Even high-flying technology companies cannot avoid geopolitical risks. This was proved by Apple’s recent (and apparently unanticipated) run-in with Chinese authorities—including the sudden shutdown of iTunes Movies and iBooks in China.

No matter how popular their products or how “borderless” their services, technology’s brave new world will increasingly clash with the older realm of borders and governments. As a result, both financial and physical costs will increase for tech companies and their customers.

Apple executives may have believed their relatively cordial relations with Beijing’s hardware regulators would extend to those monitoring media software. iTunes Movies and iBooks were both released in China in 2015, but less than seven months later, both services were canceled. Indeed, as software giants like Google and Facebook have already found out, China’s “Great Firewall” is hard to surmount. It’s a challenge made even more difficult by Chinese president Xi Jinping’s ongoing campaign to expand state censorship of domestic data and communication networks.

And then there are Apple’s well-publicized conflicts with both the Chinese and US governments over iPhone encryption. Apple has reportedly complied with about two-thirds of Chinese officials’ requests to provide encrypted data from iPhones, reflecting (at least in part) the company’s thus-far favorable government relations—not to mention its reliance on China for almost a quarter of annual revenue.

In general, the greater Apple’s smartphone market share, the greater Beijing’s appetite for challenging it on the encryption and censorship fronts—and probably beyond. This is especially true if authorities view the recent encryption clash between Apple and its “home government” in the United States as a divided front to be exploited, rather than a demonstration of Apple’s political independence. The recent entry of the lower-priced iPhone SE into the Chinese market—and its growing success against local rivals made by Xiaomi and Huawei—could well be the tipping point.

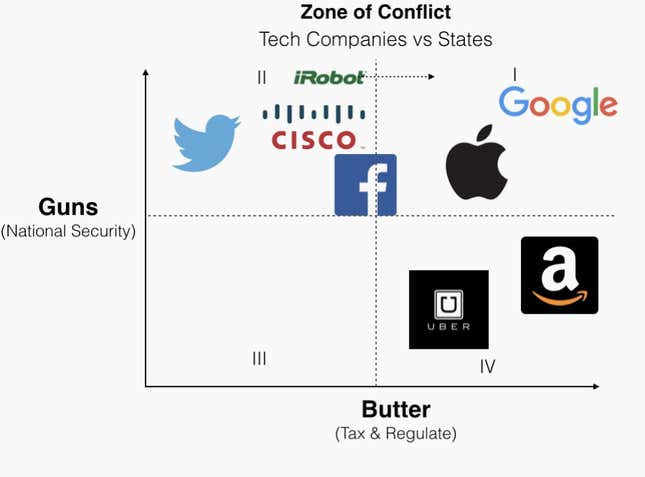

Apple’s situation clearly illustrates that, well beyond China, the interests of technology companies will increasingly clash with the security and economic prerogatives of governments and states. Following the well-known “guns or butter” problem in political economics, those prerogatives are summarized as the provision of national security/social order (i.e. the use of “guns”); and the ability to tax economic activity and regulate the distribution of state resources among the citizenry (i.e. the allocation of “butter”).

To be sure, the diffuse and decentralized nature of many new technologies can help fuel rapid growth outside of state and government control, especially relative to more traditional multi-national corporations. Eventually, however, authorities will move to regain their influence, motivated by the fact that tech companies’ diffuse, potentially “borderless” products so clearly challenge on both the “guns” and “butter” fronts. Indeed, the tech world’s growing universe of political risks is very much a product of its own success—and will almost surely continue to be so.

To better identify the most likely points of tech-state conflict, we can construct a simple, two-dimensional “guns or butter” schema and map major technology companies to the areas where they are most likely to clash with government authorities. Note that the companies are placed based on the nature of their technology and product—software or hardware, social media or sharing economy—and are selected as high-profile representatives thereof.

The further a company is placed along either the guns or butter axes, the greater its overall exposure to political risks on that front. E-commerce and sharing-economy companies in quadrant IV, for example, are far more likely to clash with governments over bread-and-butter issues like taxation and product regulation than they are over concerns about security. Meanwhile, data storage and more diffuse search and media services in quadrant II skew in the opposite position: their commercial activities will probably be restricted more by domestic security and censorship concerns rather than by the taxman.

Like Apple, the companies in (or close to) quadrant I will clash with governments on both the guns and the butter front—in other words, these companies will be most exposed to overall geopolitical risks. Fiscal authorities will try to capture their slice of often intangible and cross-border transactions. Meanwhile, regulators will restrict the distribution of goods and services and play fast and loose with intellectual property rights, due to both national security reasons (i.e. surveillance and weapons control) and more economic concerns, like protecting jobs and local competitors from disruptive technologies. Security agencies will crack down on information- and technology-sharing to better monitor domestic communication, not to mention foreign firms’ capabilities as potential cyber threats.

Interestingly, while the booming robotics industry (represented by iRobot) currently draws mostly governmental scrutiny due to security threats from drones and new weapons systems, economic concerns over automation and labor-replacement will probably multiply the industry’s political risks in the future, pushing it squarely into quadrant I.

In response, tech companies of all types will have to invest more resources in political risk identification, anticipation, and mitigation. Indeed, even providers of virtual reality will most likely be forced to contend with a range of real-life political risks. Governments will not take disruption lightly. In response, companies will have to improve external and/or in-house information and analytics on global politics; deepen knowledge and physical presence in local markets; explore joint ventures and community development projects; and devote more time and resources to government relations. These actions can help mitigate the costs of political risks. But—at least for now—neither guns or butter can be innovated away.