About

Capital Market Laboratories

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories. Mr Gottlieb’s mathematics, measure theory and machine learning background stems from his graduate work at Stanford University. He is a former option market maker on the NYSE and CBOE exchange floors and has been cited by dozens of various financial media including Reuters, Bloomberg, The NY Times and the Wall St. Journal.

+ FOLLOW THIS TUMBLRThese Tech Stocks Will Dominate This Year

The Future

PREFACE

Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Apple (AAPL) are dominating their fields with such precision and efficiency that even after looking at charts we’re left to simply say: “Wow, I didn’t know that.”

Let’s look at these marvels in new ways and then look forward to the next world changing technology stocks.

AMAZON

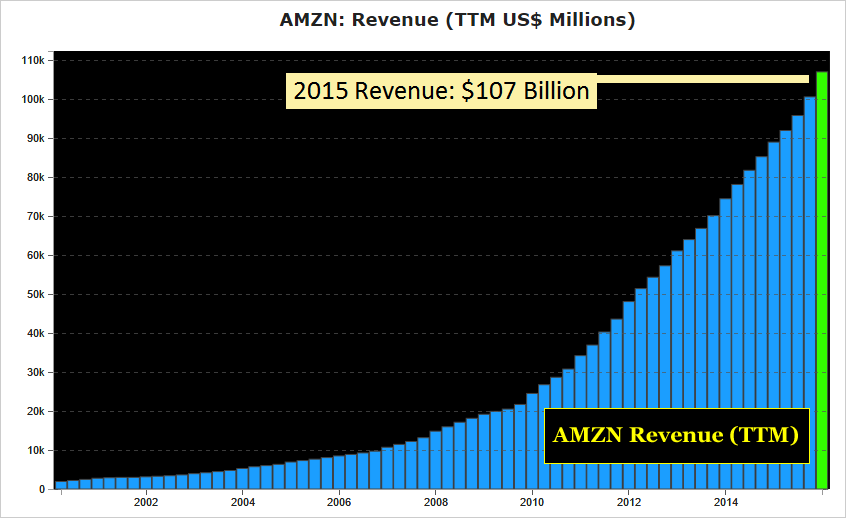

We hear about Amazon’s growth, but to really fathom it, we need to look at the incredible wall of revenue:

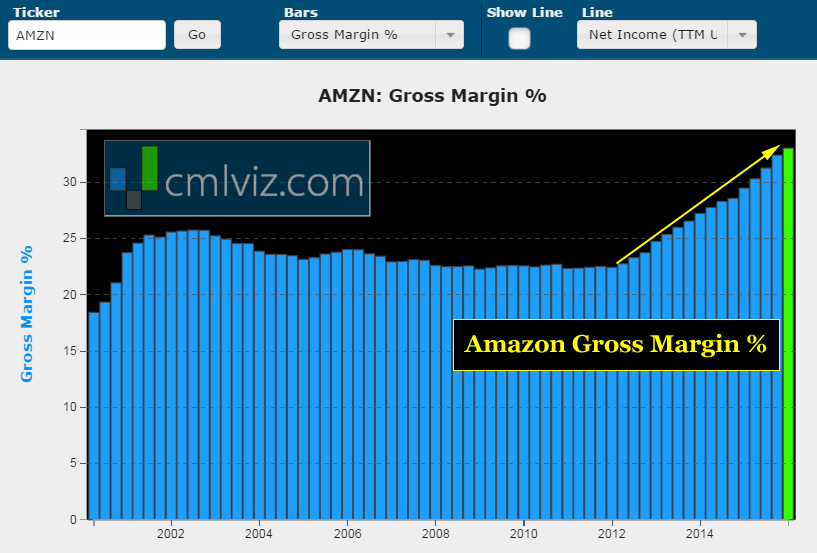

While Amazon is piling on the revenue, through the two incredible successes that are Amazon Prime and AWS (the cloud), its margins are actually increasing at the same time. Here is the gross margin percent chart through time:

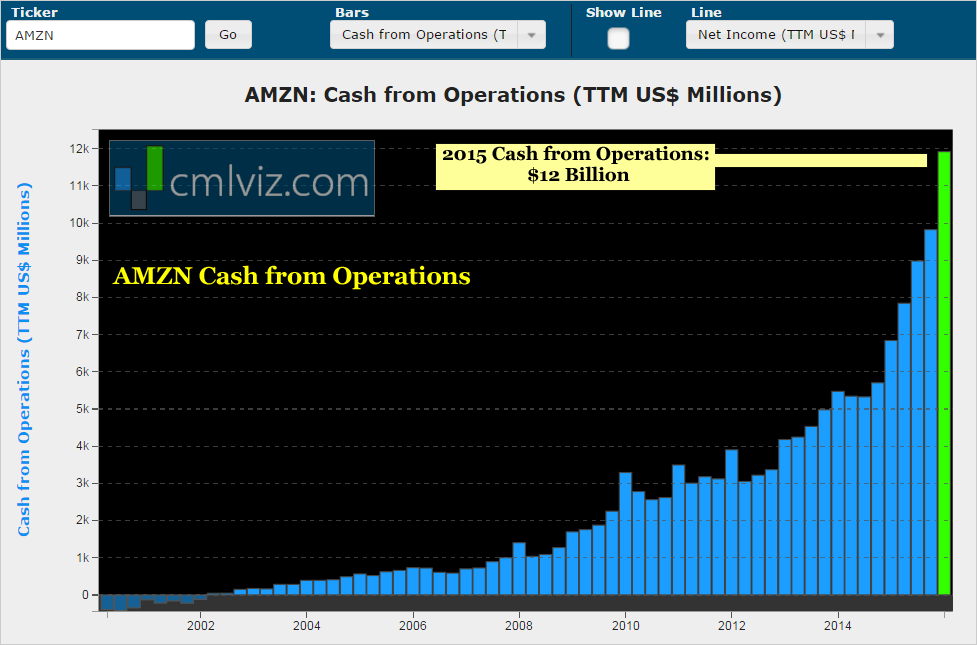

When we combine a tower of revenue growth with increasing margins, we find a company generating more cash from operations than almost any company in the world. Here is the sixteen year chart:

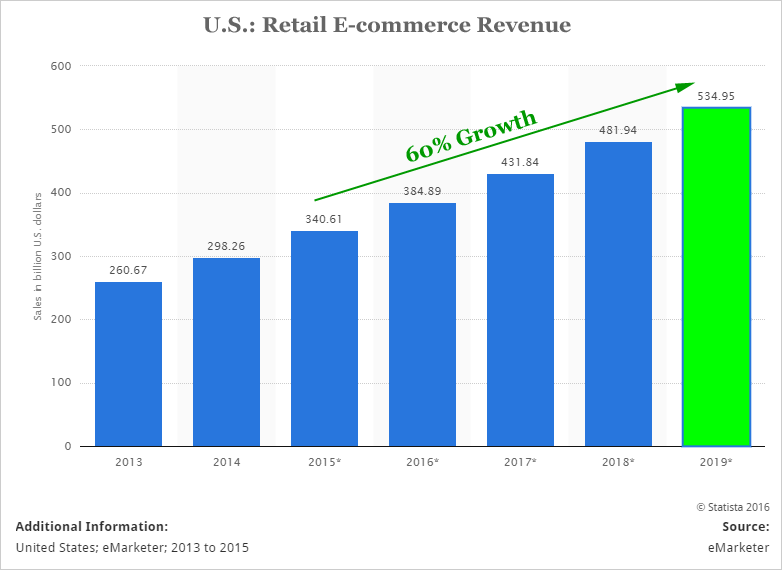

We have just looked at the “what.” To understand the why, try looking at the CML Pro research dossier: “Why Amazon is Dominating Technology and Now the World.” Here’s a taste; check this chart out via Statista:

Retail e-commerce in the United States will rise to $534 billion in 2019. That’s 60% growth from last year. Of course Amazon has wonderful other businesses, like Prime and AWS (cloud), but the engine behind the firm, the theme, is still growing massively and its market share is growing as the theme is growing.

APPLE

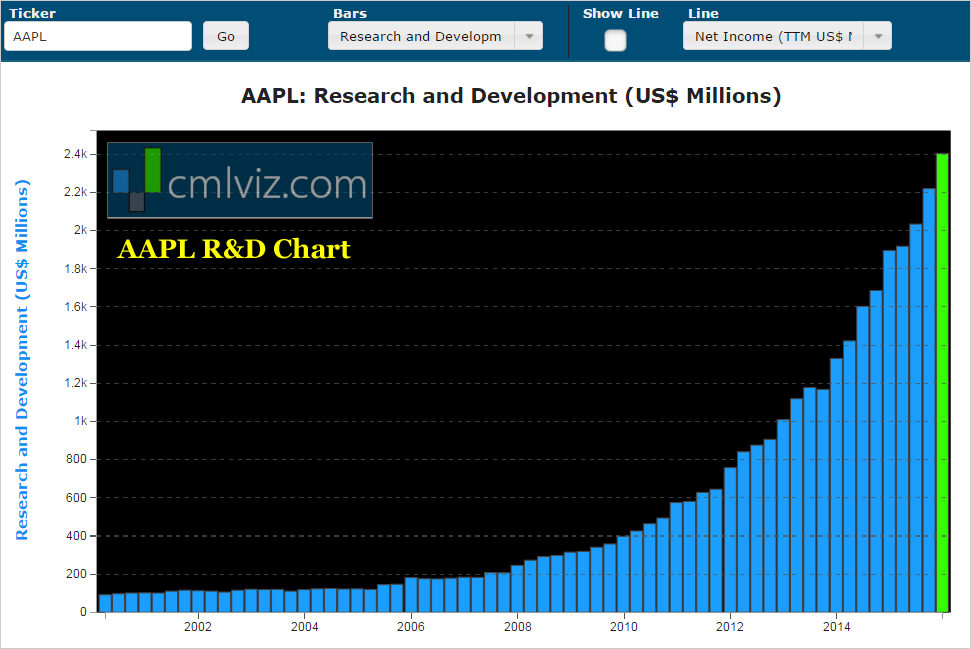

Apple is a marvel and its growth prospects are as promising as any mega cap technology company in the world, including Facebook and Amazon. In fact, Apple now finds itself in the middle of eight thematic trends. This reality is a product of an enormous increase in research & development. Here’s the chart:

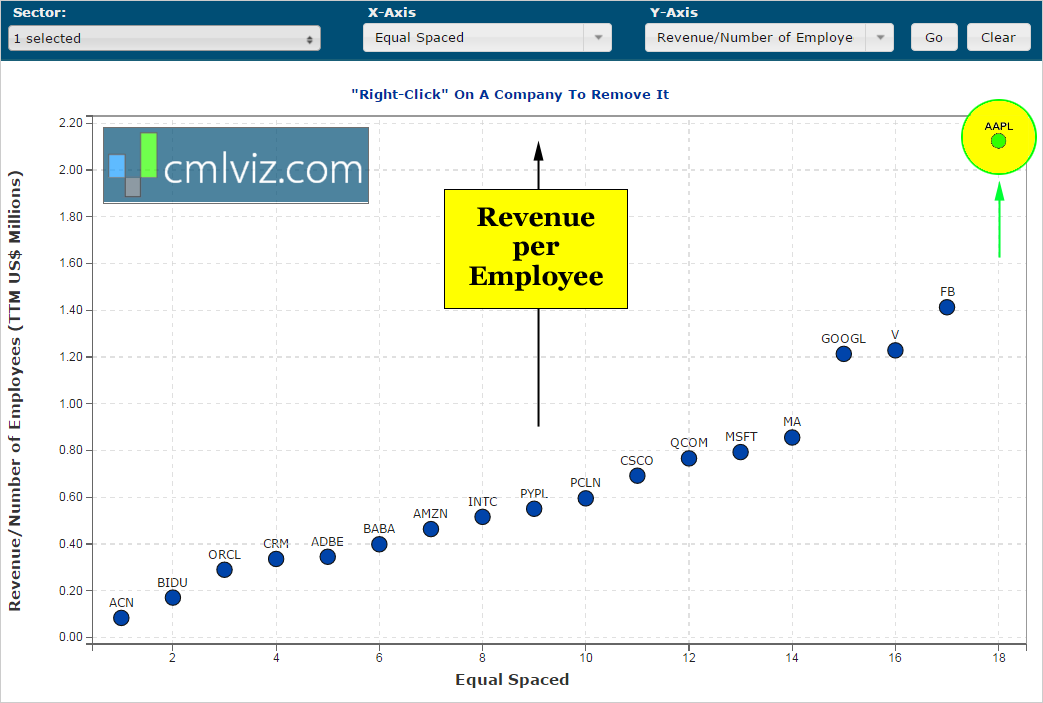

That’s an 80% rise in two-years for the largest company in the world. But Apple does something else that may surprise you. Even though it has over 110,000 employees, it generates more revenue per employee than ay large cap tech stock in the world:

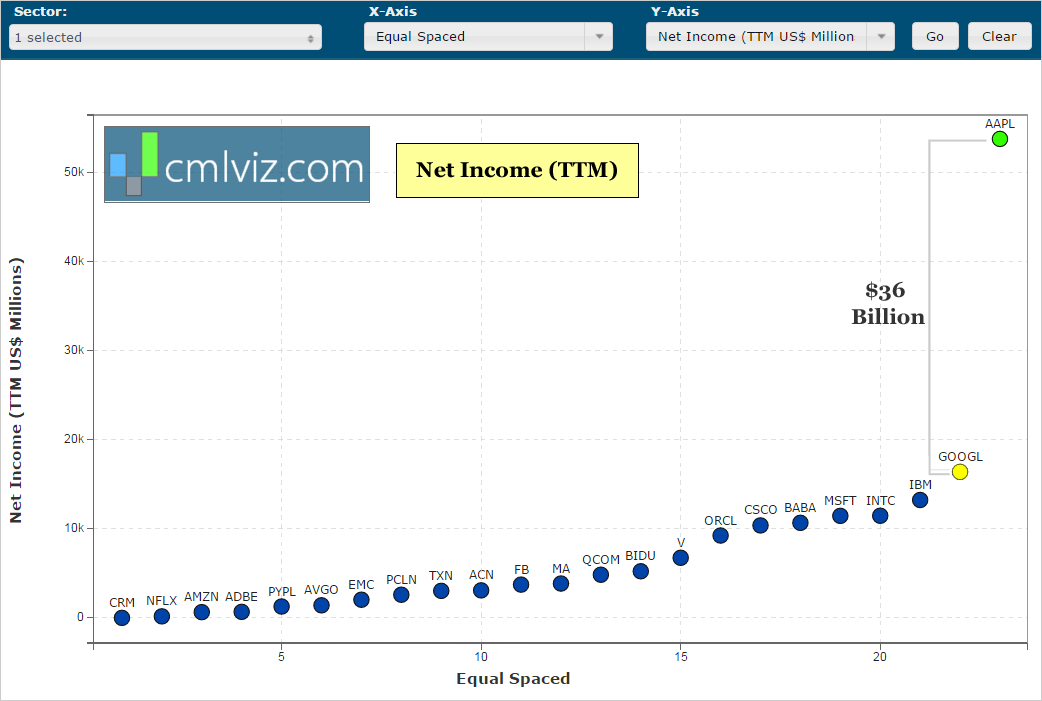

When we take Apple’s eight thematic trends, pour R&D into each of them and generate more revenue per employee than any another firm, you get this earnings chart:

Apple is the most profitable company in the world and has broken records for the most profitable quarters in back to back years for the quarters ending December 31st.

If we thought Apple was dead, try this – CML Pro projects Apple to break the all-time record again for earnings based on a secret back room handshake with India’s Prime Minister that opens it up to a market for smartphones larger than the United States. And it’s starting right now. CML Pro has the details in the research dossier.

If it ever was time get bullish on Apple, now is the time.

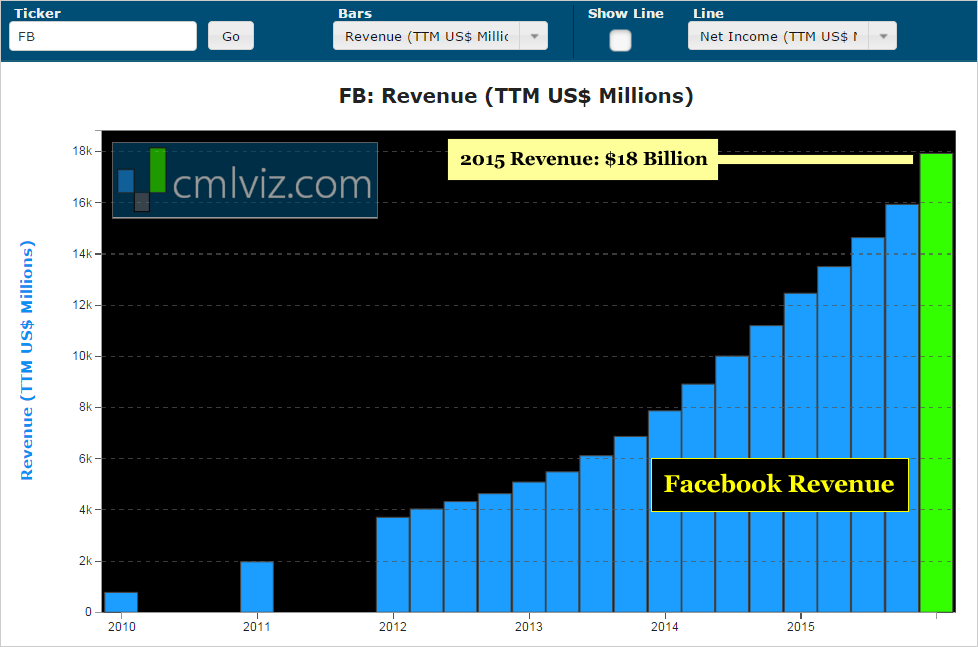

Facebook’s marvel is wrapped up in Facebook proper with 1.55 billion monthly average users (MAus), WhatsApp with 1 billion MAUs, Facebook Messenger with 800 million MAUs and Instagram, with 400 million MAUs. Here’s the all-time revenue chart:

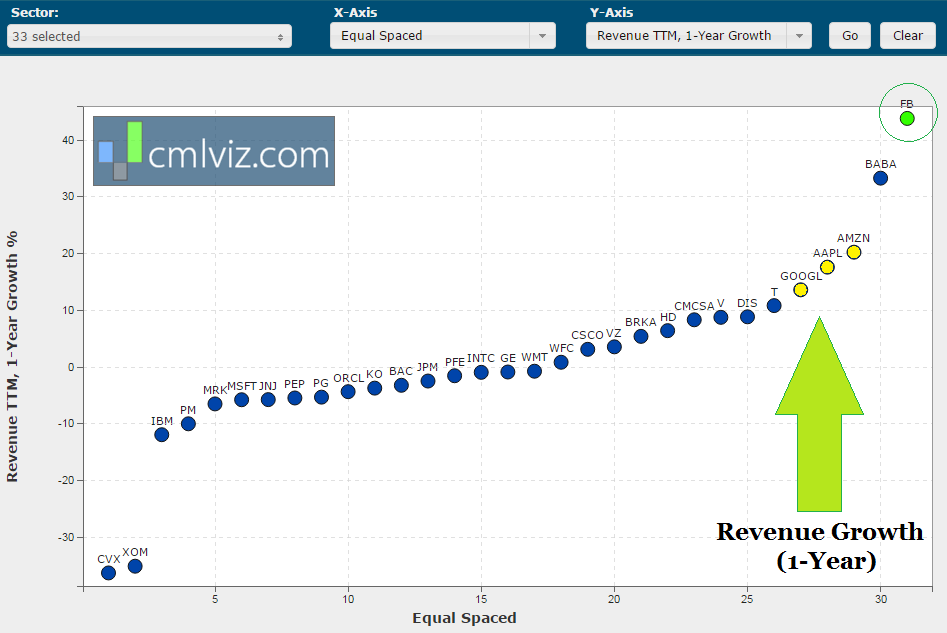

Facebook has broken an all-time in high in revenue (TTM) for every quarter it has existed, but now its earnings are breaking all-time highs. But there’s more. If we compare Facebook’s revenue growth to all other mega cap companies in any sector, there’s Facebook, and then there’s everybody else:

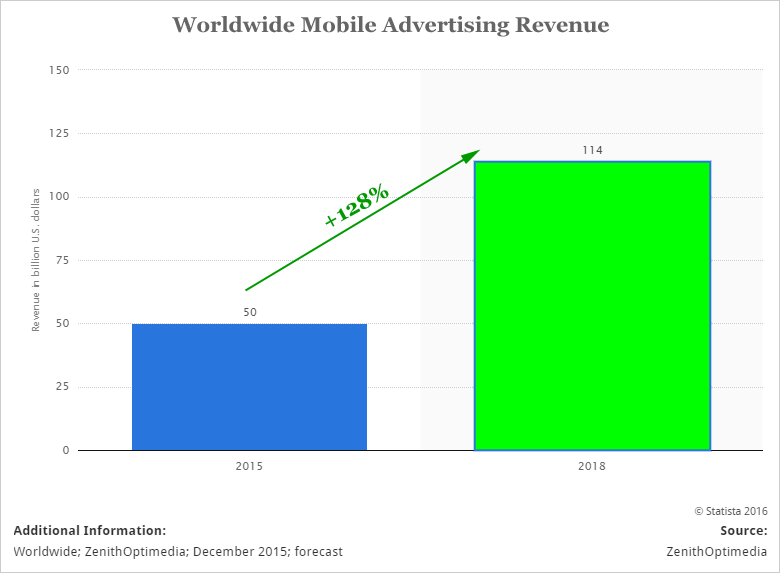

But what is the theme behind the growth? It’s mobile advertising.

Source: Statista

Fully 80% of Facebook’s revenue comes from mobile ads, and while we will hear pundits say that Facebook’s growth can’t continue forever, that’s just noise. The critical element is the driving theme and we see 128% growth in mobile ad revenue from last year to 2018.

Facebook is doing what every great company does – identify a theme, then become the winner in that theme.

NETFLIX

We will hear about Netflix’s earnings woes for the next one to two years because quite frankly, it’s an easy story for the media to write that will get clicks to their websites so they can sell ads. It will not, however, give us any knowledge.

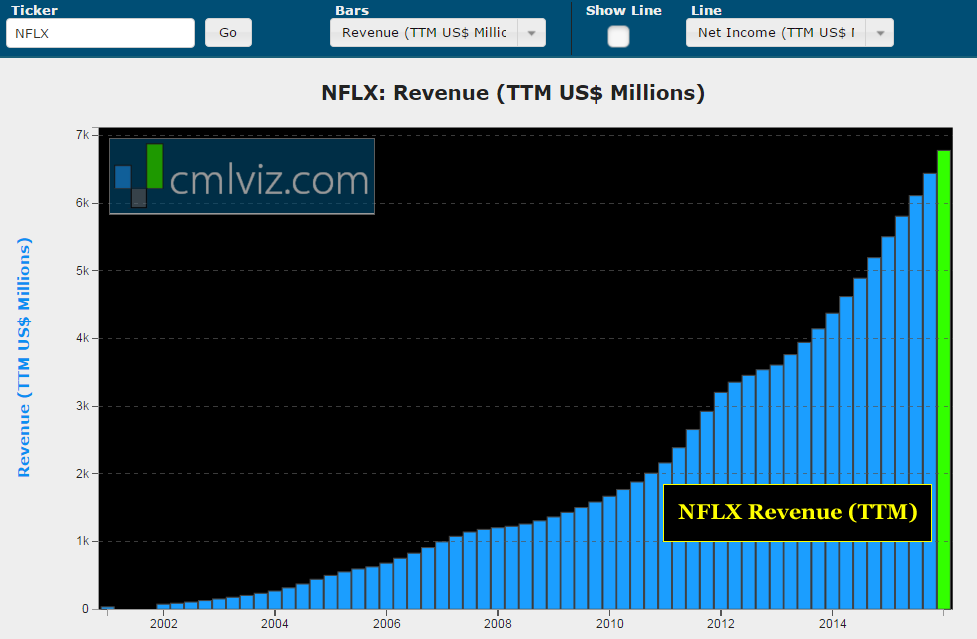

First, this is the tremendous all-time revenue chart for Netflix:

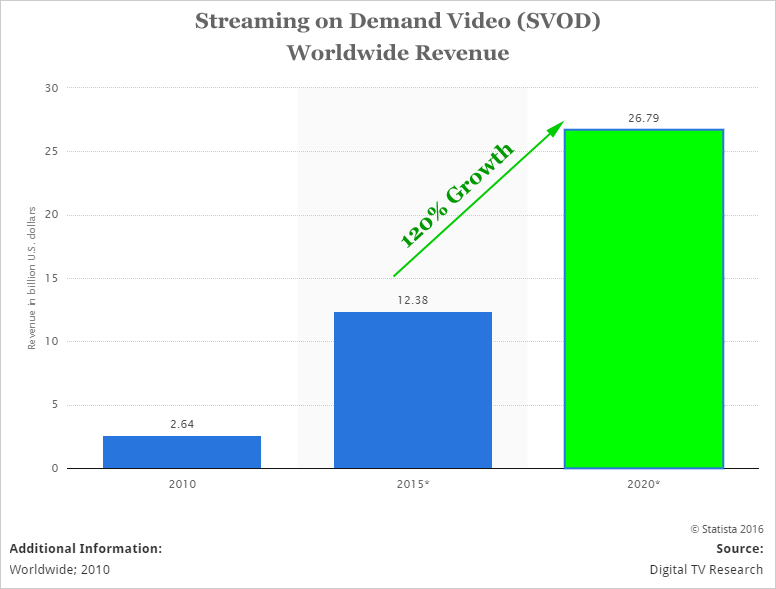

This chart is actually real, not some forecast model. But what we need to understand is why this is happening. And there is in answer – it’s right here, via Statista:

Streaming Video on Demand (SVOD) is just one of a few themes in technology that is exploding higher. In fact, worldwide revenue from just this segment will grow from $12.4 billion in 2015 to nearly $27 billion within five-years. This is the Netflix investment thesis.

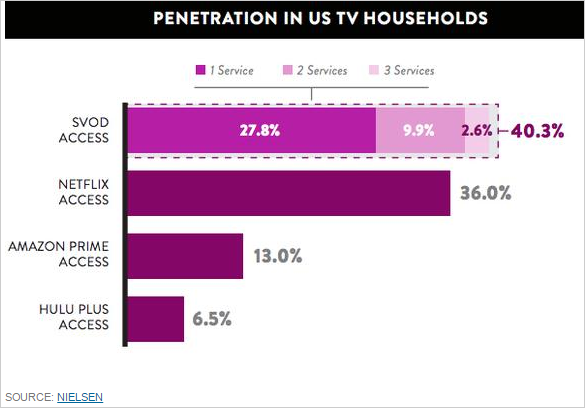

Even further, Netflix has penetrated over 90% of the homes in the United States that have access to SVOD:

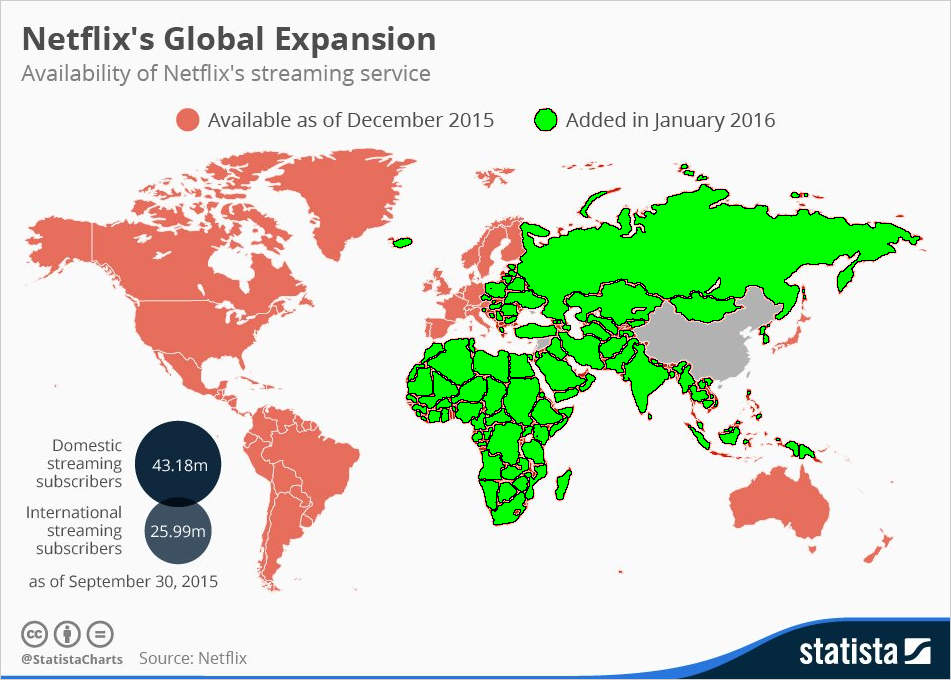

Will the growth end? Not at all – here are the countries Netflix is in, the green area was just added this year:

Netflix is doing what every great company does – identify a theme, then become the winner in that theme.

WHY THIS MATTERS

While Amazon, Apple, Facebook and Netflix are tremendous, to find the next technology breakthrough, we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top 1% have.

Each company in our ‘Top Picks’ is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there’s cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme and its stock has been exploding higher.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.