It turns out world domination can take a long, long time. Back in 2014, Network World's Brandon Butler declared that NoSQL was "giving SQL database vendors and users a scare," and a year later InfoWorld's Andy Oliver quipped that “the once red-hot database technology is losing its luster, as NoSQL reaches mass adoption,” becoming boringly mainstream.

Yet relational database vendors continue to print money; the NoSQL contenders, many of which are open source -- not so much.

Nonetheless, the SQL incumbents must be a little nervous. A new Gartner report suggests that NoSQL continues to kick the shins of its legacy RDBMS competition. As Gartner analyst Merv Adrian notes, "Over the past five years, the megavendors have collectively lost share," dropping 2 percentage points to a still-hegemonic 89 percent market share.

A 2 percent drop over five years is hardly cause for hand-wringing, but the same vendors have done a fair amount of "NoSQL-washing" of their products to pretend to give customers the best of RDBMS and NoSQL. The reason? The shift toward modern data infrastructure like NoSQL doesn't necessarily show up in Gartner's revenue-based market share numbers -- and far more than a few tens of billions of dollars is at stake.

Fat and happy in SQL land?

There's a lot of money in managing enterprise data, and there's more of it each year. In 2015, Gartner pegged the DBMS market at $35.9 billion, an 8.7 percent jump from 2014's $33.1 billion (which represented an 8.9 percent increase over 2013). That's the good news for Oracle, Microsoft, and IBM, which collectively lord over this gargantuan pile of cash.

The bad news, however, is that their dominance is slipping, if slightly.

Among these three big vendors, only Microsoft managed to increase its market share over the past five years, growing nearly 1 point to 19.4 percent overall DBMS market share. Oracle, meanwhile, dropped 1.5 points to 41.6 percent while IBM shed 5.6 points to settle in at 16.5 percent.

Meanwhile, Gartner's Adrian acknowledges that NoSQL doesn't warrant "much to write home about" if evaluated "by revenue standards." Tallying the top five vendors by revenue, Gartner estimates that "the collective total is $364 million." In other words, add MongoDB, DataStax (Cassandra), Basho, Couchbase, and MarkLogic together and they combine to earn eighth place in DBMS market share. Tack on the Hadoop vendors (Cloudera, Hortonworks, and MapR), and you get another $323.2 million.

All this big data infrastructure, in short, is only 3 percent of the overall paid DBMS market.

Popularity isn't about cash

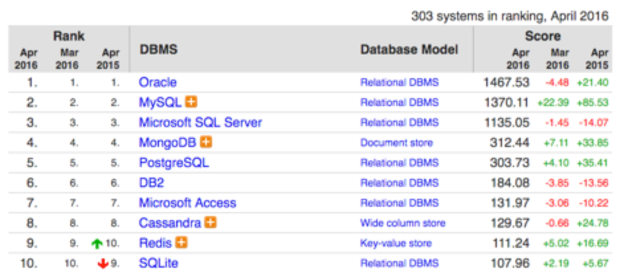

But take revenue out of the equation, and cracks in the DBMS market share numbers start to appear. According to DB-Engines -- which measures database popularity across a range of factors (including job listings and search interest) but excludes revenue numbers -- Oracle, Microsoft, and IBM are joined at the top by some noisy neighbors:

DB-Engines

DB-Engines Measured purely by popularity/adoption, MongoDB and Cassandra in particular promise to wreak havoc on incumbent RDBMS vendors. True, this popularity isn't yet turning into cash -- and it may never do so.

In fact, it may have the exact opposite effect, sucking revenue from the market, as I've written before. A year ago, Gartner claimed that as much as 25 percent of the total relational database market was made up of unpaid, open source databases like MySQL and PostgreSQL. Judging by the DB-Engines popularity index, that percentage may be even higher today.

Speaking generally of the trend toward open source, Gartner warned the megavendors: "The potential impact of [open source databases] capturing workloads that would otherwise go to commercial products will manifest in declining growth rates for the latter." But as much as MySQL and PostgreSQL represent the obvious substitutes for more expensive RDBMS solutions, it's NoSQL and other big data-focused data stores that represent the biggest long-term threat.

New data, new hardware

On this threat, independent analyst Curt Monash notes: "There are basically three things that can seriously threaten Oracle's market position, [the first of which is] growth in apps of the sort for which Oracle's RDBMS is not well-suited. Much of big data fits that description."

While Monash calls out Oracle, it's equally true of all the major RDBMS vendors.

But don't expect a wholesale dumping of the venerable RDBMS overnight. Although modern data tends to be unstructured or semi-structured, and as such is an increasingly poor fit for the tidy rows and columns of relational databases, most enterprise data remains transactional.

You should therefore expect most initial pressure on the megavendors to come from open source relational databases, and later from open source NoSQL databases -- exactly as the DB-Engines popularity rankings show.

This shift also shows up in a recent O'Reilly developer survey, in which respondents were asked to identify their primary data tools. While Hadoop, Spark, Cassandra, and MongoDB make the list, MySQL and PostgreSQL top it:

O'Reilly Media

O'Reilly Media Longer term, however, this shift in the variety, velocity, and volume of data (meaning big data), as well as the location of that data (in the cloud), is serious cause for concern among the megavendors, even if it's not yet denting their revenues (much). After all, this is not about hoarding market share, but rather a matter of remaining relevant as the next 40 years of data management is up for grabs.