Written by Ophir Gottlieb and Jason Hitchings

A lot of the information we’re about to cover might feel like a surprise. In many ways it is. That’s because our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%.

A RADICAL REALITY

Technology companies are becoming such radical hubs of innovation that they are literally redefining the world around us: automation and machine learning, virtual reality, the internet-of-things and device “meshes”, gene therapy, peer-to-peer and share-economies, global social networks. These are the themes driving technology and the global economy, and the scope and speed of the change is truly breathtaking. Here’s Gartner’s depiction:

This is a slick info graphic. But that’s all it is. When Wall Street and the mainstream media cover these trends, they almost always fail to understand critical forces underlying these changes.

TRUE POWER

Just as we can’t look at a single country’s economy in isolation of the global economy, we can’t look at an individual technology company without understanding the advances upon which they are built and depend.

PayPal and Palantir founder writes in his book “Zero to One”:

“All happy companies are different: each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.”

Peter Thiel

This takes us to the critical point. In the 80s and 90s Microsoft (MSFT) became the dominant technology company in the world by encouraging intense competition over computer hardware platform, while holding a monopoly over the software that defined the platform in the eyes of the users: Windows.

Now a new company has formed a critical monopoly by controlling the hardware and encouraging intense competition within the software developers.

Even with all of the hyperbole surrounding Apple, the dominance of their position is rarely understood. They have absolutely dictatorial power over many of the world’s richest software companies for one reason:it is upon the Apple platform that the lifeblood of their business depends.

When looked at carefully, one company surfaces as having absolutely staggering risk.

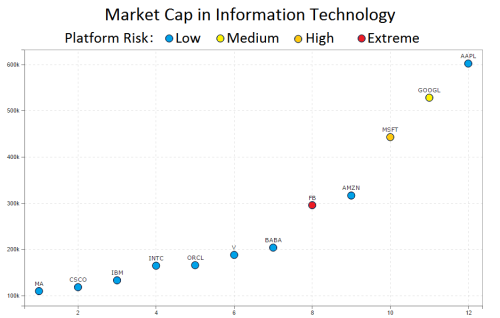

CML Pro will graph the top IT companies by market cap, and we’ve added a colored assessment of platform risk:

One of the largest software companies in the world has no hardware platform and is completely dependent on a single form of revenue.

FACEBOOK’S DILEMMA

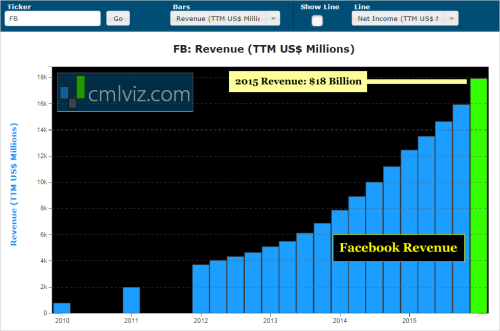

Facebook has been a colossal success. In 10 years they’ve gone from a niche social network on college campuses to becoming the globally dominant social platform with 1.5 billion active users.

They also proved skeptics wrong who said they couldn’t convert users into cash.

CML Pro shows us the mind-blowing trend:

But there’s a problem for Facebook (FB), and it’s one of the reasons that Apple (AAPL) will remain in such a dominant position for years to come:

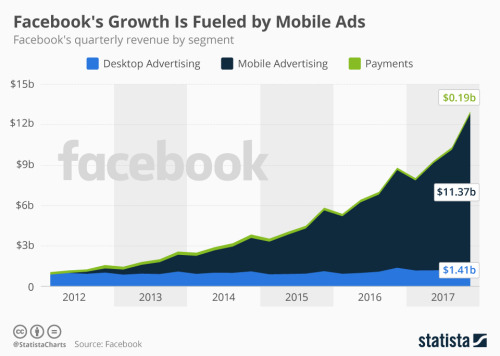

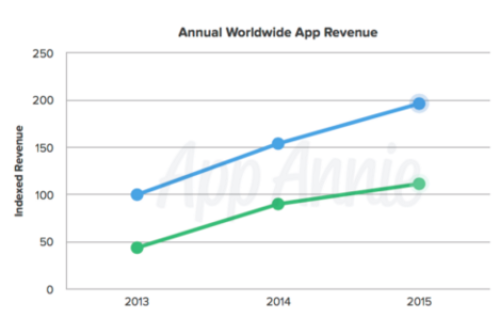

The vast majority of Facebook’s revenue comes from mobile advertising. Further, a study from AppAnnie shows that despite how many more Android phones are shipped worldwide, the majority of revenue still comes from the iPhone:

Apple has unprecedented control over what applications go onto their AppStore. In fact, Apple engineers manually review the code being published and maintain the right to reject any application they choose. This allows for far greater control than Google’s open source approach to the Android operating system. With this control comes great power and leverage over many of the world’s most influential companies.

APPLE’S W.M.D.

Of critical impact to Facebook and other ad revenue dependent companies, with Apple’s release of iOS9, users can implement ad-blocking apps that prevent mobile advertisement. Fully 80% of Facebook’s revenue comes from mobile ads and not so subtly, Apple is pointing a loaded canon at a huge portion of Facebook’s business.

In fact, in the part of the earnings call where CEOs must disclose risk, Mark Zuckerberg explicitly stated that ad blocking apps were a material threat to Facebook.

At 80% of revenue – we’d say ‘material risk’ is quite an understatement. Even Google (GOOGL) is at risk with its search ads on iPhone - a substantial part of its own revenue.

Apple is in an unprecedented position of power. They can simply choose to erase competitors, to take their business models, and to benefit from the strength of their platform.

Even with all of Apple’s strength, they aren’t immune from technological disruption. A fundamental shift has begun in the global technology landscape that could leave even Apple playing catch up. What’s more, we’ve found a company one-tenth Apple’s size that could be

the single biggest winner from this colossal change.

THE REAL WINNER

Apple is at the crossroads of massive technological trends that will radically transform our world in the years to come. This will keep Apple as a solid investment for years to come, but to truly benefit as an investor, we need to find the 'next Apple’ or 'next Google’ in the technology trends that dominate the future. To do so, we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks’ is

the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

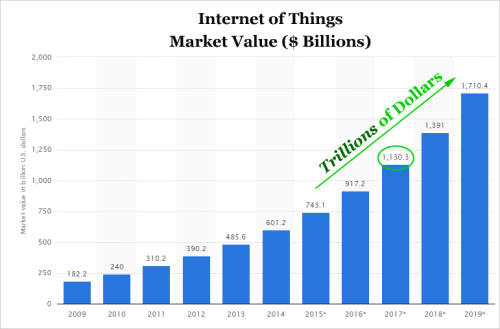

The Internet of Things (IoT) market will be measured in

trillions of dollars as of next year. CML Pro has named the

top two companies that will benefit. Then there’s cyber security:

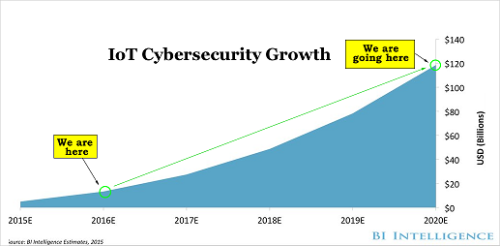

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named

the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few

thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate.

Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.