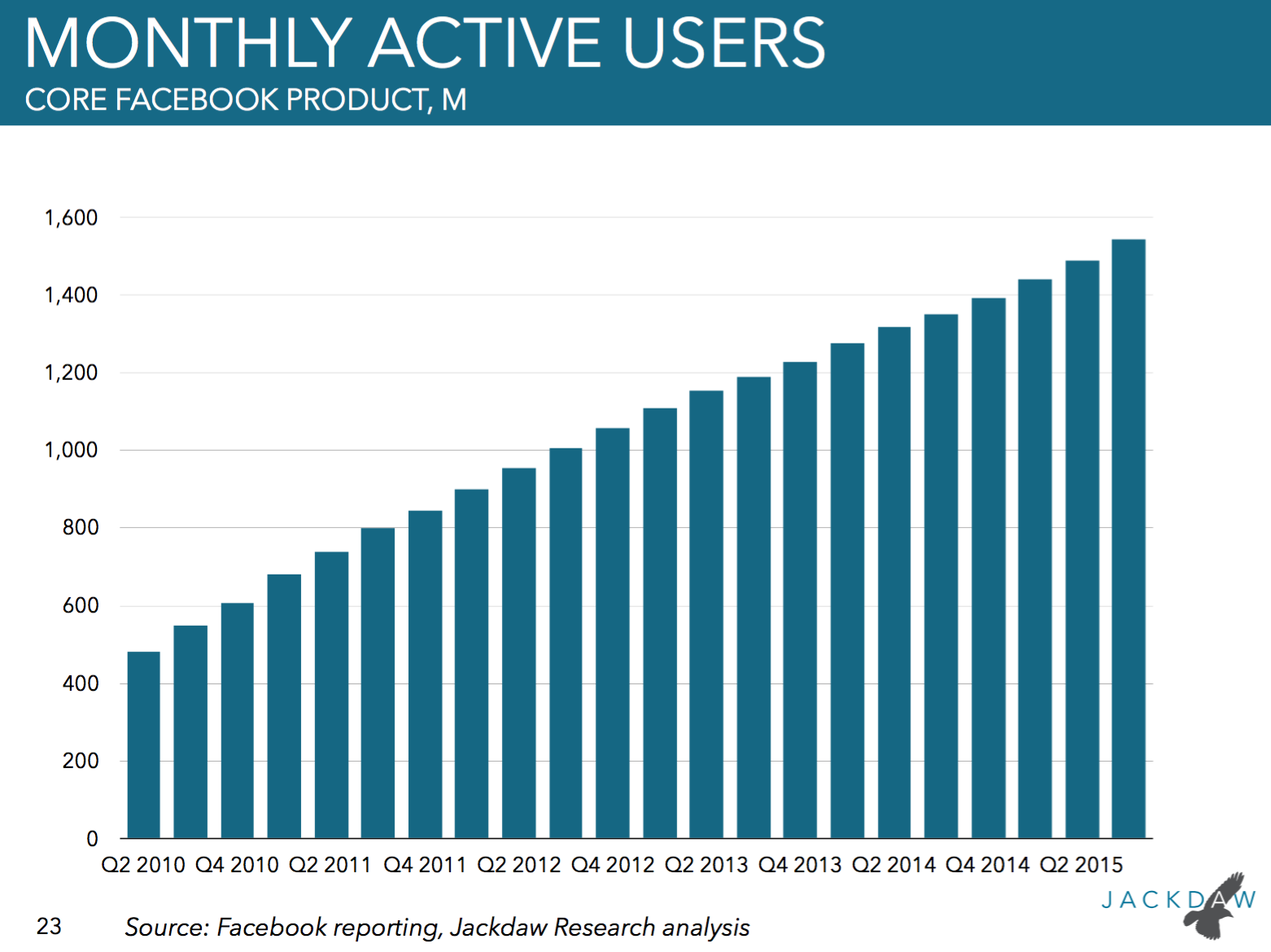

There are a number of mixed opinions of Facebook. Without question, this company has scale and potential like no company on the planet. At a monthly engagement level, user growth keeps going up and shows no signs of stopping or slowing down.

What is underappreciated about Facebook is the degree to which it is the gateway to the internet for millions of people each year. Facebook was, for many of us, a part of many of our western experiences with the internet. However, in many emerging markets it was the central experience consumers had with the internet. I recall how I first discovered this observation.

The most common question I get about my last name is what nationality it is. As you see from my picture, I’m light skinned and have red hair. Most people would think a Scottish, Irish, or English name should be more fitting. Truth is, I’m a quarter Filippino. There are zero Bajarins in the United States outside of my immediate family. But a few years ago, I started getting friend requests on Facebook from a large number of Bajarins. Turns out, a great deal of my family in the Philippines got a smartphone and a Facebook account and started discovering the internet. For most of them, they never had a computer or the internet, and for many Facebook was the only internet they knew.

As I give presentations on this subject, I use the analogy that Facebook is to emerging markets what AOL was to many of us in the West — the gateway to discovering the internet. This remains true at a global level today as we bring millions of new consumers onto the internet every year. Carriers in many of these emerging markets promote Facebook and WhatsApp in their marketing materials as reasons to get on the internet. Facebook is playing a role that only Facebook can play and it is essential for us in bringing the internet to billions of people. Because of this fact, watch the read area of this chart continue to grow and potentially rapidly.

When I look at every company providing a service to consumers globally, I conclude there is no company who will touch more humans on a daily level than Facebook. You may be tempted to push back and say, what about Google? Unquestionably, Google’s services touch almost as many people as Facebook. However, in terms of absolute time spent, Facebook still own more daily computing time than Google. This gap will only increase as Facebook continues to grow and connect another billion people and touch more people, for longer periods of time, than any other company.

I get push back from many, including many of Facebook’s primary VCs, when I say I believe Facebook is a once in a generation company. I’m not sure we will see a company with this kind of global scale anytime soon and possibly never again.

While there are real revenue concerns for Facebook, I’m still bullish on their prospects. Partly because Mark Zuckerberg has shown the gutsy decision-making skills to go acquire things he believes belong in the Facebook suite of assets. Mark takes a stance that seems to end up saying, “Why wait for something to disrupt us when we can go buy it and add it to our family of apps”. This approach is bold and aggressive and ultimately why I think Facebook can take on their competition head to head.

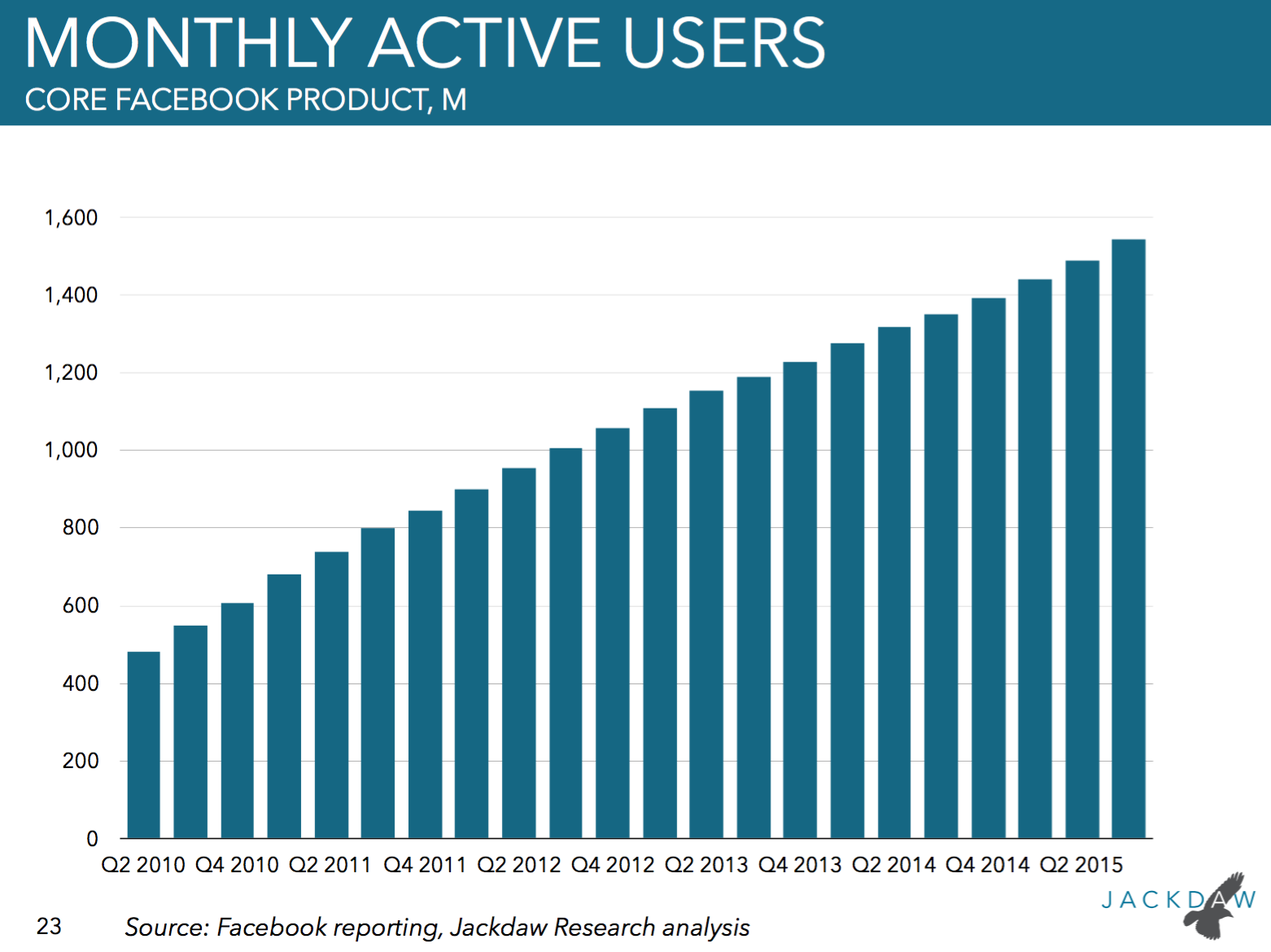

However, this is the money chart from Facebook.

This is the only chart I really look at from their earnings each quarter. Facebook is actively doing what both Jan Dawson and I have articulated for Tech.pinions subscribers — do everything possible to milk their existing user base for as much revenue as possible. Today, this is done through ads. However, as I said here about social commerce, the payments side of this could change Facebook’s revenue line in profound ways.

Think about this. Today, with an advertising based model, Facebook’s ARPU of western countries is slightly higher than that of WeChat’s in China. WeChat is largely a transaction-based platform, not an advertising one. So what happens when Facebook can add a transaction engine on top of their existing model? My sense tells me it will dramatically change their ARPU in a sharp direction up and to the right.

This is particularly important in areas of the above chart where Facebook’s revenue per user is quite low, like Asia Pacific and much of the rest of the world. These are not markets where Facebook will make much from advertising but it can make revenue from transactions by being in the middle of social commerce, banking, or even financial services.

Facebook will certainly see competition from players who focus on a specific segment of the market. Snapchat is an example. Snapchat will likely never see the scale Facebook has but Snapchat is stealing time away from Facebook with the lucrative teen and millennial market. Ultimately, Facebook’s scale will play as an advantage, particularly in emerging markets. How they deal with competition in developed markets like Twitter, Snapchat, and Pinterest, which all steal time away from Facebook, will be interesting. But I’ll stand by my conviction that, once they solve the social commerce angle, it will create a new period of financial growth and add new layers of stickiness.

Facebook quarter charts provided by Jan Dawson’s quarterly deck service.

And you didn’t even mention Oculus which I’m convinced will be a household name before the decade is out. I for one look forward to touring the pyramids of Egypt and Great Wall without leaving my office.

Zuckerberg is one of those rare guys who can see around corners (Steve Jobs was another one). People question some of the deals he makes (WhatsApp, Instagram). Given enough time, most of these deals will make perfect sense.

I’m really ambivalent about FB and the other proprietary services running on top of the Internet. Just today there was the story of a guy who got hacked, then got his account back, but empty, he lost 9yrs of posts, friends, likes…

I’m trying to find an analogy to the proprietarization of the Internet…. Oh, 20th century telecoms: global infrastructure with a “public” taste (subsidies, right of way, regulations…), but de facto private monopoly operators extracting rent like crazy. This time around the rent is not monetary but in terms of lock-in and data siphoning, but I think the underlying mechanism is the same.

I’ll bet you after a few crises and, alas for me, in a few decades, the virtual social infrastructure of the Internet will evolve the same way telecoms did, with forced interoperability (ie, shared logins, standard formats protocols and APIs) and behemoths broken up. After a while the pace of innovations slows down, incumbents become reactionary and market failures (ie, monopolies) become painful. FB is today’s 1950 AT&T.

This was beautiful Admin. Thank you for your reflections.