Fundamentals

Written by Ophir Gottlieb and Jason HitchingsTHE $600 BILLION BET

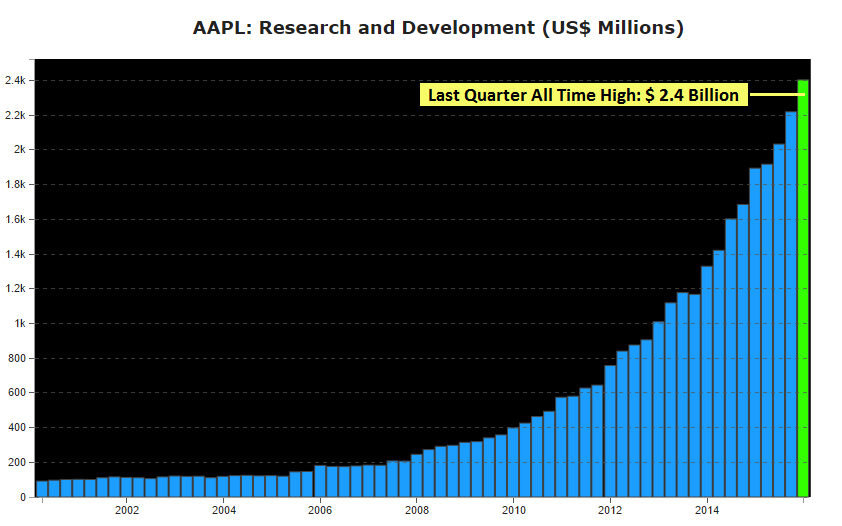

Apple is making massive investments into R&D across a spectrum of technologies,

from virtual reality to mobile payments

to an electric, self-driving car. Not only is Apple investing billions,

but the rate at which they are investing is accelerating. All told, the cash Apple is pouring

into R&D is one of the world’s largest bets on future technologies.

CML Pro

will show us just how big the bet has become:

$2.4 Billion Dollars per Quarter. Annualized, Apple will be investing more into R&D then

the entire economic output of 60 different countries. What’s more, their entire $600+ Billion valuation

likely hangs in the balance.

Will this massive bet pay off?

The shadow hanging over Apple isn’t a question of whether the industries they are investing in

will be successful – virtual reality, mobile payments, and electric cars will unquestionably each be massive –

the real question is if Apple will be

successful in them. Is Apple too late,

or will success in iPhones, iPods, and laptops translate into customers buying cars and paying

for groceries with new technologies created by the world’s most profitable company?

HOW APPLE WINS

To answer this question, and to guide our investments into Apple, we first must understand the pattern of Apple’s past victories.

Apple’s successes have a distinct form, and for all of their market leadership,

Apple’s path has never been to ‘be first’.

Many people think of the Apple Computer as the first such device targeted for the mass market.

Not so. Apple didn’t invent the personal computer, the Italian company Olivetti did

with the Programma 101, 13 years before the Apple computer went live. Even the Xerox Alto, with a graphical display and mouse, debuted in 1973, 3 years before the Apple I (source:

Wikipedia).

Apple’s comeback during the 2000s was cemented with the iPod.

But Apple didn’t invent the portable music player or even the MP3 player,

Korea’s Saehan did in 1998, about 3 years before the iPod came to life

(source:

The Register).

When the iPod was released in 2001, the portable music market was already awash in mini-disc and MP3 players from

companies like Sony.

And the smart phone? Not even close. IBM’s Simon could do email, faxes, schedule appointments,

display 160 x 293 pixels, and run 3rd party applications.

And that was all in 200…? Nope. 1992. 15 years before the iPhone

(source:

Phone Arena).

In 2006, before the first iPhone was ever sold, 80 million smart phones shipped world-wide

and Nokia was dominating the landscape (source:

Bloomberg).

And yet Apple has proven that being first is over-rated. They’ve proven this by making all the money.

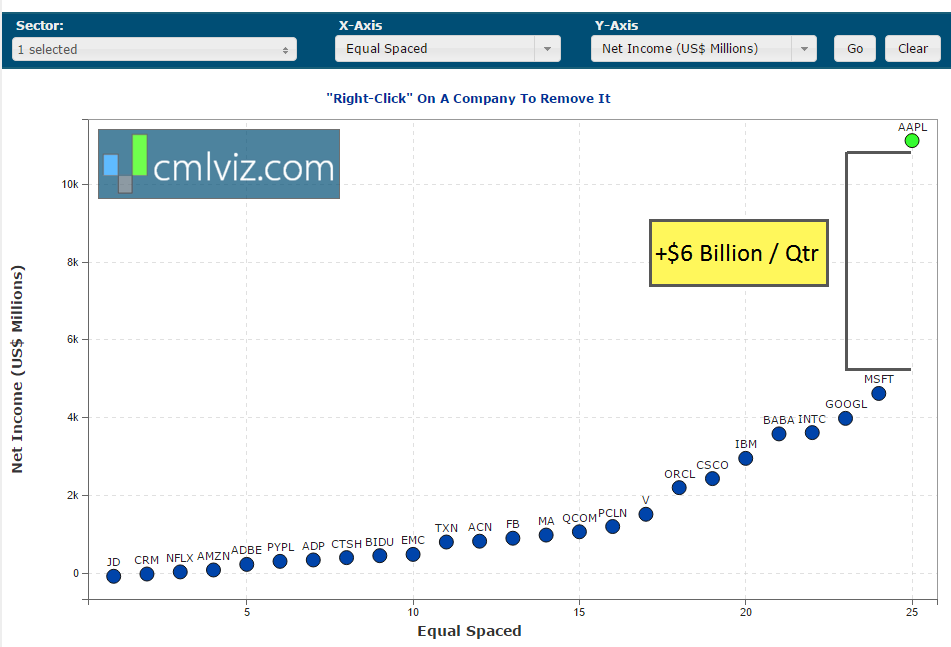

How much money? Let’s turn to

CML Pro

and look at

Net Income of Apple and its peers to make it crystal clear:

Apple earns more than twice as much as anyone else in tech. $6 Billion more per quarter than second place.

More than Google (GOOGL) and Microsoft (MSFT) put together.

Do you thrive on understanding what’s really driving a company’s stock price? Sick of always being one step behind the market?

Join us. Level the playing field, get the same analysis hedge fund managers do. CML Pro.

Apple’s track record of “making all the money” stands on 3 distinct pillars:

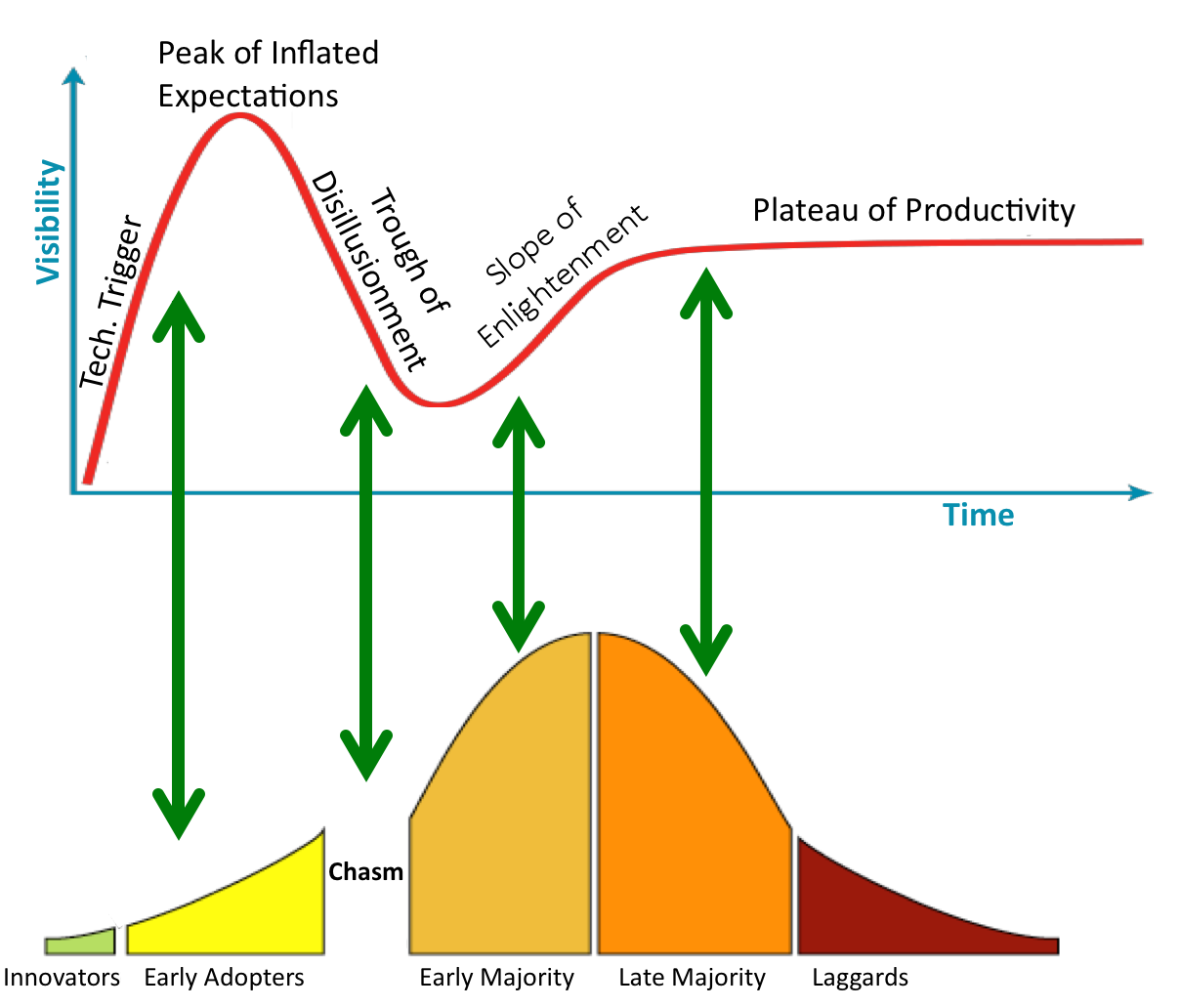

Pillar 1: Timing the technology adoption curve to dominate the true movement.

Most technologies go through a cycle of excitement and hype created by the “innovators” and

“early adopters” before consumers are ready to take the plunge. This is why the dates

connected with the technologies referenced above don’t jive with our own experience. Those companies were too early

and their products died a quiet, costly death.

Pillar 2: 'Productization’ genius. Apple is the most effective company ever

at taking existing technologies and delivering

them to the world as sleek, fun, and dependable devices.

Whether you look at the iPod’s click wheel or how the iPhone 1’s rounded edges

felt in the user’s hand, Apple has shown clear mastery of 'productizing’ technology.

Pillar 3: Brilliant Marketing. Apple has unparalleled success in

marketing technologies as must-have status symbols.

Starting with their edgy 1984 Super Bowl spot, continuing with the iconic dancing

shadows wearing white iPod headphones, and driven home with the “I’m a Mac / I’m a PC” mass TV buy, Apple has created

what is likely the strongest brand in history.

THE FUTURE

We see that Apple has a long record of creating sleek, fun, reliable, status symbols.

This bodes very well for Apple’s future as it devotes its massive engineering and

marketing resources to persuading customers to replace their wallets with their iPhones,

and to trade in their gas powered cars for new, high-tech vehicles with Apple logos on the hood.

After all, what is the ultimate, sleek, fun, reliable status symbol?

The Luxury Automobile.

Get the full analysis in CML Pro’s Apple Research Report.

THE REAL NEWS

What’s truly shocking is that this isn’t even the real revolution happening at Apple.

Apple is undergoing a massive change that could result in a doubling of Apple’s stock price.

To understand this tectonic shift, and to get all of CML Pro’s research, tools, and 2016 top picks,

click here to sign up now.

WHY THIS MATTERS

The top 1% are keenly aware of the deep data that will move markets.

CML Pro research goes deeper than anything the main stream media can produce and sits side-by-side with research from Goldman Sachs, Morgan Stanley and Merrill Lynch on professional terminals.

The difference is that CML Pro was built to break the information asymmetry that has transferred masses of wealth to the top 1% simply because of access to data.

This is just one of the fantastic reports CML Pro members get along with all the charting tools,

top picks for 2016, research dossiers and alerts. For a limited time we are offering CML

Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate.

Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

richkillion reblogged this from ophirgottlieb

richkillion reblogged this from ophirgottlieb  richkillion liked this

richkillion liked this rllrsk18 liked this

ophirgottlieb posted this