Apple stock crash nears another scary level

Investors hoping the Apple (AAPL) stock implosion would end this year are now clinging to what's left of the triple-digit stock price.

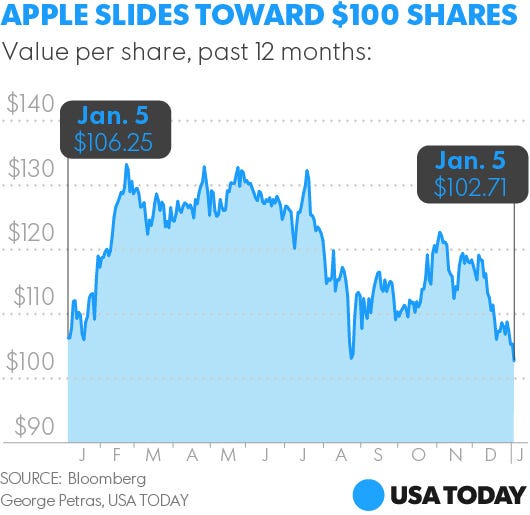

Shares of the gadget maker were down another 2.5% Wednesday after falling 2.5% on Tuesday to close at $102.71. The once-hot stock is now careering toward the $100-a-share level -- a price threshold bulls are hoping will finally hold. Apple's stock hasn't closed below $100 since late October 2014.

Shares of Apple have lost about 25% of their value from last year's high and are at their lowest close since August 2015. Once a stock investors used to brag about holding, the shares are down 4% already this year coming off a 4.6% decline in 2015.

Fanning the stock's decline Tuesday was a report in Japan's Nikkei Asian Review that Apple plans to cut the production output of its iPhone by 30% in the first quarter of 2016. That only fuels intensifying concern as demand for smartphones continues to mature, making growth much more difficult. A difficult smartphone market is bad news for Apple since it relies on the business for a majority of its profit. Apple also counts on charging $650 for smartphones, which drives high profit margins especially in the hardware industry where prices generally fall over time.

Apple shares skid off report on iPhone production cuts

Meanwhile, new products and services designed to diversify the company's revenue, such as Apple Music, Apple Pay and the Apple Watch, have failed to catch on with consumers. Apple bulls are hopeful the company will report sales traction with some of these new products and services when the company reports first-quarter results at the end of this month.

All told, Apple investors are suffering epic losses as the over-enthusiasm for the stock turns into disappointment. Remember all the talk about Apple being the first $1 trillion company? Now, the stock is headed in the other direction - and fast. More than $176 billion in shareholder wealth has been destroyed since the stock hit its all-time high of $134.54 on April 28, 2015. Apple's market value is now $573 billion.

Rather than wondering how high Apple's stock can go up - the worry is how low can it go. Shares of Apple are now just 12% higher than the lowest point the stock traded an an intraday basis over the past 52 weeks: $92 on Aug. 24, 2015.