The short interest in Apple Inc.’s (NASDAQ: AAPL) stock fell nearly 10% in the first weeks of this month to 57.25 million shares. That was for the period that ended February 12, and it followed a more than 3% drop in the previous period. In fact Apple has slipped out of the top 10 most shorted Nasdaq-traded stocks.

The pullback is odd given the ongoing negative sentiment about stock. Shares are down more than 18% in the past three months, and essentially flat in the past week as the broader markets have inched up again. Some investors must think Apple has bottomed or that it has become oversold. Its shares were up 150% over five years by mid-2015, which shows how much the stock has been punished.

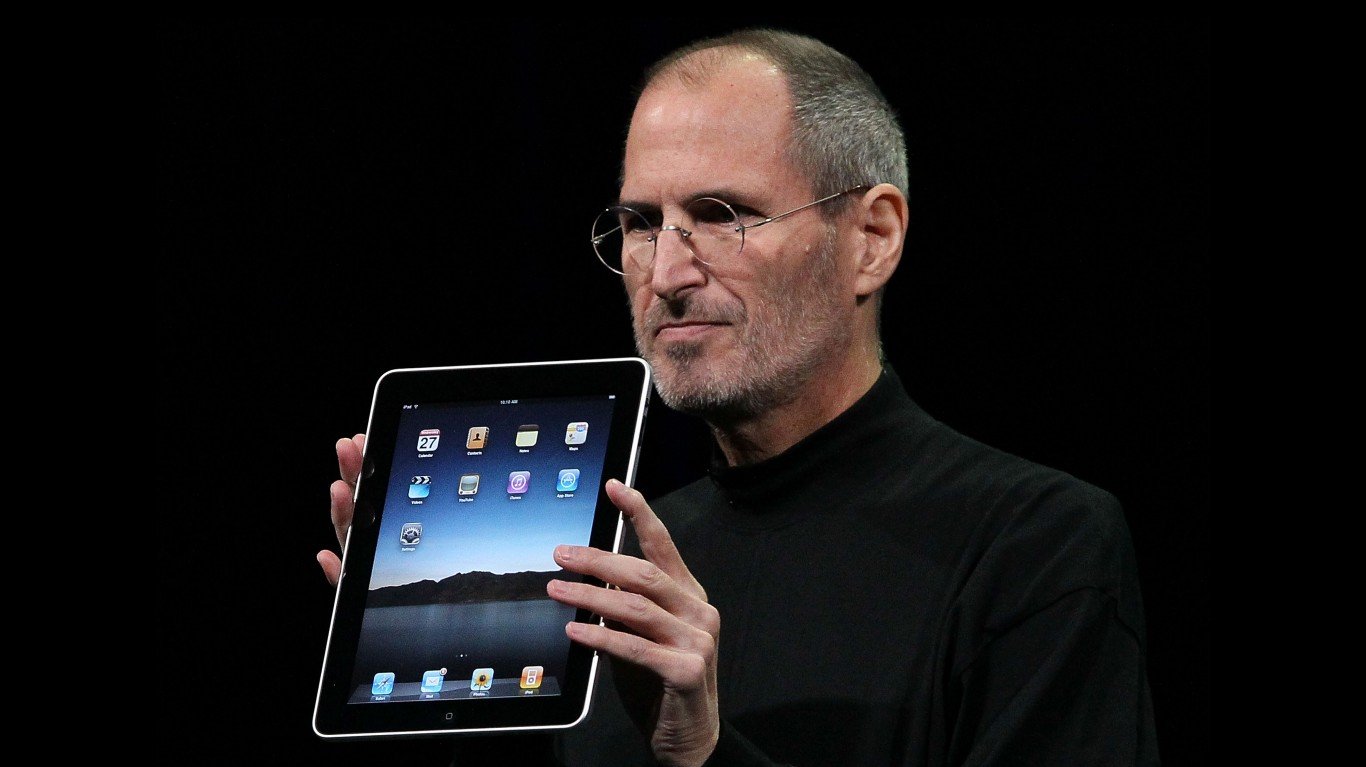

Apple’s most recent earnings report showed a flattening of iPhone sales and only modest improvement in revenue:

Apple announced financial results for its fiscal 2016 first quarter ended December 26, 2015. The Company posted record quarterly revenue of $75.9 billion and record quarterly net income of $18.4 billion, or $3.28 per diluted share. These results compare to revenue of $74.6 billion and net income of $18 billion, or $3.06 per diluted share, in the year-ago quarter. Gross margin was 40.1 percent compared to 39.9 percent in the year-ago quarter. International sales accounted for 66 percent of the quarter’s revenue.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.