There was a time when Apple Inc. (NASDAQ: AAPL) could sell 50 million iPhones in a quarter effortlessly. It did 50% better than that in the first quarter of its 2015 fiscal year, during which it sold 74.5 million. However, that was a holiday quarter. In the quarter after that one, it sold 61 million. Analysts believe that the company was lucky to sell 45 million in the quarter about to be announced.

And the 45 million is optimistic among some analysts. According to Barron’s:

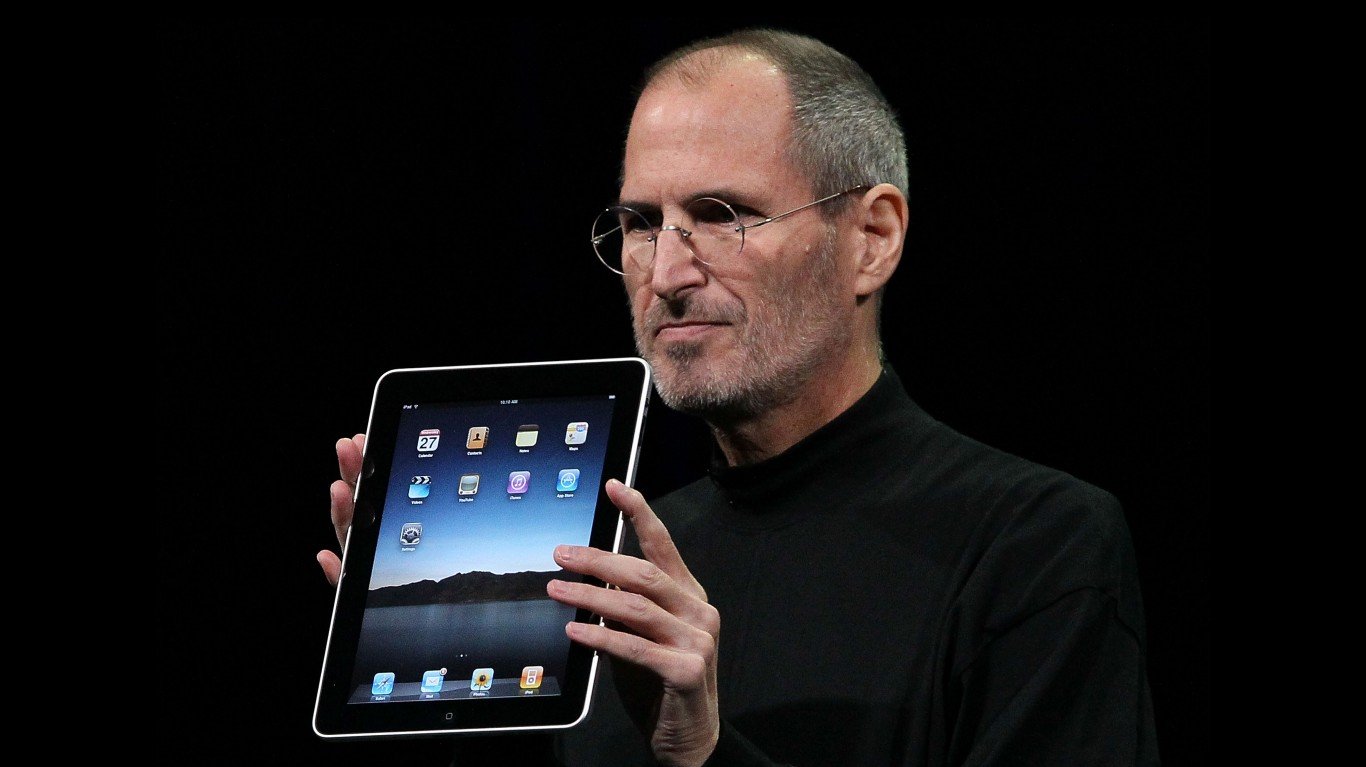

The Street is modeling $42.18 billion in revenue in tomorrow’s report, for the three months ending in June, and $1.40 in EPS. that’s presuming Apple makes sales of 40 million iPhones, 9 million iPads, and 1 million iPods. …

[O]ne of the most bullish analysts, Drexel Hamilton’s Brian White, wrote that this quarter will see a 19% decline in iPhone units, the biggest ever, and that it will be a trough, from which things will start to improve.

During the current quarter, iPhone sales could be dead again, ahead of the iPhone 7 launch. The puts the next potential 50 million iPhone quarter, the one during which presumably the iPhone 7 will launch, probably in September. That will be the make or break quarter for Apple — the most important in two years. And it is followed by the holiday quarter, the quarter during which Apple has to have its 2016 home run.

Investors in Apple wonder when its share price will be back to its all-time high of $133. That would be nearly a third higher than the current price of $97. Microsoft Corp. (NASDAQ: MSFT) has had that kind of run in the past year. So has Amazon.com Inc. (NASDAQ: AMZN). In both cases, the companies have done well with the most important tech revolution of the past decade: the cloud. Apple does not have that kind of new generation product. And it won’t.

That leaves it as all but a one-product company, for better or for worse.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.