only five days after the launch, which has made the

impact on this quarter difficult to assess. Even this timeline has not

limited sales; it did report selling 13 million new iPhone models, a

30% year-over-year (YoY) growth in iPhone sales.

Earnings Estimates

The

Street believes earnings-per-share (EPS) will hit $1.88, reflecting a

32.39% YoY fourth quarter earnings growth. The consensus sales estimate

stands at $51.02 billion, that’s 21.12% of expected YoY top line growth.

Apple has guided for a revenue range of $49 - $51 billion. The Street

predicts a gross margin of 39.30%, the midpoint of Apple’s guided range

of 38.50% - 39.50%.

Analysts are predicting 48.40 million

quarterly iPhone sales, well ahead of the 39 million shipments reported

for 4QFY14. The consensus estimate average selling price is $649 per

iPhone.

Morgan Stanley remains bullish, it says the survey

shows stronger demand for the iPhone than expected. That, combined with

weak sentiments, should drive the stock higher. Equity firm Susquehanna

also remains positive about the share price, saying initial demand for

the iPhone 6s and 6s Plus is not as high as when the previous two models

were launched last year. The firm says that recent pullbacks on Apple

shares hint at weak sentiments, with investors not expecting substantial

YoY growth.

A renowned London-based supplier, Dialog

Semiconductor, posted its 3Q results on Monday morning. It missed the

Street on sales and issued a lower-than-expected guidance for its

upcoming quarter. Considering that Dialog gets 78% of its business from

Apple, it could point towards deteriorating iPhone sales. Dialog’s stock

was down 20.70% to $35.35 at 3:21 PM EDT Monday. Stocks of other Apple

suppliers including Skyworks Solutions and Avago Technologies are also

sinking, with Apple itself sliding 2.96% (at $115.55) at the same time.

It

remains hard to predict whether the enterprise will report a

substantial YoY growth in iPhone shipments, although up to now Apple has

always pulled an iPhone rabbit out of the sales hat.

Valuation

Apple currently has a blended forward price-to-earnings (P/E) ratio of 11.67x, much less than that of its rivals; Microsoft has a P/E of 18.65x, while Google has a ratio of 22.03x. This suggests the stock currently trades at a discounted price compared to its rivals. Therefore, we suggest a Hold rating on Apple shares, and recommend investors to hang on and see what the magic number turns out to be this time.