About

Capital Market Laboratories

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories. Mr Gottlieb’s mathematics, measure theory and machine learning background stems from his graduate work at Stanford University. He is a former option market maker on the NYSE and CBOE exchange floors and has been cited by dozens of various financial media including Reuters, Bloomberg, The NY Times and the Wall St. Journal.

+ FOLLOW THIS TUMBLRHere’s what Apple needs to announce next week to move markets

Apple Inc (NASDAQ:AAPL) September 7th Event

Date Published: 2016-09-02WHAT COULD MOVE THE MARKET: SNAPSHOT

• Watch for any upgrades to the iPhone that allude to waterproofing, curved edges, OLED lighting or an all glass screen. Anything else is likely not market moving.

• Watch for updates to Apple Pay in conjunction with Touch ID, any update here could be market moving.

• Finally, watch for the highly unlikely announcement of an un-tethered Apple Watch – that would be a huge surprise and also likely market moving.

PREFACE

On September 7th, Apple will be hosting its next big event, and there’s a lot to watch – some of it could be market moving.

iPhone

For now, the story starts with the iPhone, but for once, it does not end here. The general consensus has landed around Apple announcing two new models: iPhone 7, and the 5.5 inch iPhone 7 Plus. There has been some talk of a third iPhone, perhaps an upgrade to the new-old-new small screen iPhone SE which has been Apple’s biggest hit this year.

We can start with the date: September 7th for the iPhone 7. There were certainly Wall Street estimates that had the announcement a week later, and sales starting a week after that. Last quarter Apple sold about $265 million of iPhones a day, so an extra week of iPhone 7 sales in the month of September could lead to a wave of raised revenue forecasts for the quarter ending September 30th. That could be market moving to the upside depending on the actual for sale date.

Diving into the phones themselves, this round of new iPhones is widely expected to be rather blasé, as Apple looks to next year’s 10-year anniversary and what people expect to be some rather large upgrades. Make no mistake, whatever the new iPhones are called and whatever new looks they have, this is in many ways a very odd “in the middle” moment for Apple. It’s quite likely that many of the desired major upgrades are getting held back for next year.

At the same time, the company needs a boost from upgrades, seeing iPhone sales fall for the time ever this year. It’s a pretty uncomfortable place to be, and that’s just reality, even though the new phones will be at the very least, “competent.”

Rumors and possibilities for this new iPhone series, listed in order of likelihood read like this:

- Upgraded A10 chip

- Removal of 3.5-mm headphone jack

- Second gen Touch ID

- Dual-lens camera

- 4 speakers (up from one)

- Water resistance

- Curved screen

- OLED display

- All glass chassis

The final four bullet points are likely going into next year’s model, but we never know what Apple could do. If any of the last three elements are in fact announced this year, it would likely be a positive catalyst to the stock in the short-term.

The dual-lens camera would be new to Apple, but not new to smartphone owners.

“

[T]he most dramatic change is likely coming to the 5.5-inch iPhone 7 Plus and not the 4.7-inch iPhone 7: a dual camera system. This could be used to emulate optical zoom where digital zoom basically crops a shot and loses detail.

[T]he most dramatic change is likely coming to the 5.5-inch iPhone 7 Plus and not the 4.7-inch iPhone 7: a dual camera system. This could be used to emulate optical zoom where digital zoom basically crops a shot and loses detail.

”

Source: 9TO5MacThe shape, style and design of the phone itself are expected to remain unchanged.

But the iPhone, for once, may not be the main attraction for Wall Street analysts.

APPLE SERVICES

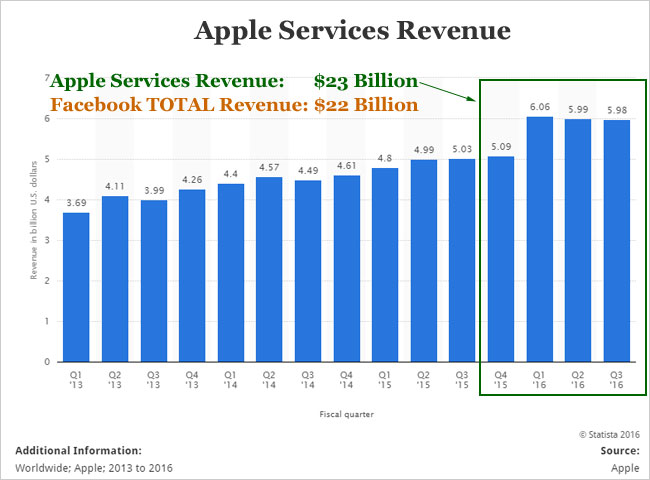

The shrewd investor will keep an eye out for any talk surrounding Apple services upgrades, especially Apple Pay. As Tim Cook pointed out on the most recent earnings call, Apple services alone will be large enough to be a Fortune 100 company by next year. Here’s a chart of service revenue with some context:

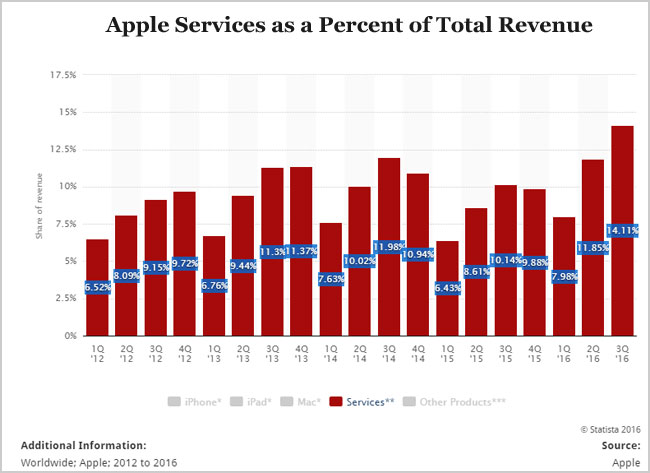

We can see that Apple Inc. services is larger than all of Facebook’s revenue. Now, that will change by next year, as Facebook is still seeing 50% growth rates while Apple Services will grow at a slower pace, but the point is, 14% of Apple’s business is the size of Facebook. It’s happening – Apple is diversifying. Here’s a better image of the trend:

WHY SERVICES MATTER

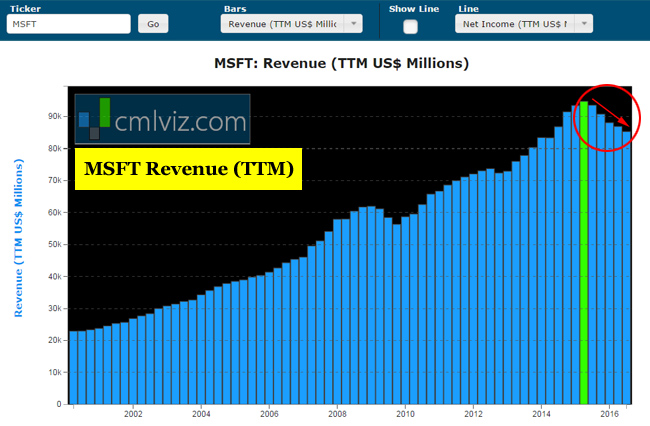

A dollar of revenue from services is worth more than a dollar of sales of hardware, and that’s a critical fact to grasp. Wall Street places a higher multiple on revenue that is seen as recurring, like services, as opposed to non-recurring, like a hardware sale. To hammer the point home, this is a staggering series of charts for Microsoft. We start with revenue (TTM).

As Microsoft has been forced to pivot from one-time software sales to its Office 365 product, which is recurring revenue, its sales numbers have plummeted from a high of $95 billion to now $85 billion, with five consecutive quarters (TTM) of drops. But, the pivot to recurring revenue has overshadowed the lost revenue, here is Microsoft’s stock chart since the peak of sales.

The stock is up nearly 40% as revenue has declined. That’s the power of recurring revenue and Apple has something to say about it now.

Of all the various pieces that fit into Apple Services, the one that has the possibility of turning into a true giant is Apple Pay. The mobile pay market is seen expanding to $3 trillion by 2022 according to Bank of America, a 200-fold increase from 2015. But Apple has gone yet further than mobile pay.

In late March we reported that Apple would be bringing its Apple Pay to mobile e-commerce sites and then one step further puts Apple Pay on all desktop and laptop products for Apple within a couple of years and that means owners will soon be able to go to broader e-commerce websites to use Apple Pay.

If Apple can help us realize a world where we tap our iPhones while shopping online, it has effectively killed the password, the credit card, PayPal – all of it. Fingerprint and pay is a meaningful disruption to the current technology and in and of itself could be a business that adds $200 billion in market cap to Apple stock over the next few years.

Let’s listen to any updates on that progress, or anything else surrounding the Apple Pay and Touch ID combination technology.

To read more about the disruption that is Apple Pay we direct you to the dossier on CMLviz.

OTHER HARDWARE

We are also likely to see the first ever upgrade to the Apple Watch after its release nearly two-years ago. This would be a market mover if Apple could have successfully un-tethered the Watch from the iPhone effectively making it a stand -alone product. But, everything we have heard leading up to this event is that Apple has not successfully un-tethered the Watch and that makes it less than market moving.

The new MacBook Pro should be released this year, but it’s unlikely that it will be announced on the event September 7th – that’s usually reserved for the iPhone.

CONCLUSION

Watch for any upgrades to the iPhone that allude to waterproofing, curved edges, OLED lighting or an all glass screen. Anything else is likely not market moving. Watch for updates to Apple Pay in conjunction with Touch ID, any update here could be market moving. Finally, watch for the highly unlikely announcement of an un-tethered Apple Watch – that would be a huge surprise and also likely market moving.

Laslty, note that Apple is giving its big presentation after all of the other Android phone makers, so we are likely to hear a lot of head to head comparisons from Apple pointing out hand selected superiority. We will definitely hear references to the recent Samsung Galaxy Note 7 battery explosions.

The author is long shares of Apple Inc. (NASDAQ:AAPL).

mortallyshinywerewolf liked this

mortallyshinywerewolf liked this ophirgottlieb posted this